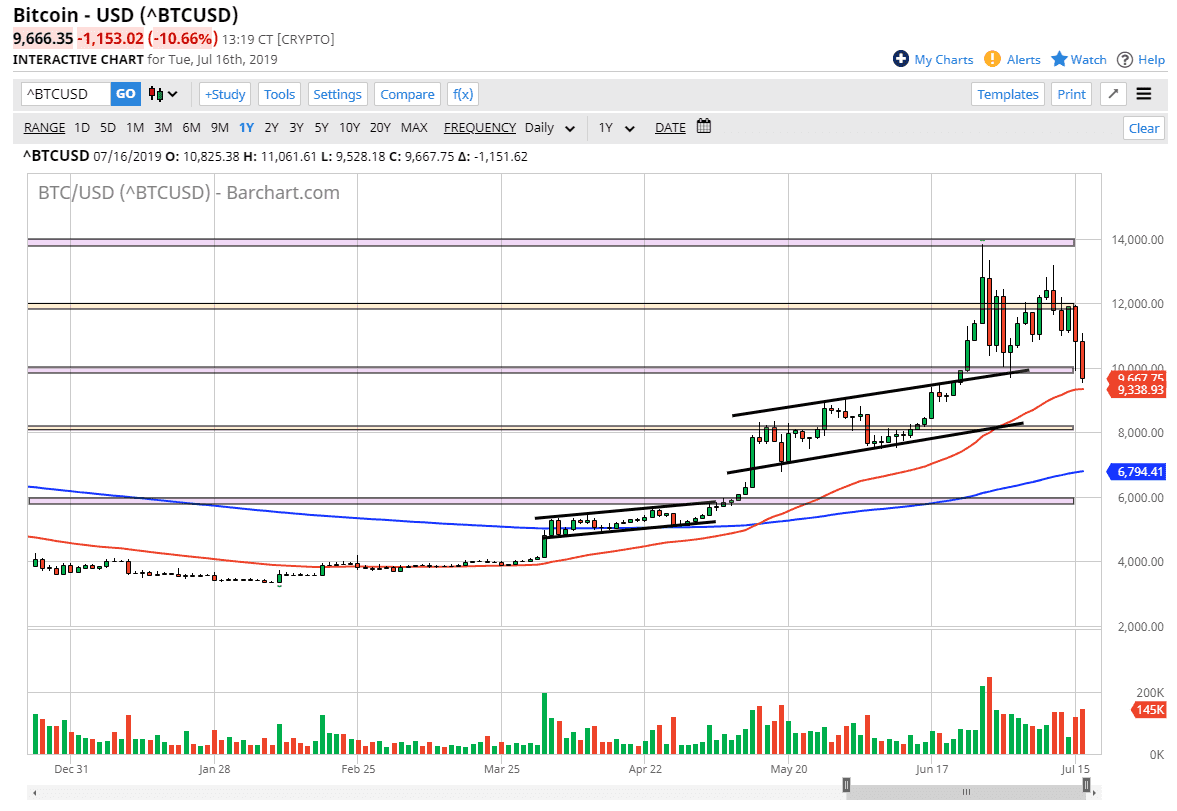

Bitcoin saw more selling pressure on Tuesday, breaking below the $10,000 level. That of course is a very negative sign and it could lead to a bit more selling but right now we are still looking at a market that is in an uptrend, so let’s not get ahead of ourselves here. Ultimately, we are in an uptrend but a bit of a pullback does in fact make sense, as it could give us an opportunity to find a bit of value.

Looking at the 50 day EMA just below which is pictured in red, there should be some support in this area. I think that some type of bounce at this point is more than likely going to be a sign to jump back in and I do think that there are plenty of people that have missed this move. That being said, if we break down below the 50 day EMA, then the $8000 level underneath would be the next target. If you watched the video yesterday, you will remember that I said that $10,000 should be an area of interest down to the 50 day EMA, and then if we were to break down below there the $8000 level would be your next support level. That’s still the same analysis I’m looking at here, but the fact that we got towards the 50 day EMA so quickly makes me believe that we could probably see a little bit more downside.

You’ll notice that I’m still not looking to sell this market, at least not until we break significantly below the $8000 level. This market is most certainly bullish, and even though we’ve had a huge break down during the last couple of days, it hasn’t exactly been a massive collapse, at least not in terms of volume or velocity. We had gotten a bit ahead of ourselves, so something like this makes quite a bit of sense. If you truly believe in Bitcoin, then this type of action is what you need to see in order to believe in the crypto currency.

That being said, be cautious and take your time. After all, the pullback could be for a few thousand dollars. Ultimately, being patient will probably be the best advice that anybody can give you in this market. The days of 25% gains are over, or at least they should be. Clearly, if we want to own this digital asset, we need to see stability.