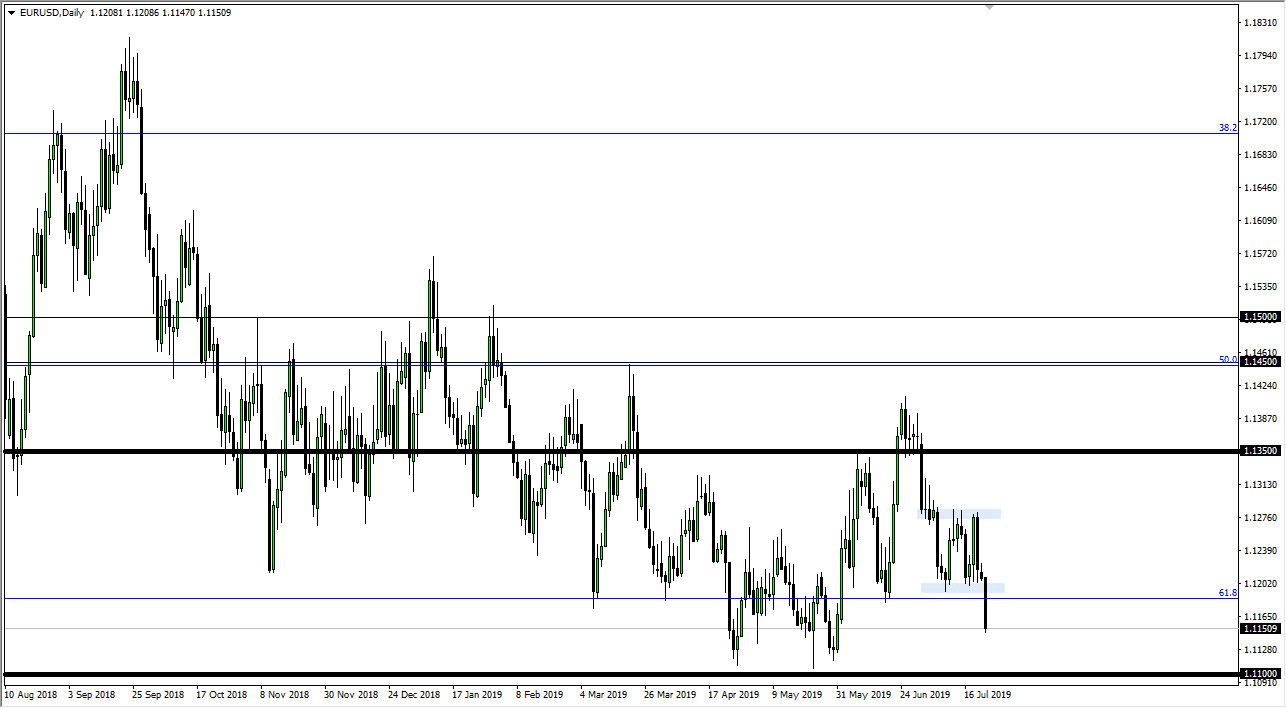

The Euro broke down significantly during the trading session on Tuesday, slicing through the 1.12 level which of course is an area that has attracted a lot of attention. Ultimately I believe that this market is probably trying to figure out how to reach lower levels ahead of the ECB interest rate decision and of course the press conference. Ultimately, I think this is a bit of a “risk off” move heading into the volatility and potential trouble coming.

The Euro broke down enough to slice through a range that we have been in for a couple of weeks, and then break through the 61.8% Fibonacci retracement level underneath. That is an area that of course will attract a lot of attention, and ultimately I think that we are going to go looking towards the 1.11 handle underneath. That’s an area that is going to be very crucial as it was the most recent low, and if we were to break down there it would be a very negative sign, especially considering that we already know that the Federal Reserve is very likely to cut interest rates.

Expect a lot of noise on Thursday, but in the meantime it’s more likely that we will have a bit of hesitation to jump in one direction or the other on Wednesday as we await that crucial announcement. People will be looking to the ECB to decide whether or not they are going to be more dovish or not. If they are, that could put a little bit of a negative vibe into this market and that could be what pushes things below the 1.11 handle. However, the 1.10 level after that will probably be rather supportive as well as it is a large, round, “Century figure”, and of course will attract a lot of money in one direction or the other.

Over the next 24 hours it is probably best to leave this market alone, because we are setting up for traders trying to get ahead of the announcement and this is always a bit of a gamble as to which direction we are going to break. With that being the case, you should probably wait until Friday to put any money to work as we need to see the reaction to the press conference in order to see where the Euro probably goes next.