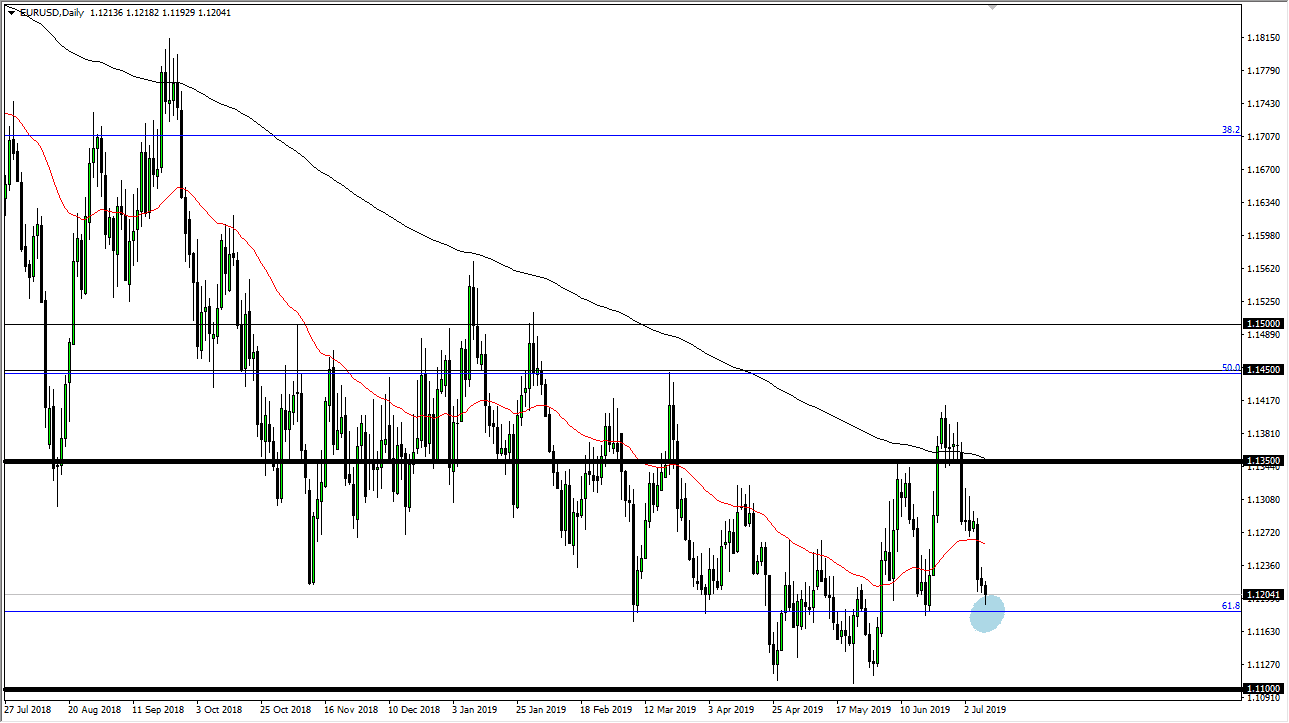

The EUR/USD pair initially felt towards the 61.8% Fibonacci retracement level during the day on Tuesday but then turned around to show signs of life again as the 1.12 level has shown itself to be supportive. However, we failed on the rally during the Monday session as well, so at this point the market looks very confused. That’s the natural state of this pair, so it should not be a huge surprise anybody who’s traded it for more than about 10 minutes.

At this point though, we have the Humphrey Hawkins testimony in the US Congress over the next couple of days, and that almost certainly drive where the US dollar goes next. Ultimately, the testimony of Jerome Powell in front of Congress will more than likely be the short-term catalyst as to where this pair goes. If the US dollar softens, that should send this pair higher almost by necessity. At that point I would anticipate that the market probably goes looking towards the 1.13 level above where we start to face our first significant resistance barrier.

Ultimately, if we break down below the 61.8% Fibonacci retracement level that is marked on the chart, it’s very likely that we will reach down towards the 1.11 level underneath, which should offer a significant floor in the market. Ultimately, I do think that it’s only a matter time before the rally comes back into fashion, because we have been building a bottoming pattern for some time. Unfortunately, the perfect set up would have been not having the break down a couple of days ago, but we are still very looking supported, and it does look like we are trying to form some type of longer-term “rounded bottom.” Although the ECB looks to be very dovish, this would make sense as there’s been a major shift in how the Federal Reserve has been talking.

The next couple of days will be about Jerome Powell and nothing else, as we continue to see whether or not the Federal Reserve is likely to cut interest rates just once, or several times between now and the end of the year. The more dovish he sounds, the higher this pair will go even though there are a whole plethora of issues in the European Union currently dogging the Euro. Without a doubt, the most important thing you can do in this pair right now is to slowly add to a small position when things work out. Jumping in with a full position right now is very dangerous.