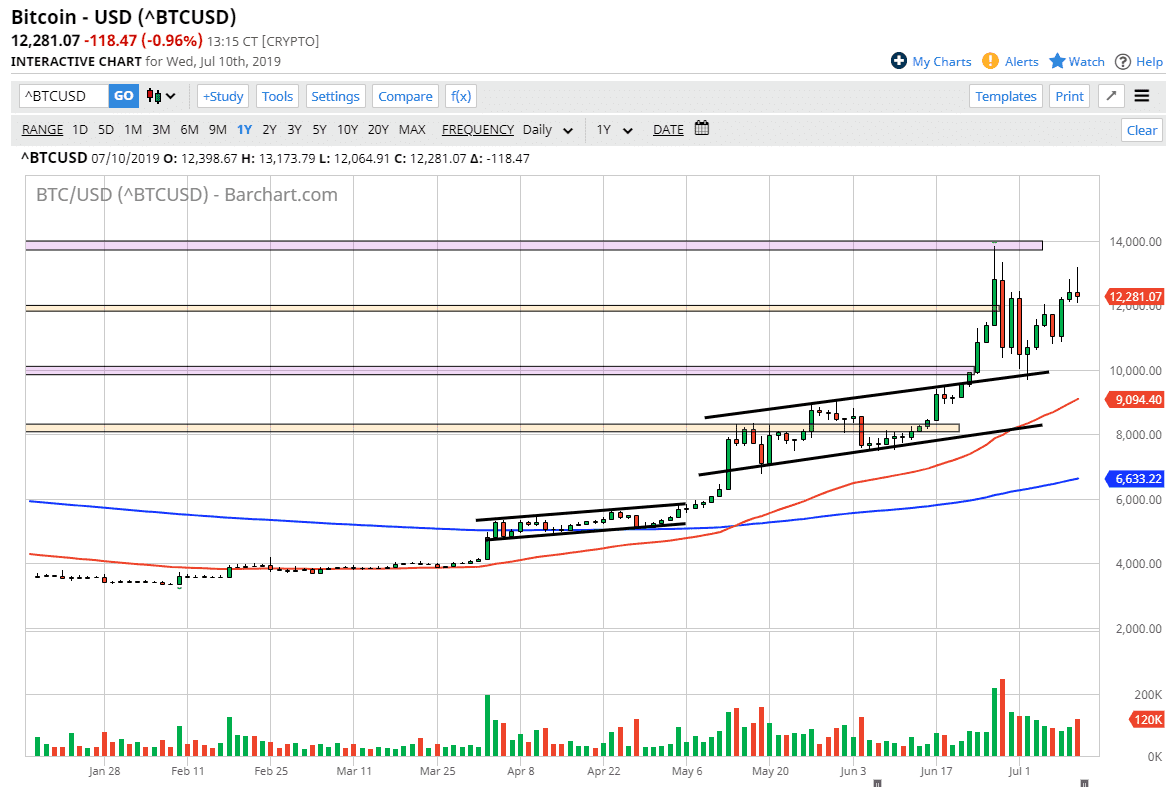

Bitcoin markets initially tried to rally during the trading session on Wednesday but then turned around to fall pretty significantly. This is a massive shooting star that I’m looking at and it does suggest that perhaps Bitcoin could roll over from here. While I don’t think that Bitcoin is going to suddenly change the overall trend, I do think that a pullback is all but imminent.

Looking at this market, I see a lot of support underneath at the psychologically and structurally important $10,000 level underneath, so I think that could be thought of as the “floor” in the market. It would be very difficult to imagine that people will be paying attention to that large round figure, as it is not only such a psychologically important number but it is also where the top of the channel trend line runs through. I think at this point it’s obvious that the Bitcoin market tends to pay attention to every $2000 level, so course that makes sense.

The alternate scenario of course is that we break above the top of the shooting star, and that would be a very bullish sign. That would almost certainly open up the door to the $14,000 level next. That would have sellers trapped, which is exactly what you want to see in a situation like this. If we break down below the $10,000 level, it’s likely that the 50 day EMA which is pictured in red on the chart will be tested, perhaps even show signs of support. Ultimately, this is a market that is trying to go higher, but it needs some type of catalyst.

Looking at this chart, I think that we are simply trying to build up enough momentum to finally take off to the upside. We are close to the top of the overall range of consolidation, so I think that value hunters will return at lower levels. A significant hammer or some type of bounce from lower levels, especially near the $10,000 level, would be a nice buying opportunity based upon the massive amount of support that we have seen. However, if we were to break down below that level and the 50 day EMA, we could reach down towards the $8000 level underneath. Overall though, Bitcoin is very bullish and I don’t want to fight the overall trend. That being said though, it’s very likely that the uptrend needs to cool off a bit so that we can build up the necessary momentum.