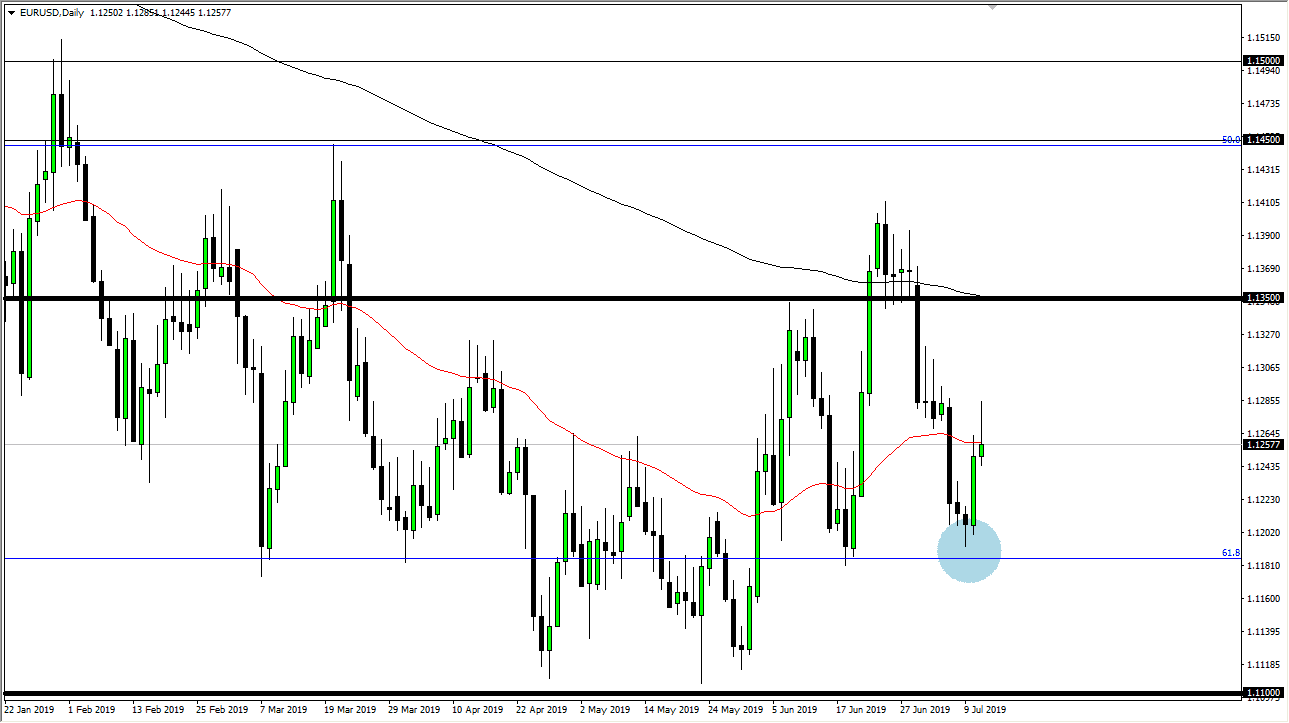

The Euro tried to rally during the trading session on Thursday but found enough resistance above the turn things around and form a massive shooting star. This of course is a very negative look, and the question now is whether or not the Euro can hold any gains? The 50 day EMA is slicing right through the shooting star, so suddenly one has to wonder whether or not we are going to be able to hang on to any gains.

Recently, I have been talking about the possibility of a turnaround, and a bottoming pattern. Ultimately, the market would need to stay above the blue circle I have on the chart and the 61.8% Fibonacci retracement level to turn things around. The alternate scenario is that we break above the top of the shooting star, which would be an extraordinarily bullish sign. If that happens, the market will probably go looking towards the 1.1350 level. This is a market that is trying to react to the idea of interest rate cuts coming out of the Federal Reserve. That should soften the US dollar and by extension strengthen the Euro as it is the “anti-US dollar.”

At this point in time it looks like we are going to chop around and considering that it’s going to be Friday it may be a bit much to ask for this market to make a huge move. I do favor the upside still but recognize that there is a certain amount of uncertainty when it comes to the overall outlook for the European Union and that’s probably the one thing that’s keeping this market somewhat lower. However, as long as we don’t make a “lower low”, it’s very likely that we will eventually break out to the upside, even though it might take most of the summer.