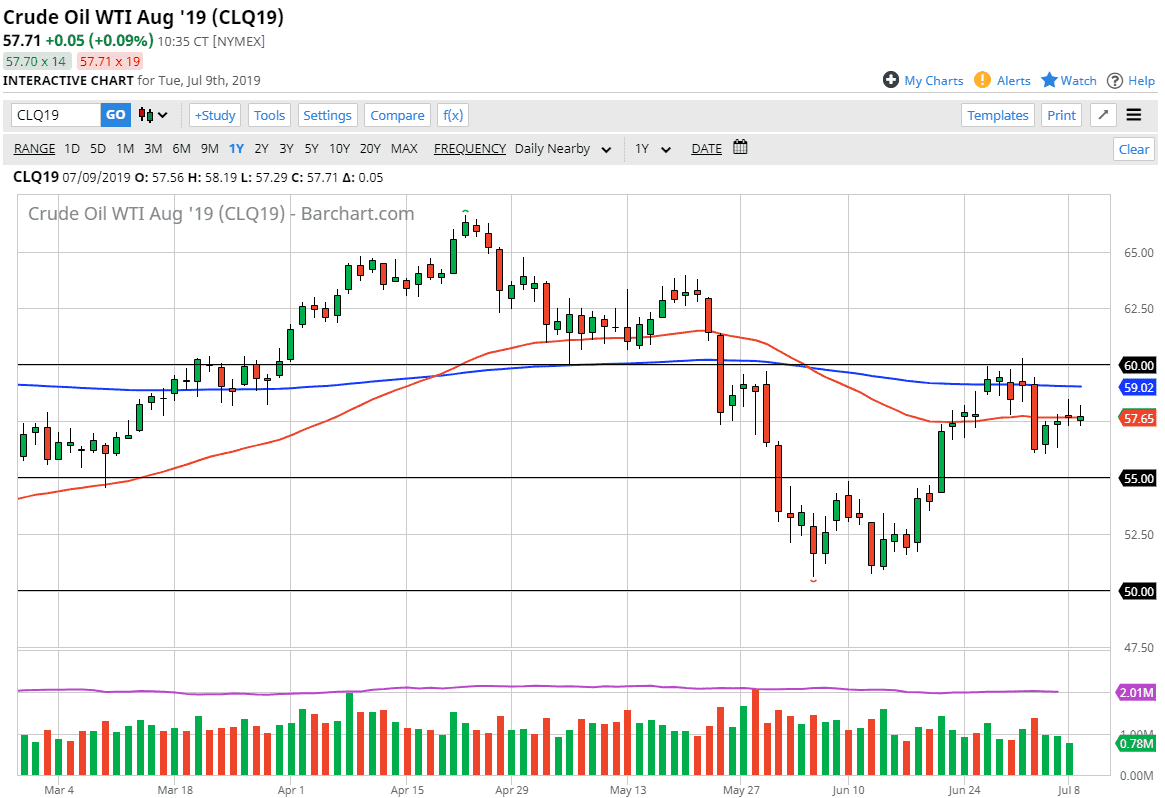

Crude oil markets did very little during the trading session on Tuesday as we continue to dawdle around the 50 day EMA. The market is essentially stuck and doesn’t know where to go next. This makes sense as Jerome Powell will be giving his testimony in front of Congress over the next couple of days, and of course we are at a major technical level that will continue to cause both support and resistance.

The 50 day EMA captures a lot of attention, and that is right in the middle of the candle stick. Just above, we have the 200 day EMA at the $59 level that begins resistance to the $60 level. Any rally at this point should be a nice selling opportunity until course we can break above the crucial $60 handle. Ultimately, I believe there is a significant amount of support from $55 to the $56 level. In other words, we are right dead in the middle of that range, which essentially makes this “no man’s land.”

We need to see an impulsive candle stick to start trading or shrink down to a very tight timeframe in order to take advantage of what has been a relatively well-defined range as of late. If you can trade the five-minute charts than of course you can use the areas mentioned previously as both support and resistance to simply fade rallies or breakdowns that are unlikely to complete. However, we will eventually get an impulsive candle out of this range, and when we do it should give us a signal to go either long or short for a bigger move. Once we get that, then you can start to put real money to work.

We course have our weekly inventory numbers we will have to pay attention to but I also believe that Jerome Powell will be a major contributor to where we go next. If the US dollar and the US economy is spoken of in dovish terms, that could actually be negative for crude oil even if it drives down the value of the US dollar, which typically is bullish. I think at this point enough people are concerned about the global growth story that oil is going to continue to struggle overall. However, there is no breakout of this range yet to confirm one way or the other. With that, trade small positions and play the range we are offered.