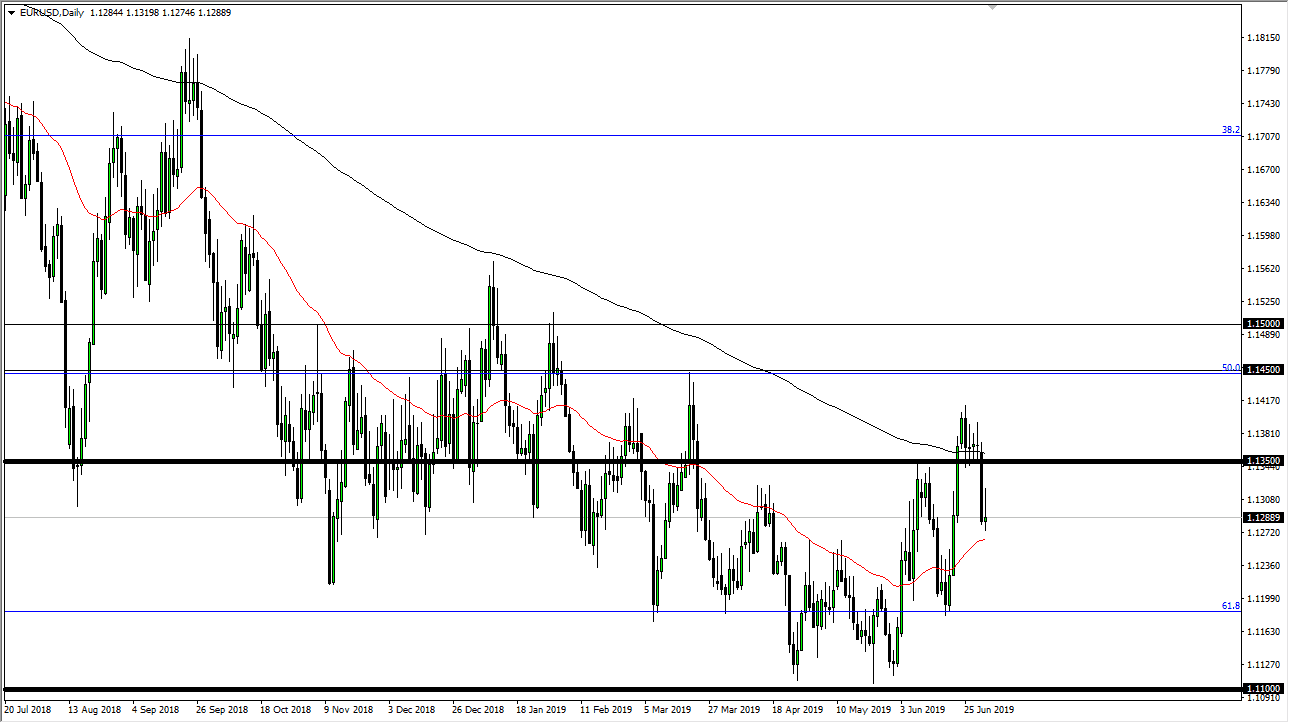

The Euro initially fell a bit during the trading session on Tuesday but then turned around to rally from the 50 day EMA to reach above the 1.13 level. Later though, we sold off and we have formed an inverted hammer at this point. Beyond that, the 50 day EMA underneath offered support just as the 200 day EMA offered resistance and was the scene of the breakdown candle from the Monday session. We are all over the place in the Euro/Dollar pair right now, which shouldn’t be much of a surprise considering how choppy it typically is.

The Federal Reserve is looking to cut interest rates, and that should continue to put bearish pressure on the US dollar, but ultimately the European Union looks economically sick as well. I think this is going to be the biggest problem trading this pair, you are simply looking at a couple of central banks that are going to be dovish to say the least. There is no reason to think that the Euro should explode to the upside, but it does look like we are forming some type of longer-term bottoming pattern.

All of that taken into account, one of the things that we need to pay attention to is that the 1.12 level underneath or the area around it I should say, is an area that should be rather supportive. If we were to break down through there, that would make a “lower low”, and therefore could wipe out the idea of a bottoming pattern. If we can stay above there, then it’s very likely that we will eventually see buyers jump in.

An alternate signal could be a break above the top of the candlestick from the Tuesday session, because you would be wiping out all of that resisted pressure and getting people on the wrong side of the trade. That doesn’t mean that we are simply going to slice higher, because the 200 day EMA and the noise between the 1.13 and the 1.14 levels will cause certain problems. However, it would be a “higher low”, which is a very bullish sign and suggest that perhaps we are in fact going to be forming a longer-term turnaround here. To the upside, we would be looking at a move towards the 1.15 handle, which is something that I still think happens given enough time but the next couple of days should be crucial.