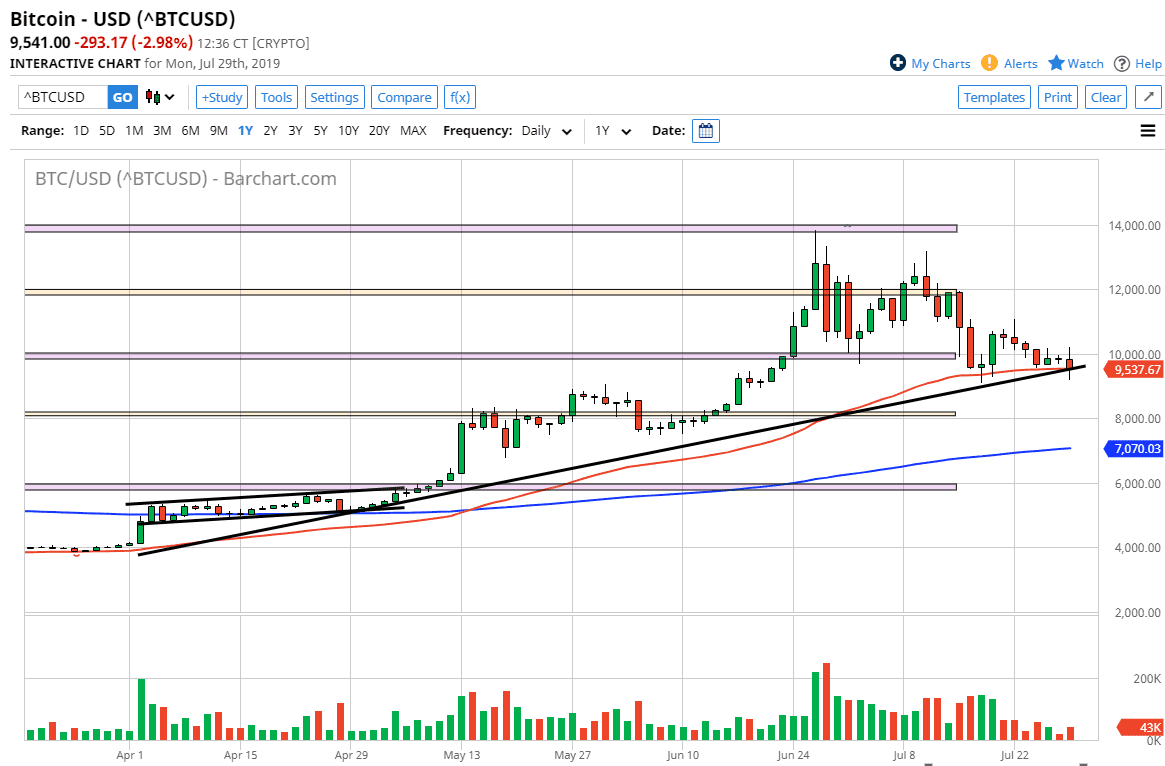

Bitcoin markets went back and forth during the trading session on Monday, testing the uptrend line that is clearly marked on the chart. That being the case, we also have the 50 day EMA sitting just below that could cause a bit of support as well. Granted, Bitcoin hasn’t exactly taken off to the upside but we are stable, something that is crucial to bring in fresh money. It’s difficult to imagine a scenario where people are going to come in and chase momentum forever, much like they did a couple of years ago.

Looking at the candle stick for the trading session, you can see just how confused the market seems to be but it also looks as if the 50 day EMA is getting a lot of attention as well. If we can break above the top of the candle stick for the trading session on Monday, then I think it opens up the door towards the $11,000 level. That’s an area that has been resistance recently, and I think at this point we are simply going to “tread water” in order to try to find some type of reason to go higher. That being said, if we do break down below the bottom of the candle stick during the trading session on Monday, then the market breaks down towards the $8000 level underneath.

At this point, I think that the market will probably have to make a decision relatively soon, but I think we are starting to see this market trying to form some type of bottoming pattern in order to reach towards the $12,000 level eventually. I think at this point it’s much easier to buy Bitcoin than it is to sell it but we may just simply need to drift around for a little bit longer in order to build up the confidence that’s necessary for this market to rally.

The alternate scenario of course is that we break down and then eventually break down below the $8000 level. If that were to happen, it could be the beginning of something rather ugly. I don’t think that’s going to happen, and with the Federal Reserve having the major meeting this week, they could do something very anti-dollar, sending this market higher, looking at the differentiation in the Forex markets. Ultimately, I think that the market will get what it needs out of the Federal Reserve in order to send the US dollar lower.