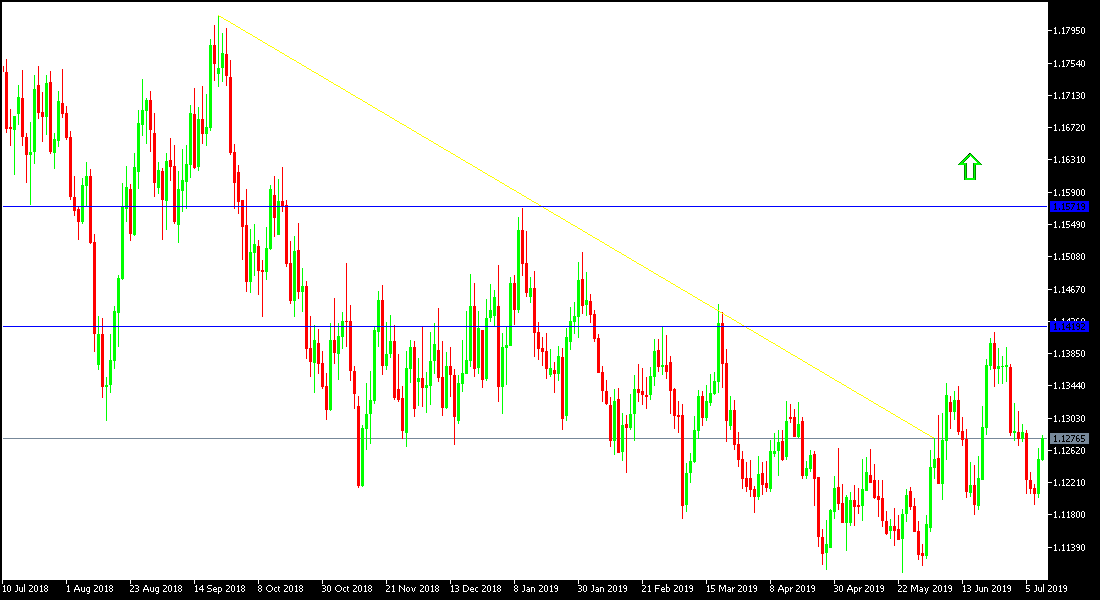

Global developments, which were a product of the global trade war, have raised doubts about the economic outlook and have strongly contributed to the adjustment of US Federal Reserve monetary policy makers to their view of the US economy and to try to intervene and do the necessary to maintain economic growth. The testimony of Federal Reserve Chair Powell in front the US Congress, and the latest minutes of the bank's meeting, underscores the near-chance of a reduction in US interest rates. Expectations have reached 100% that the bank will do so when it meets later this month. The adjustment contributed to stronger gains for the EUR / USD pair for a second consecutive day, reaching 1.1280 at the time of writing, rebounding from a two-week low when it tested support at 1.1193. Despite the recent rebound, the pair is still moving within its bearish channel.

Cautious signals from the US Federal Reserve about the future of its monetary policy, supported the evaporation of optimism resulting from US jobs figures for June, based on which, the markets excluded that the bank will cut US interest rates at this month's meeting. The general trend of the pair remains bearish, and with technical indicators reaching oversold levels, weakness in the euro will continue to contribute to the bearish move.

As for Trump trade wars around the world, markets have always questioned Trump's management policy. Fears are still there of surprises about the trade relation with China, as they have often negotiated and eventually new tariffs are imposed. The continuation of the global trade war means that the Eurozone economy is slowing down and the euro may lose more.

Technically: As expected, the EUR/USD bearish trend is strengthening by testing the 1.1200 psychological support and after that, the nearest support levels will be 1.1170, 1.1060 and 1.0980 respectively if fears for the future of the Eurozone persist. The upward correction attempts above the pair may target resistance levels at 1.1285, 1.1355, and 1.1445 as first stops. In general, there were no signs of a stronger bullish correction.

On the economic data front: The pair will await the announcement of German and French CPI data and the statement from the ECB. From the U.S, there will be the CPI Data and Powell’s testimony in front the Congress.