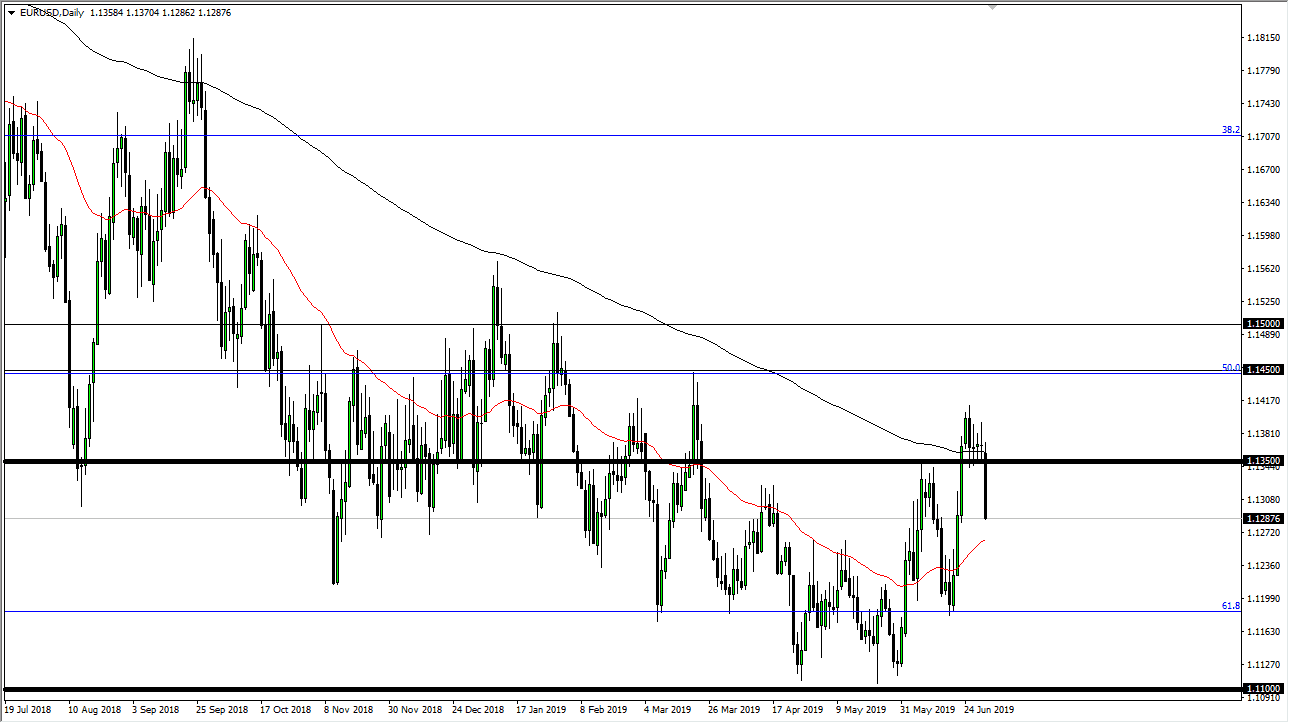

The Euro got absolutely hammered during trading on Monday as we came back to work. The 1.1350 level, an area that had been so reliable recently, has in fact given way to quite a bit of selling. This was a very choppy day as we had initially fell, turned right back around to rally bank later in the day and try to reach the 1.1350 level. However, we turned around again and started to fall during US trading. At this point, the market is showing extreme amounts of volatility and the next couple of days could very well be crucial.

The technical set up right now shows that the support has given way and the 200 day EMA is offering resistance, which is pictured in black on the chart. To the downside, we have the 50 day EMA and read that is turning higher and is coming into play rather soon. With that in mind, we could get a bit of a bounce but I suspect that we have more noise ahead of us than anything else. After this extraordinarily bearish candle, it is technically a sell signal but there are a couple of things that keep me away from shorting this market.

The argument against shorting starts with the Federal Reserve and the fact that it will be cutting interest rates rather soon. Perhaps the market is concerned that they won’t cut rates due to the US and China sounding a little bit more consolatory over the weekend. However, the Federal Reserve is very likely to cut rates in July, and that should continue to weigh upon the US dollar. Ultimately, the market should turn around as we have been trying to grind higher. When you look at the chart, you can see that we have made a couple of “lower highs”, and therefore it looks as if we are trying to form a longer-term bottoming pattern. These are never quick, so the fact that we could pull back to the 50 day EMA to find buyers wouldn’t be much of a stretch.

I am going to sit on the sidelines for 24 hours when it comes to the Euro and wait to see if we get some type of supportive action at the 50 day EMA. If we don’t, then I suspect we are going to try to break down below the 1.1195 handle. However, if we get some type of supportive candle such as a hammer near the 50 day EMA, then it ends up being a nice buying opportunity.