For three trading sessions in a row, the EUR/USD gains stop around the 1.1280 resistance level awaiting stronger catalysts to continue the bullish correction tone in order to breakout the bearish channel which still strongly stands. The positive inflation numbers from the U.S –CPI &PPI- stopped the USD losses, which suffered a lot against other majors due to confirmation from the Fed Reserve on the near interest rate cuts. The ECB also wasn’t far from this direction, as the Eurozone economy is suffering greatly, which will support a dovish policy stand by the ECB, which could eventually lead to dropping the interest rates to the negative area, as the continuation of the global trade wars negatively and strongly affect the Eurozone economy more than the economy of the US, who is a major part in these wars.

In his second testimony before the US congress, Jerome Powell stressed the close date for US interest rates cut, stronger than what was expected. Therefore, expectations reached 100% that the bank will do that in their meeting this month. This percentage dropped a little after the US inflation data, but is still in high probability level. Powell said: “Doubts around trade tensions and fears about the strength of the global economy, still affect US economic forecasts”. Signals from the US central bank contributed strongly in US stock indexes reaching record highs.

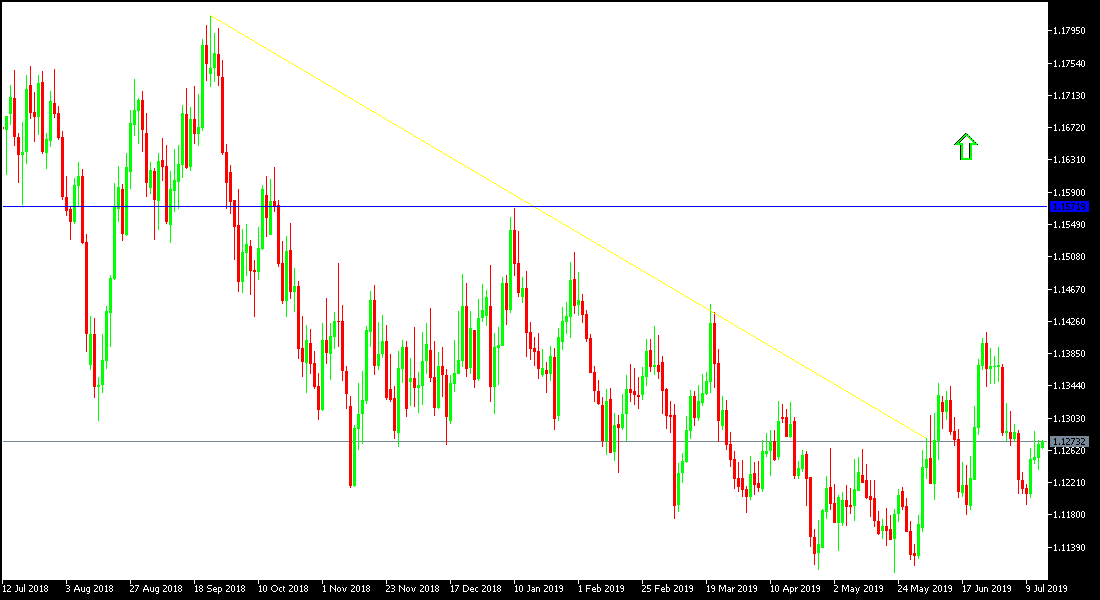

Technically: despite the recent bounce, the overall trend for the EUR/USD is still bearish, and this direction will be stronger in case it moved towards the psychological support at 1.1200, which will increase pressurs towards stronger support levels that may reach to 1.1170, 1.1060 and 1.0980, respectively, that is with the continuation of fears towards the Eurozone future. On the bullish correction side, the bullish bounces attempts might target resistance levels at 1.1285, 1.1355 and 1.1445 as initial targets. Generally, there were no signs on a strong bullish correction in the near term.

On the economic data front: Economic agenda for today has no important releases from the US or the Eurozone.