The bitcoin market drifted a bit lower during the trading session on Tuesday, looking very likely to try to find support underneath. During the Tuesday session we initially dropped below the $10,000 level but then turned around to show signs of resiliency yet again. Yes, there are people out there sensationalizing the fact that the market break down below the $10,000 level during the day, but you can see we turned right back around. Beyond that, there are plenty of supportive things underneath that should continue to keep this market alive.

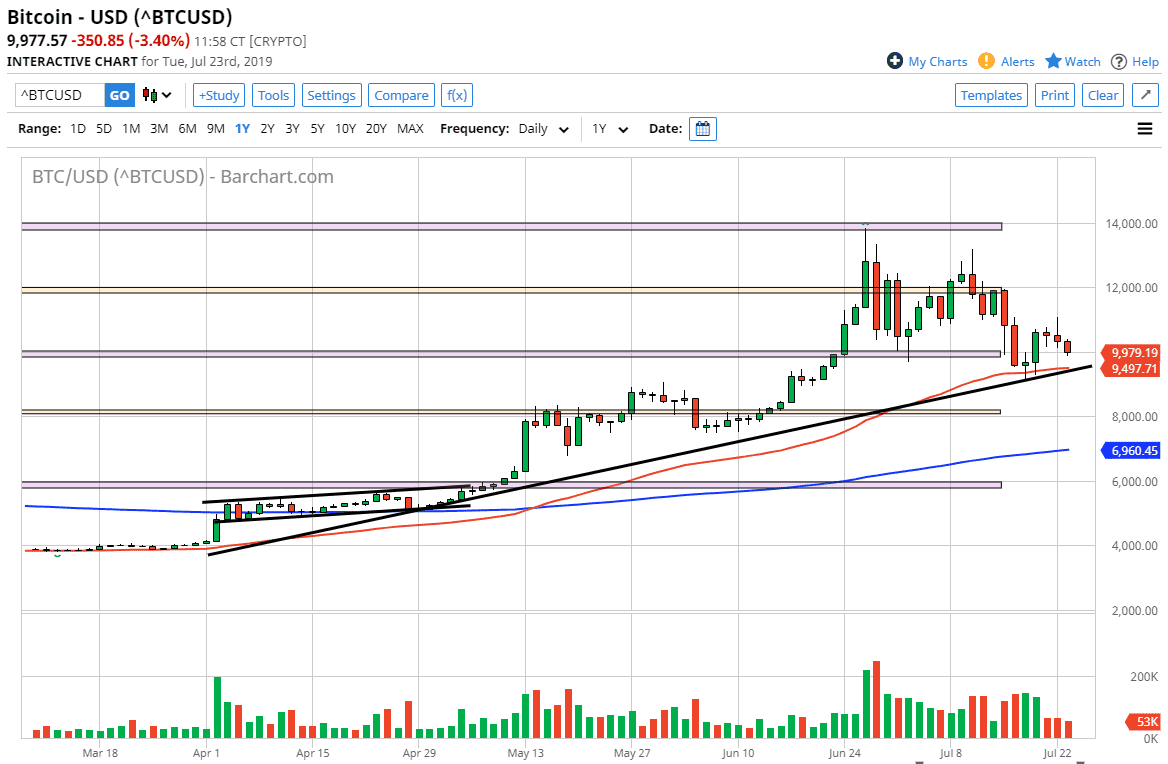

Looking at the chart, it’s obvious that there is an uptrend line underneath, and I think that is something that should be paid attention to. Beyond that, we have the 50 day EMA so that could attract longer-term traders as well. The 50 day EMA is tracing right along the uptrend line, and that is another reason to think that this market should go higher. All things being equal, it’s very likely that there should be plenty of buyers just below. You’ll notice that we didn’t get too far below the $10,000 level, so I would not make a big deal about the fact that we dipped below it.

To the upside, if we can break above the top of the shooting star candlestick from the Monday session, that should open up more money into the market and reach towards the $12,000 level. That is a level that will more than likely continue to be attractive for traders, as we can see that there has been several attempts to break above it. In fact, we even got as high as $14,000 at one point. Looking at this chart, the market is likely to try to continue to go higher, but at this point in time it looks like there is a lot of noise above. Bitcoin has of course been very bullish until most recently, where we have simply gone sideways. I think it’s very likely that the market will continue to go higher but we also need to build a bit of a base before that happens, and of course we have the Federal Reserve looking to cut interest rates and that should continue to push alternate currency such as Bitcoin to go higher. If we did break down below the uptrend line, then I believe that the $8000 level will be your next support level going forward.