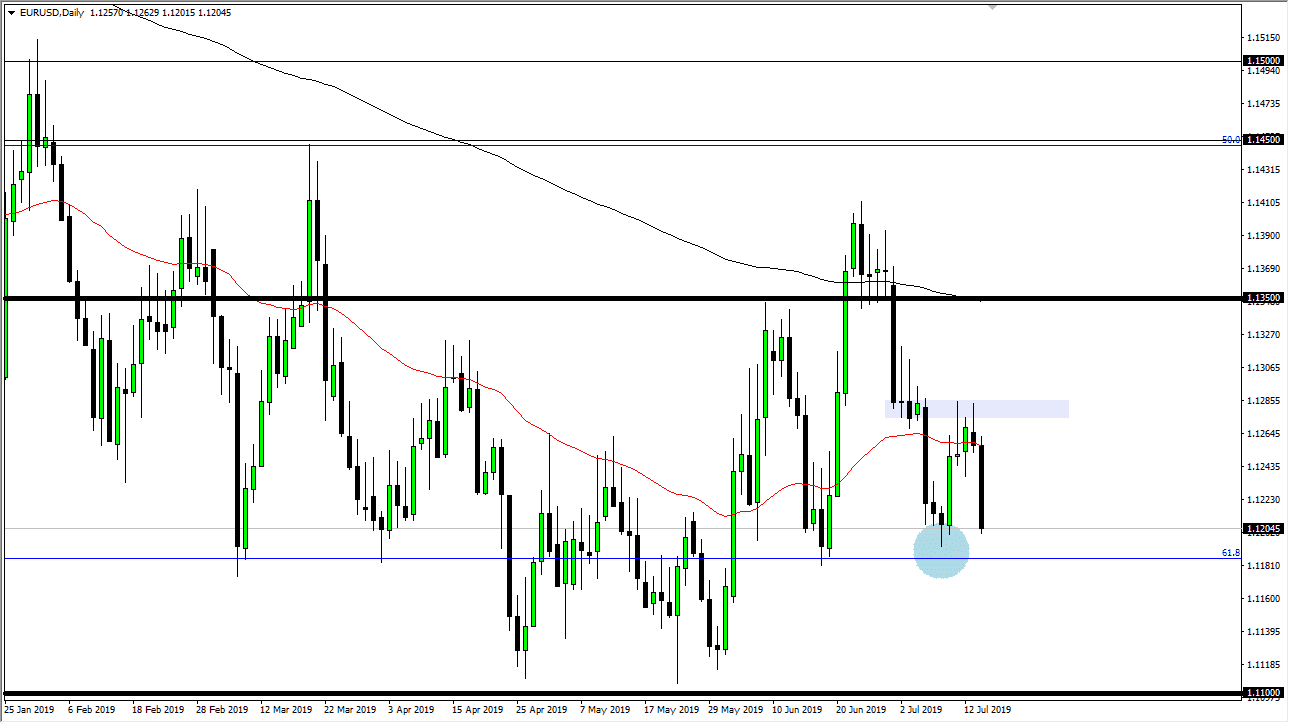

During the trading session on Tuesday we have seen the Euro break down rather significantly. That being the case, we have slammed right into the support level right around the 1.12 level. Ultimately, we are still in consolidation, but we are most certainly pressing the downside at this point.

Recently, we have seen the 1.13 level offer resistance while the 1.12 level has offered support. This is a market that is rather choppy and erratic, because we are focusing on several things at once. The Federal Reserve cutting interest rates of course does help lift this market a bit, but the question now is whether or not they are cutting just once, or perhaps cutting several times? The length of the candle stick does suggest that perhaps there is a lot of bearish pressure, and perhaps people are focusing on the internal problems with the European Union overall. After all, the European Union hasn’t grown significantly in ages while the United States economy continues to show signs of strength.

Retail sales coming out of America very strong during the trading session only reinforces this distance between the two economies, so at this point it’s likely that the market will continue to be somewhat negative, but again at the same time we have the Federal Reserve trying to push this market higher.

The 61.8% Fibonacci retracement level is just below, and that could offer support. If we were to break down below there, then the market probably unwinds down to the 1.11 handle underneath. To the upside, if we can break above the 1.13 level the market will go looking towards the 1.1350 level. This is a market that I think continues to have trouble deciding which direction to go, but there is an argument to be made that we are trying to find support underneath. Ultimately, I believe that the market is probably one that you need to trade back and forth on short-term charts, as there is no real directionality at this point, but we should start to get more clarity over the next couple of weeks. The market does of course suggests that volatility is here to stay, but on short time frames only. This is probably one of the least interesting markets that I follow currently but I will of course keep you up-to-date here at Daily Forex.