Bitcoin initially tried to rally during the trading session on Monday, but then rolled over to show signs of weakness again. That being said, there are plenty of reasons to think that we could go higher, not only from a technical analysis standpoint but from a fundamental standpoint as well. Bitcoin has recently been acting much like the gold market, paying attention to the US dollar and the Federal Reserve as far as where interest rates go. Money has been flowing into Bitcoin to escape low rates overall, and perhaps escaping from the mainland of China as well.

Support underneath

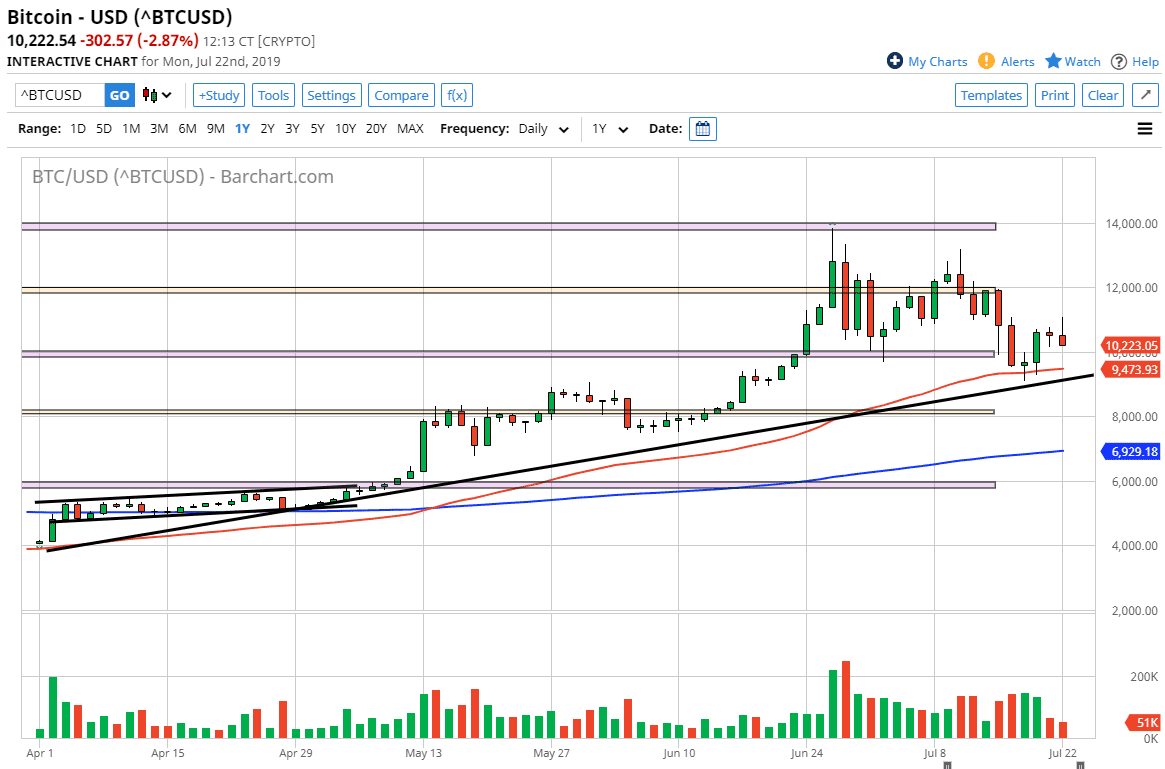

I currently believe that there is plenty of support underneath. After all, we have several different technical factors coming into play just below. The first of which of course is the $10,000 level which is a large, round, psychologically significant figure. Those levels quite often because reactions, as large institutions will come in and start buying and selling at these large figures. Beyond that, we also have the 50 day EMA, which is pictured in red on the chart, just below there which could offer quite a bit of support at the $9500 region.

Even beyond that, the market has an uptrend line just below, so therefore it’s likely that we are going to continue to show buying pressure underneath, and it’s very likely that we will find value hunters coming back in this market and trying to take advantage of “cheap Bitcoin.”

Fundamental reasons

There are fundamental reasons for Bitcoin to rally beyond anything involving blockchain. For example, a lot of monetary controls on the mainland of China have driven market participants look for ways to get out of China when it comes to protecting their wealth, and at this point it’s likely that the central banks around the world cutting rates will also drive money into Bitcoin as it drives down the value of fiat currency. There are a whole host of central banks around the world that are going to be doing this, and with a couple of central banks having interest rate decisions over the next week or two, we could see more money flow into Bitcoin.

The alternate scenario

Looking at the chart, there is an alternate scenario obviously. If we were to break down below the $10,000 level, the 50 day EMA, and of course the uptrend line, that would be three separate support levels being broken, and that should have money flying into the market. At that point, I suspect that we would be looking at the $8000 level which is a large round number that has attracted a lot of attention as it has before.

Ultimately, there is an upward slant in the Bitcoin market, so I am bullish but I also recognize that it is very noisy and choppy, so patience will be needed. Longer-term, I think that we will eventually go to the $12,000 level, and then possibly the $14,000 level after that. Pay attention to the US dollar, it’s half of this equation.