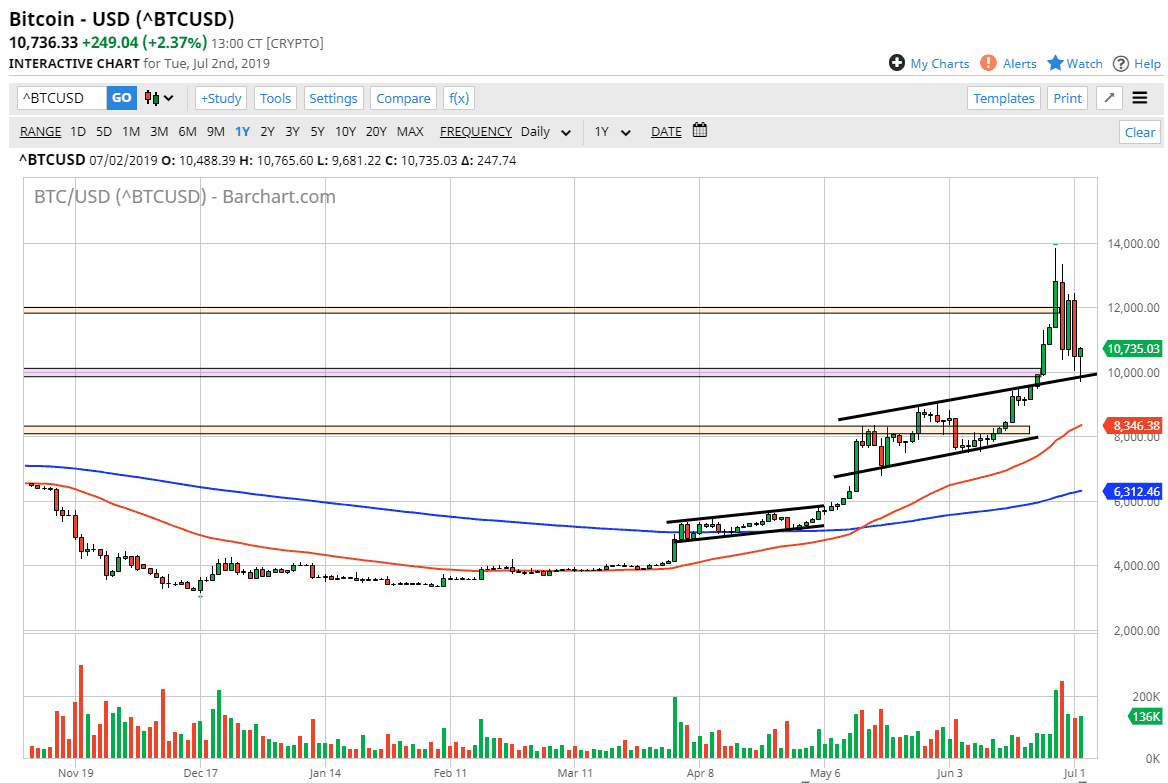

The bitcoin markets initially fell during the trading session on Tuesday but found enough support at the previous uptrend line from the top of the channel to turn things around. Beyond that, the $10,000 level has offered psychological and structural support as well. This is an area that I’ve been watching and the fact that we are starting to see life at that area suggests that the market is in fact going to continue to be very technically driven, thereby making it much easier to trade if you take a look at the big picture.

Looking at this chart, the fact that we are forming a hammer is not lost on me, and I recognize that as being rather important. Beyond that, we have the psychologically important $10,000 level that held as support, so that of course is something to take a look at as well. I had recently suggested that we could pull back to the $10,000 level but that the buyers should be interested in that area. As soon as we pulled back below there, the market has found buyers as expected, which of course is a good sign.

Looking at this chart, it now looks as if the market is ready to go back towards the top of the recent consolidation, which is the $14,000 level. I think that a break above the top of the trading session for Tuesday is worth paying attention to and the fact that we are heading into the July 4 holiday probably helps as well, as volume might be a bit light and thereby exacerbate moves to the upside. Obviously, that can work in the other direction as well and if we were to break down below the hammer from the trading session on Tuesday, then we could go down towards the 50 day EMA underneath, which typically offers at least some reaction in this market. That currently sits closer to the $8400 level, perhaps as high as $8500 by the time we would get there. That’s an area that has been a cluster in the past, so that would be interesting as well. That being said, I do believe that we are more likely to go higher in the short term than down, and it would be willing to suggest that a move to at least $12,000 is probably likely over the next couple of days. Bitcoin has been very bullish as of late, and this pullback should be thought of as a potential gift.