Although the pressure on the US dollar has increased again, the EUR / USD did not benefit greatly from the rebound, which did not exceed 1.1244 at the time of writing. In the last two trading sessions, the pair tested the 1.1200 psychological support, while continuing inside a violent bearish channel on the daily chart, and until this moment, there were no strong signs of nearing the launch up. As the single European currency continues to suffer from the bleak economic outlook, due to continued pressure from on the German economy, the leading economy of the region as a whole. The German ZEW Economic Sentiment Index fell to its lowest level in eight months. We noted a divergence in Eurozone consumer price index results, which is still far from the 2% target set by the ECB.

So far, the pair has not been able to take stronger gains despite the US central bank's recent confirmation of a near-term cut in US interest rates. Earlier, the European Central Bank (ECB) announced it would support easing its monetary policy to counter this slowdown. Which could push it to cut interest rates into the negative territory for the first time in the history of the bank's policy. The global trade war continues to have a stronger impact on the Eurozone economy than the US itself.

On the Fed's policy level, Jerome Powell has on several occasions underlined the imminent date for a cut in US interest rates more than previously expected. Therefore, expectations for the bank to do so increased when they meet at the end of the month. The signs from the US central bank have contributed strongly to the US stock indexes reaching record highs.

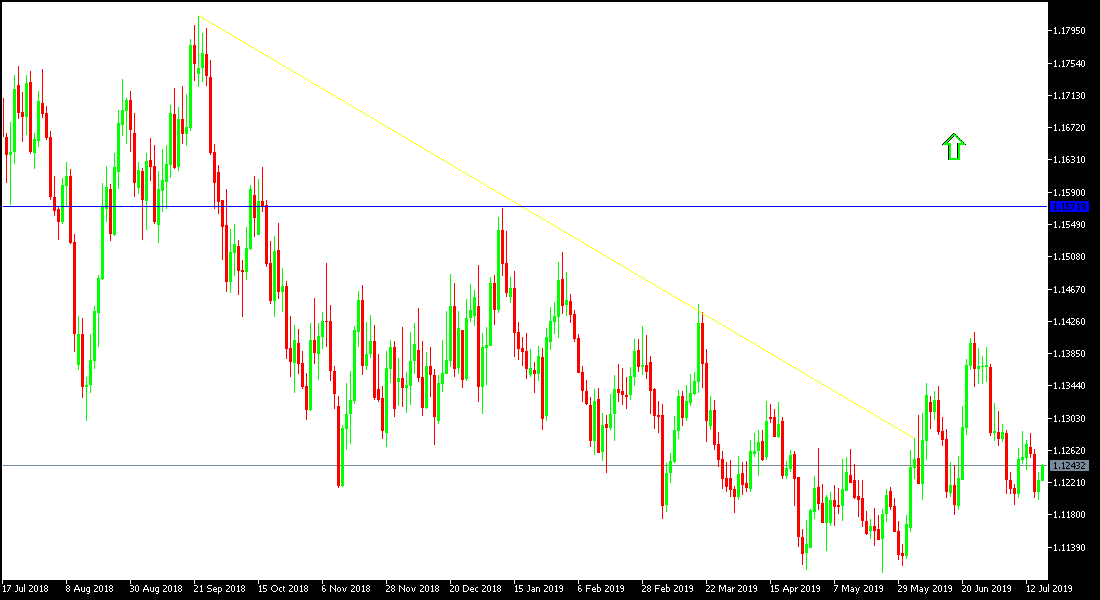

Technically: The general trend for the EUR / USD remains bearish and is the close to a break below the 1.12 psychological support and then it will be easier to move towards stronger support levels at 1.1170, 1.1060 and 1.0980 respectively, if the Eurozone economy continues to slow down. On the upside, attempts to bullish rebound for the pair may target the resistance levels at 1.1285, 1.1355 and 1.1445, respectively. Overall, the pair is still moving within a stronger bearish channel.

On the economic data front: The economic calendar today has no important data from the Eurozone, and the pair will focus on the U.S Philadelphia industrial index data of and the unemployed claims.