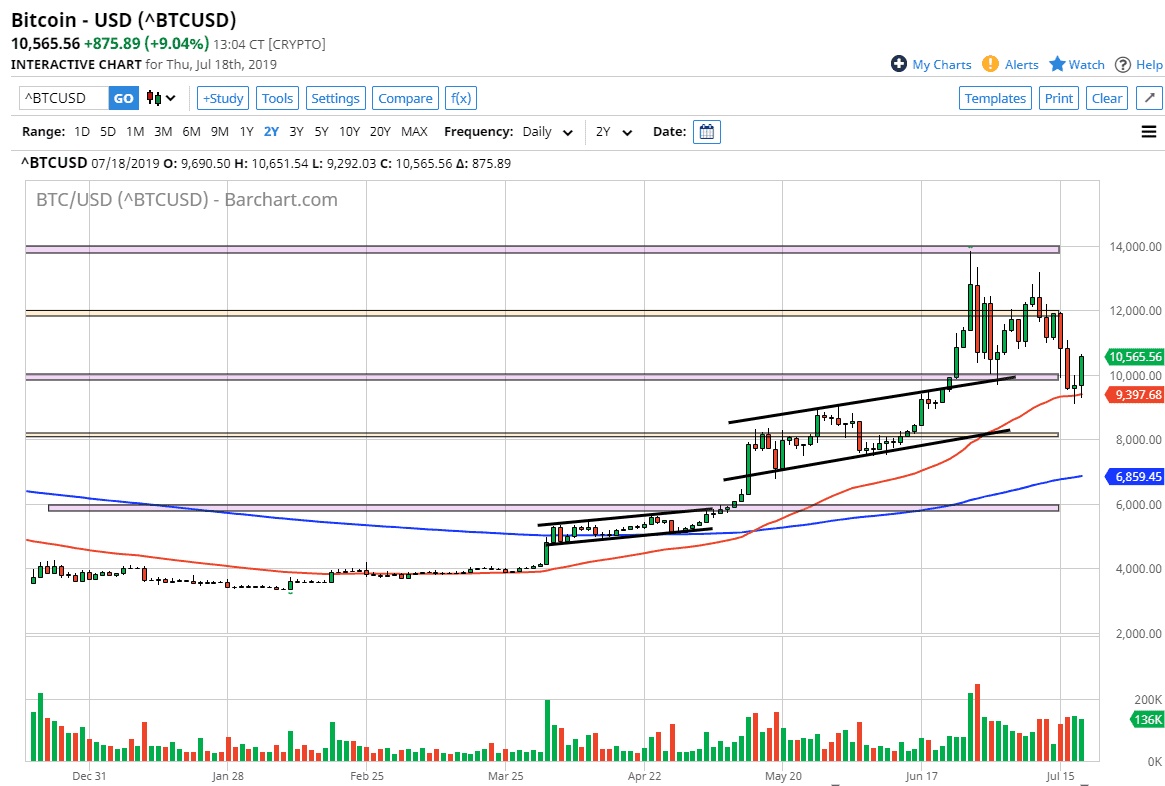

Bitcoin markets rallied as expected during trading on Thursday, after forming a very neutral and supportive looking candle stick on Wednesday. If you remember from the previous video I did on Bitcoin, I pointed out that the $10,000 level was psychologically important so it could offer a little bit of resistance. However, we also have the 50 day EMA offering support, which is something that tends to be rather important in the Bitcoin markets. By bouncing from this area and recapturing the $10,000 level, this is in fact very bullish sign.

You also remember that I had suggested that we will probably go looking towards the $12,000 level above. We have seen some selling pressure from that area, so it will be obvious resistance. However, being in an uptrend and of course with the central banks out there looking to cut interest rates, it makes quite a bit of sense that the Bitcoin market continues to rally, right along with gold. After all, people are looking to protect their wealth and try to stay away from depreciating assets.

All things being equal, this is a market that should continue to grind higher, because the Federal Reserve and other central banks around the world are going to loose monetary policy and we obviously have a lot of concerns when it comes to the global economy. Ultimately, this is a market that will probably benefit from the economic uncertainty out there, because the Forex world is trying to chew itself up right now. That being said, if we were to break down below the $8000 level that would be a major turn of events. I don’t think that happens anytime soon, especially after the action on Thursday. If we can clear the $12,000 level, it’s likely that we could go to the $14,000 level after that. I do expect that to happen, but it may take some time to get there. Ultimately, bitcoin had gotten ahead of itself so the fact that we pull back the way we did is rather healthy. Stability is what we need, and this pullback is what we have recently seen in the way of that potential stability. This marketplace has a tendency to get a little ahead of itself, and I think that’s what we have just witnessed. By pulling back, we can now start to attract value hunters that will continue to grind its way to the upside.

That being said, if we were to break down below the $8000 level that would be a major turn of events. I don’t think that happens anytime soon, especially after the action on Thursday. If we can clear the $12,000 level, it’s likely that we could go to the $14,000 level after that. I do expect that to happen, but it may take some time to get there. Ultimately, bitcoin had gotten ahead of itself so the fact that we pull back the way we did is rather healthy. Stability is what we need, and this pullback is what we have recently seen in the way of that potential stability. This marketplace has a tendency to get a little ahead of itself, and I think that’s what we have just witnessed. By pulling back, we can now start to attract value hunters that will continue to grind its way to the upside.