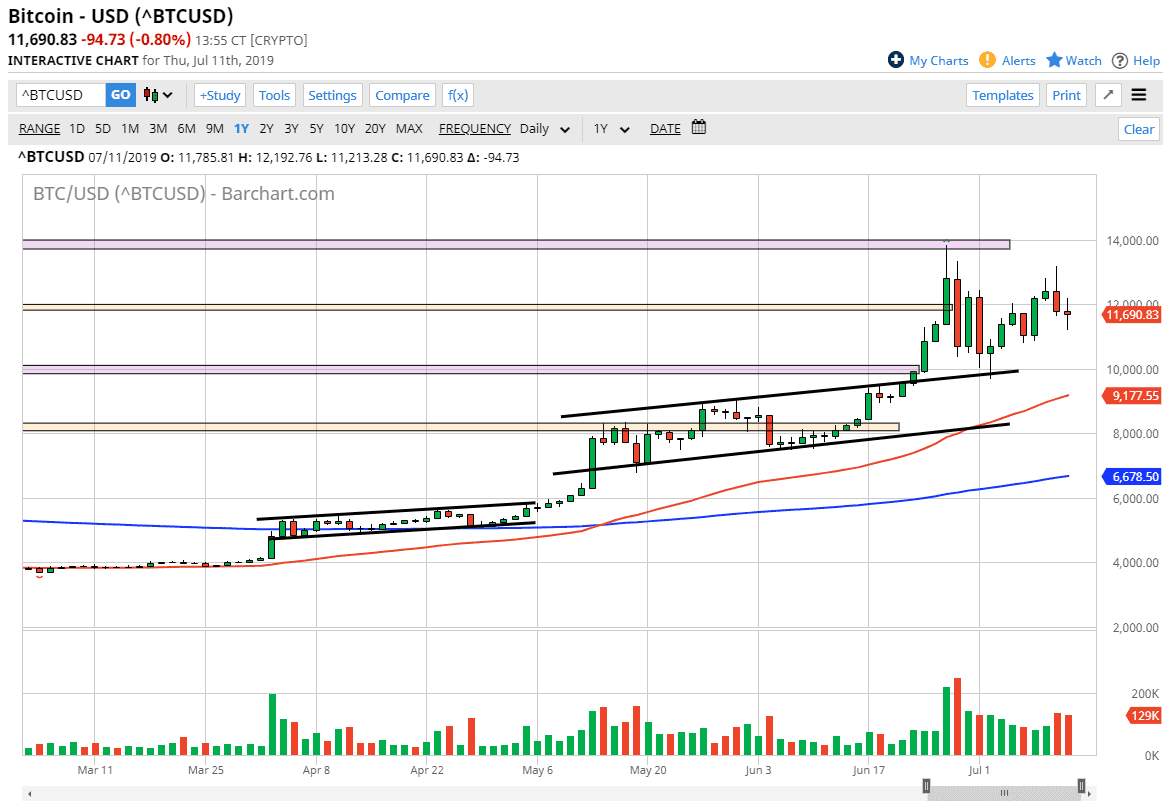

Bitcoin markets rallied a bit during the day on Friday to reach towards the psychologically and structurally important $12,000 level. That’s an area that we have sliced through a couple of different times, so while it is important, it’s essentially what I look at as “fair value” in the short term. Looking at this chart, you will notice that I have every $2000 marked on the chart by highlighted rectangles. That’s how this market has been trading, and I don’t think that’s going to change anytime soon. I believe that the $14,000 level above is going to continue to be massive resistance, but eventually we could break above there in continue to go much higher.

To the downside, the $10,000 level should be massive support as it is not only the most round of figures, but it is also the top of the extrapolated up trending channel that I have marked on the chart. Beyond that, the 50 day EMA comes into the picture in that general vicinity, and if the market were to pull back toward that level, by the time we get there it’s very likely the EMA will meet price.

To the upside, if we can break above the $14,000 level I think it makes quite a bit of sense that the next target will be the $15,000 level as it is a very significant psychological figures well. At that point, quite a few of the retail traders that got so beaten down a couple of years ago could be made whole. If that’s going to be the case it’s likely that the $15,000 level could be very difficult to break above. If we do though, I suspect that you will see more momentum into the market.

The market looks very likely to be volatile to say the least, but I think that short-term pullbacks will offer plenty of value. While we have made a “lower high” recently, the reality is that the move to the upside had been so astonishing that of course we needed to pull back and catch our collective breath. Ultimately, we are building up the necessary momentum to make a much bigger move in the Bitcoin space. If we did somehow break down below the $10,000 level, we could go looking towards the $8000 level which will be even more supportive. Expect volatility, but the great thing about this is that you can add slowly.