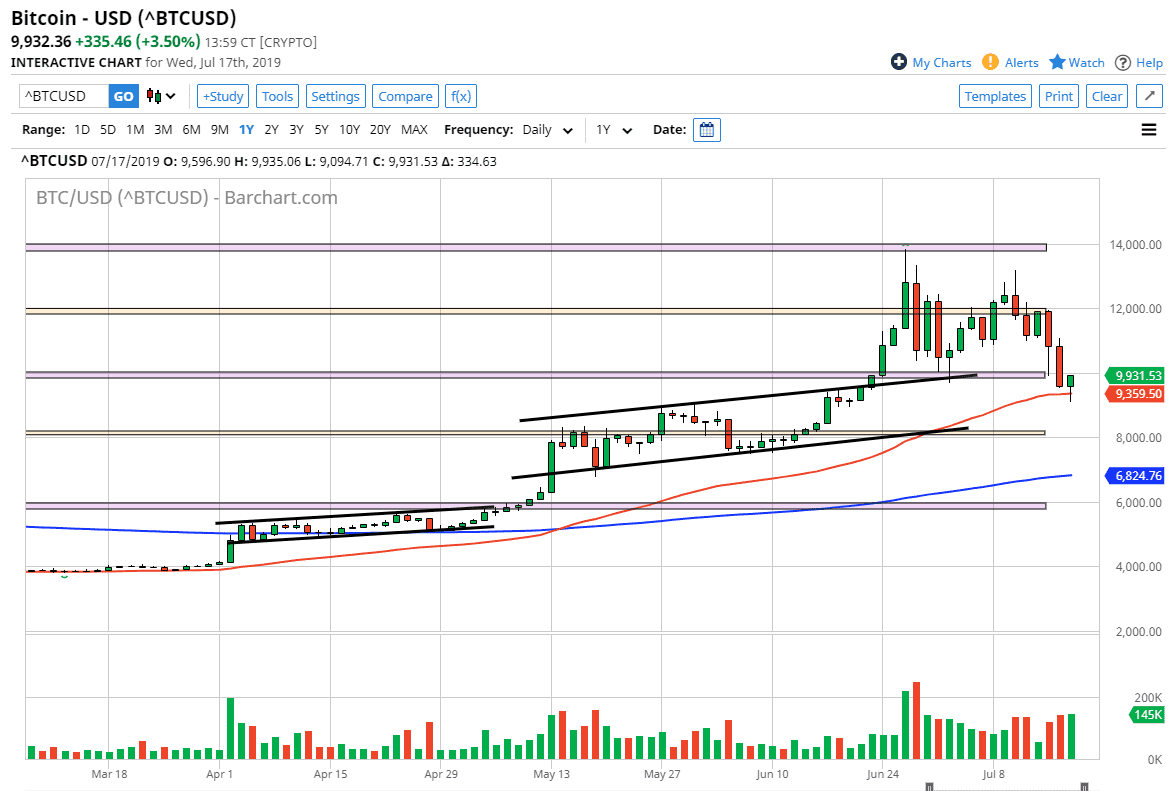

Bitcoin markets fell initially during the trading session on Wednesday, breaking down below the 50 day EMA, an area that a lot of technical traders will pay attention to. The fact that we are starting to form a hammer is also a very good sign, and at this point it lines up in a somewhat perfect manner. The $10,000 level is above, and if we can break above that level it will not only break the top of the hammer, which in and of itself is a technically important buy signal, but it also recaptures a major area of potential support or resistance.

Looking at this chart, and that could give this market the ability to reach towards the $12,000 level, maybe even the $14,000 level. This is exactly where we need to see support come back into the marketplace, as it is a perfect level for longer-term players to pay attention to. Ultimately, if we were to break down below the bottom of the candle stick for the Wednesday session, that would be a very negative sign but I think at this point we are likely to see a lot of support at $8000. That being the case, if we were to break down below that level I will simply sit on the sidelines and wait.

You will notice that I haven’t mentioned selling the market, which is something that I have done in the past and got a lot of flak from the public all the way from $19,000 down to $4000. That being said, I’m not afraid to short Bitcoin, and have done so a couple of times in the futures markets in the past. Having said all of that, and the fact that I do not believe in Bitcoin, the fact that I’m not willing to sell it should tell you how bullish this candlestick and chart actually looks to me. At the end of the day, I’m a trader and I’m not anything beyond that. At this point I think that the market should continue to go higher, at least in the relatively short term, so I have no interest in trying to fight the trend. In the end, it’s about making money and not trying to become a “believer.”

I believe that Bitcoin is going to be too volatile to ever actually be used as money, because if you think about it there doesn’t take much imagination to think about the following situation: where I live, there is an auto body shop that is rather popular that accepts Bitcoin. Quite often, your bill can be $3000, possibly even more. The biggest problem with this is that if you are the contractor doing the work and you charge $3000 for your work, what happens if bitcoin suddenly loses 30%? You can see the problem here. Until the volatility dies down, this is a speculators market. Regardless, it’s in an uptrend and that’s all that really matters.