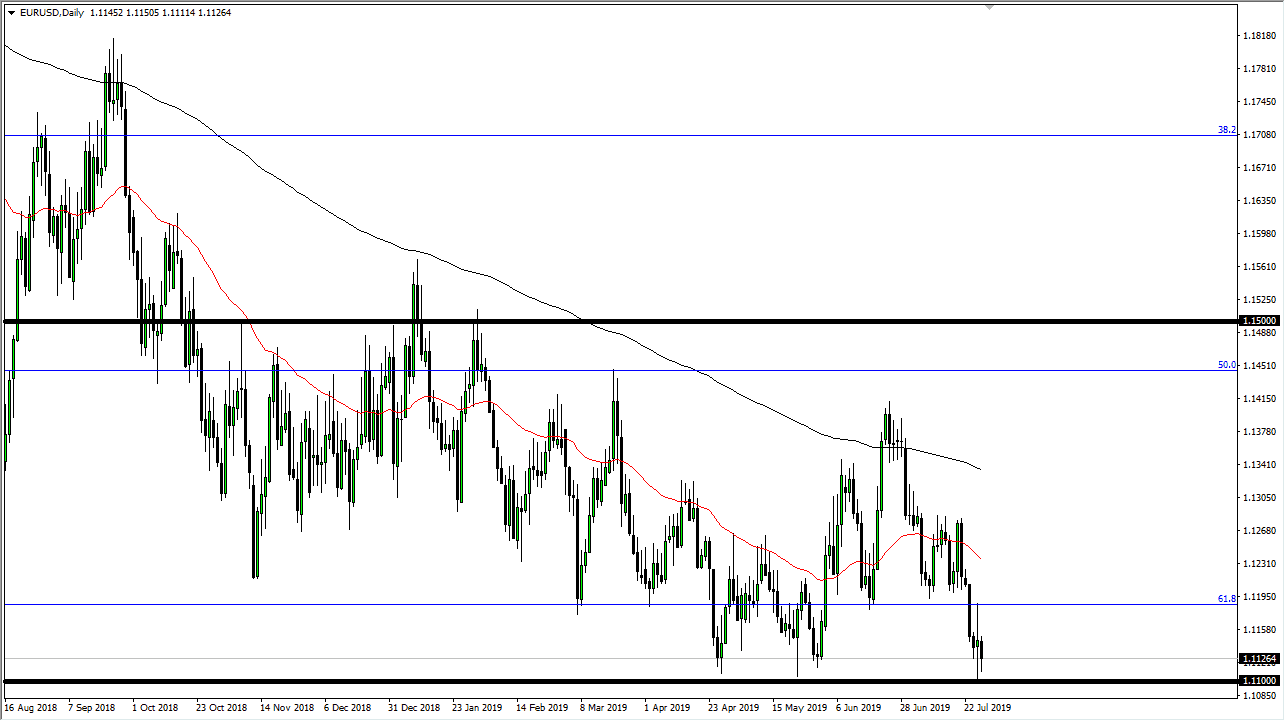

The Euro continues to go back and forth, and it looks as if we are likely to see more of the same going forward. The 1.11 level underneath is massive support, an area that has seen buyers more than once. We recently have seen a lot of volatility due to the ECB meeting and the press conference, and as a result it’s very likely that the market is looking at the 1.11 level is going to be the “floor.”

I think at this point as long as we can stay above the 1.11 level, we will find buyers and then reach to higher levels. I think at this point we are trying to form some type of base for the longer-term move. I believe that the 100 pips just below the 1.11 level will be massive support, so given enough time I think that the market will find plenty of buyers to turn this thing around. What’s the catalyst you ask? Going to be simple, it’s going to be the Federal Reserve.

Federal Reserve is going to be cutting interest rates rather soon, but at this point I think it’s only a matter of time before we get an interest rate statement and perhaps press conference. At this point, the press conference being overly dovish will send this market right back around. That could be the major catalyst to turn this market to the upside and reach towards the 1.14 handle above. All things being equal, I think that the Euro is getting a bit overdone to the downside and then I think that the value hunters are starting to come out now. Given enough time I would anticipate that this could be the bottom of the downtrend, but this is going to be a very messy affair to say the least. The market participants continue to be a bit skittish, and that makes sense considering that both of the central banks are looking to be as dovish as possible, but in the end the Federal Reserve typically gets what it wants, and that means that the Euro should continue to strengthen longer-term. That being said, I am cautiously optimistic but if we were to break down below the 1.11 handle I would be looking to “reset” any type of supportive position. I think there is much more risk to the upside then down longer-term, and am starting to put small pieces of this position together in order to build a core position.