The German Economic Sentiment Index, ZEW, fell to an eight-month low with continued pressure on the Euro, as economic data continued to confirm that the Eurozone economy was slowing down, as well as the continued global trade wars. The EUR / USD fell to 1.1201 level and is stable around there at the time of writing, ahead of the Eurozone consumer price figures announcement. Stronger losses for the pair were supported by US retail sales figures, which still confirm the strength of US consumer confidence, despite the direction of monetary policy makers to cut interest rates.

The pair's gains quickly evaporated, which the pair managed in achieving with the US central bank's recent confirmation of a near-term cut in US interest rates. Earlier, the European Central Bank (ECB) announced that it would support easing its monetary policy to counter this slowdown. Which could push it to cut interest rates into the negative territory for the first time in the history of the bank's policy, as the global trade war continues to have a more negative impact on the Eurozone economy than the US itself.

In his last testimony, Jerome Powell emphasized the near-term date for cutting US interest rates more than previously expected. That strongly pushed outlooks for the bank cutting rates when they meet later this month. Powell's said: "Doubts about trade tensions and concerns about the strength of the global economy, still affect the US economic outlook." The US central bank's signs strongly contributed to the US stock indexes' record highs.

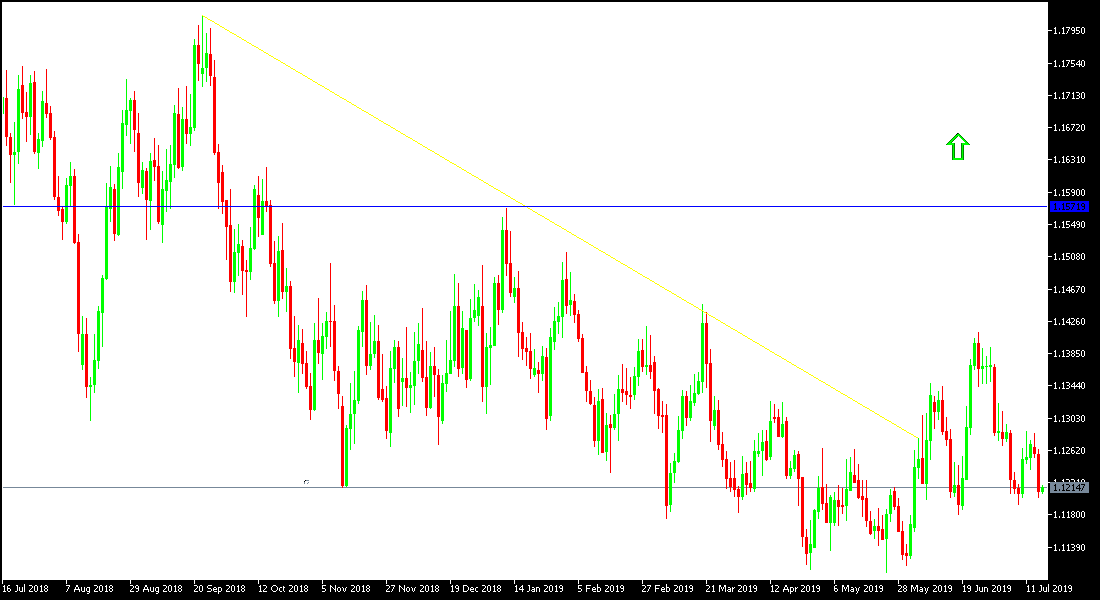

Technically: The general trend of the EUR / USD is strongly bearish and is very close to a break below 1.12 psychological support which will increase pressure to move towards stronger support levels of 1.1170, 1.1060 and 1.0980 respectively as the Eurozone economy continues to slow. On the upside, the pair’s attempts for a bullish rebound may target the resistance levels 1.1285, 1.1355 and 1.1445, respectively. The pair is moving within a stronger bearish channel.

On the economic data front, the economic calendar today will focus on the announcement of the consumer price index for the Eurozone, and building permits and housing starts data from the U.S.