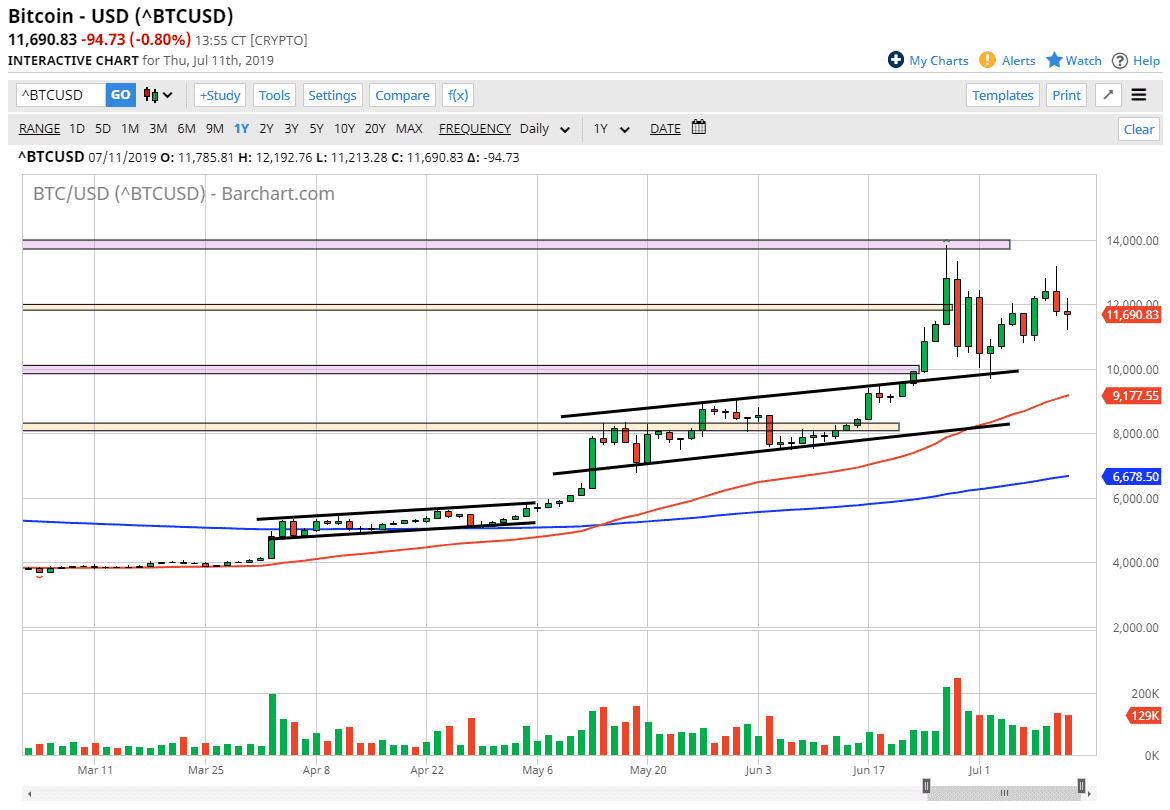

Bitcoin markets did very little during the trading session on Thursday as we continue to dance around and look for some type of directionality. It makes sense that we do very little though, because this is a market that doesn’t quite know what to do because we had rallied so quickly previously to get here. That being the case, it’s very likely that we are going to see buyers underneath as we had previously rallied, and I think that the most obvious level to look for buyers at would be the $10,000 level. I also recognize that there is significant resistance above at the $14,000 handle, so I think that the sellers will come back into the marketplace.

Overall though, what am seeing here is that we are close to the $12,000 level, which is essentially “fair value” according to the $4000 range. Short-term dips offer value, just as getting a little too close to the $14,000 level above could be a bit too expensive. That being said, the fact that we had rallied to get up here suggests to me that perhaps what we will see is an eventual break out to the upside.

For those of you who have been trading Bitcoin for some time, you remember how parabolic markets end, and quite poorly. The fact that we are grinding sideways is a very good thing as it lets the market digests these humongous gains. A break above the $14,000 level would be a sign that we are ready to make the next move higher. The $10,000 level being broken to the downside would be rather concerning, but we have the 50 day EMA starting to slide up towards that level, so I think that it’s only a matter time before longer-term traders get involved and start pushing higher as well.

All things being equal I am bullish of Bitcoin but I also recognize that we need to take a certain amount of time to get comfortable at these high levels, and more importantly have fresh money coming into the market as they realize that the Bitcoin market is perfectly comfortable hanging around this area. We are not overly expensive, which is a little exhausted and there is a huge difference between the two. All things being equal I anticipate that we will eventually break the $14,000 level and go to $15,000 after that.