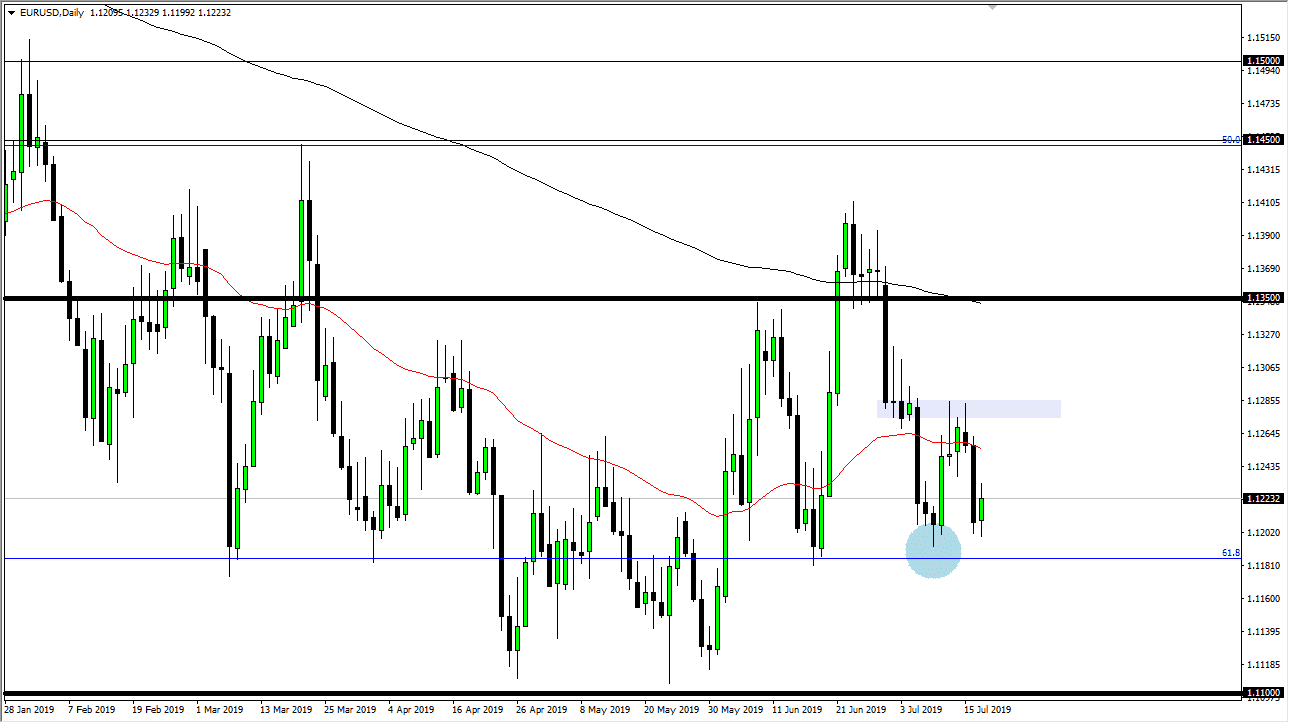

The Euro initially fell during the trading session on Wednesday but found enough support near the 1.12 level to turn things around and rally. While we have seen a bullish candle stick, the reality is that we are still stuck in a small range, and as a result I think it’s going to continue to be very choppy. The question at this point isn’t whether or not we have a bullish day, but whether or not there was real support there. I am a bit skeptical, and I think that we are probably looking at a scenario that favors that short-term traders, as we simply don’t have anywhere to be.

Looking at the central banks, it makes quite a bit of sense that the pair continues the chop around with no real clear direction as the markets have been following the fact that both of these central banks look likely to have loose monetary policy. In other words, there is no “winner” when it comes to the interest rate differential.

Looking to the downside, the 1.12 level it looks very supportive, just as the 1.13 level above is very resistive. That being the case, I like the idea that the short-term traders continue to play both of these ranges until we get some type of impulsive candle that breaks out of this area. If and when we do, then we can start to talk about the idea of where to go for the longer-term move. In the short term though, I just don’t see any catalyst to make this happen. Ultimately, I believe that we are trying to form some type a bottom, especially considering that the Federal Reserve will do everything it can to bring down the value of the greenback. While not an explicit strategy, it’s what they are doing by proxy considering they are trying to cut rates. The ECB certainly will be soft, but the ECB is already at extraordinarily low levels, so this may be simply a matter of repricing the currencies against each other.

I think at this point though, if we were to break down below the 1.12 level, then the market goes down to the 1.11 handle. Overall, I think that the market is simply going to be essentially “dead money” for the next several days, as the market simply have nowhere to be in a course this is the wrong time of year to expect a lot of volatility under normal circumstances.