Bitcoin markets fell a bit during the trading session on Friday, as we did see a bit of a “risk off” move in general. While crypto traders will hate to admit this, the Forex world has a major influence on what happens in these markets. Remember, this is the BTC/USD pair, not just the “Bitcoin market.” In other words, you are measuring the value of Bitcoin against the US dollar which did get a bit of a boost during the trading session on Friday.

As the jobs number came out much stronger than anticipated, it drove money into the US dollar as people began to speculate that perhaps the Federal Reserve was not willing to cut interest rates in an economy that was burning a little hot anyway. They have since come out and suggested that the Federal Reserve will do whatever it takes to keep the economy going, which of course means elevate stock prices. That of course means lower interest rates. If that’s going to be the case, then it makes sense that the US dollar will fall, and as we measure Bitcoin against that same very currency, it should buy a it’s very nature lift.

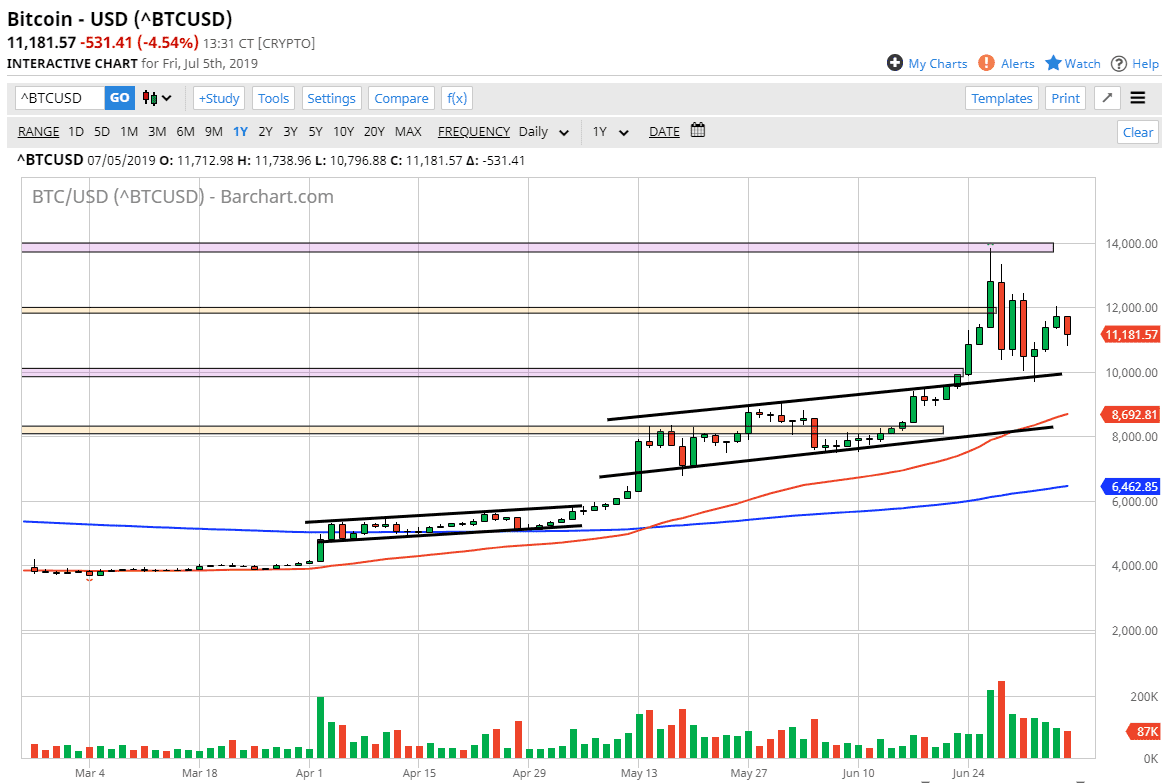

Bitcoin had fallen quite a bit, but we have got a bit of a bounce in the process. All things being equal, it’s obvious that the Bitcoin market has formed a short-term bottom, with perhaps a significant amount of support at the $10,000 level. At this point, it looks like the hammer that formed on Tuesday was indeed an excellent buying opportunity. It also looks as if the $12,000 level above is going to cause significant resistance and breaking above there should then send the market to the $14,000 level after that. Longer-term, nobody really knows what will happen with Bitcoin, because it has a knack of going higher than anybody thinks and breaking down just as quickly.

As things stand right now, this is a market that looks like it is ready to be bought on dips, and as long as we can stay above the $10,000 level there’s no reason to think that this market is one that can be sold. I like the idea of picking up Bitcoin on these dips and building up a larger position. That being said the easy money has already been made as we were $4000 lower than current trading in just the last couple of months.