During the session on Monday, Bitcoin plunged rather hard during a press conference by the US Treasury Secretary, suggesting that more regulation was on the way for crypto currency in general. That being the case, there were probably a lot of algorithms jumping into this market and shorting it. That being said, we have seen the move that we have expected, and it was done in a rather short amount of time.

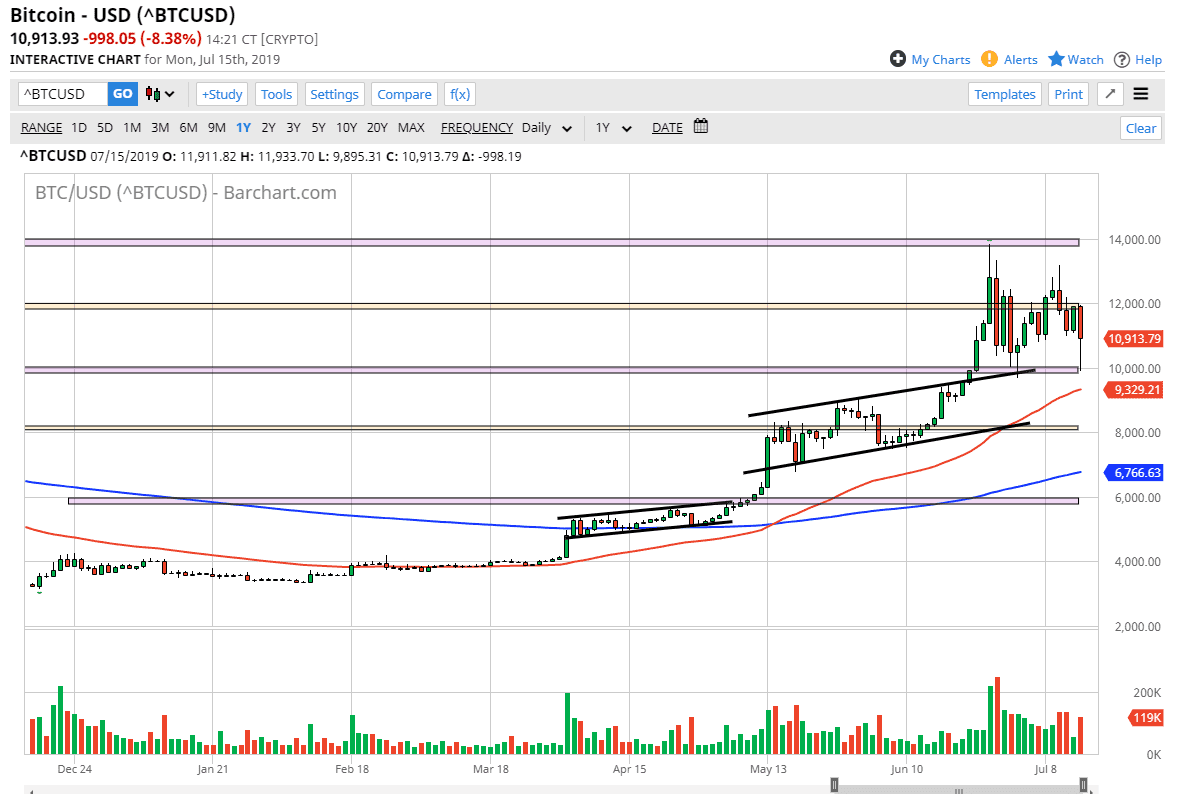

Bitcoin fell from the crucial $12,000 handle, which of course is important due to the fact that Bitcoin seems to move in $2000 increments when looked at from a longer-term perspective. To the downside, the $10,000 level has offered significant support. That is an area that is a large, round, psychologically significant figure of course, so obviously it has attracted a lot of attention. Beyond that, the 50 day EMA sits just below there, and of course if you extrapolate the top of the channel, the resistance line slices right through where we had been during trading.

The bounce that has happened from that level is rather important and more importantly: impressive. This tells me that the market is very likely to continue to show signs of life underneath, and that we should then go higher. I like buying these dips, because quite frankly the trend is most certainly to the upside. You all know that I am not a “true believer” of Bitcoin, but I am a trader and I recognize that we are in and uptrend and showing no real signs of selling off. At the end of the day, prices the only truth that matters.

That truth tells me that there will continue to be buyers underneath, and that we will eventually more than likely try to go to the upside. I believe that we are going to consolidate between $10,000 underneath at $14,000 above. The $12,000 level represents “fair value.” I believe that the market is simply killing time right now in order to build up enough momentum to finally break out to the upside. Longer-term, a move above the $14,000 level will more than likely open up the next key psychological barrier in the form of $15,000. I have no interest in shorting this market but am the first to admit that if we were to somehow break down below $8000, then we need to rethink a lot of things. Currently, that does look very likely.