The EUR/USD pair did not do a lot for several consecutive sessions and is settling around the 1.1160 level at the time of writing. The pair is waiting carefully for the Federal Reserve Interest Rates decision, with expectations for interest rates cut by a quarter point. Investors will be watching for the content of the Bank's monetary policy statement and the comments of Governor Jerome Powell following the decision to identify the future of the Bank's monetary policy, especially as global trade wars continue. Any signals from the bank to complete the course of policy easing will support stronger losses for the US dollar. If he suggests that the bank is reducing its rates for insurance purposes only and will study the performance of the economy after the cut, the dollar losses will be limited.

Investors will continue to monitor the different economic performance and monetary policy of both the Eurozone and the US, and it is expected to be in favor of the US dollar. The European Central Bank kept the interest rates unchanged at 0.00%, but hinted in the monetary policy statement, according to Mario Draghi, that the bank is determined to provide more stimulus plans for the Eurozone economy, which is suffering from a slowdown due to the continuation of the global trade war. As for the economic performance, recent economic data confirm that the Eurozone economy is strongly affected by the continuation of the global trade war. In contrast, the US economy still shows resistance and good performance.

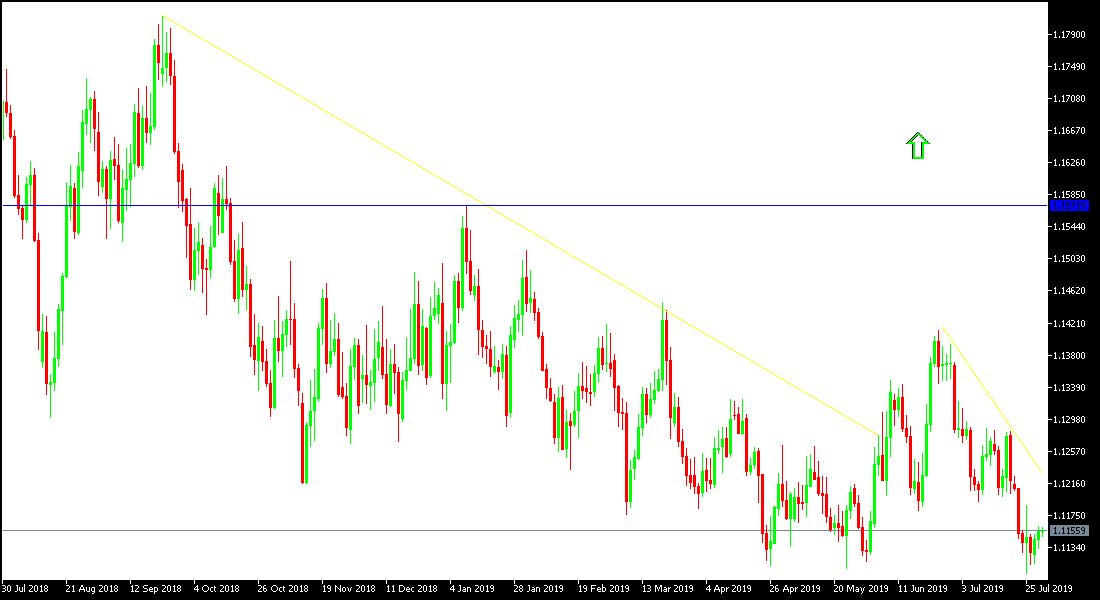

Technically: the EUR / USD performance is still bearish despite recent stability and any move below 1.11 will support the strength of this trend and will test stronger support levels which may be closer to 1.1045, 1.0980 and 1.0900 respectively. On the upside side in the event of a bullish correction, the resistance levels will be at 1.1200, 1.1285 and 1.1345, respectively. The pair is still bearish and still better sold from every ascending level.

On the economic data front: The economic calendar today will focus primarily on the announcement of German retail sales, the change in German unemployment, inflation figures and GDP in the Eurozone. During the US session, ADP Data will be announced for the change in the non-farm payrolls, Chicago PMI, monetary policy decisions from the US Federal Reserve and the press conference of Governor Jerome Powell.