The EUR / USD is settling down around 2-month low, reaching to 1.1130 support at the time of writing. The single currency monitors the ECB's monetary policy decisions amid expectations that the bank will keep interest rates unchanged. Investors will carefully watch the monetary policy statement and comments by Bank Governor Mario Draghi. The bank may introduce more stimulus plans to support the Eurozone economy, which is suffering from a slowdown due to the continuation of the global trade war. The German economy is driving a slowdown in the economy of the region as a whole.

According to PMI results, the manufacturing sector continues to lead a slowdown in the Eurozone economy, but the service sector is relatively stable.

By the end of the month, the pair will be on for an important date with the announcement from the US central bank, the closest to lower US interest rates, and according to the hints of bank policy officials, the bank will move its policy as it sees fit to face the risks that will slow the US economic growth. U.S President, Donald Trump, and Congressional leaders recently approved the debt and budget deal to avoid government closures or defaults. The last government closure was the longest in the history of the United States and has shaken confidence in the world's largest economy.

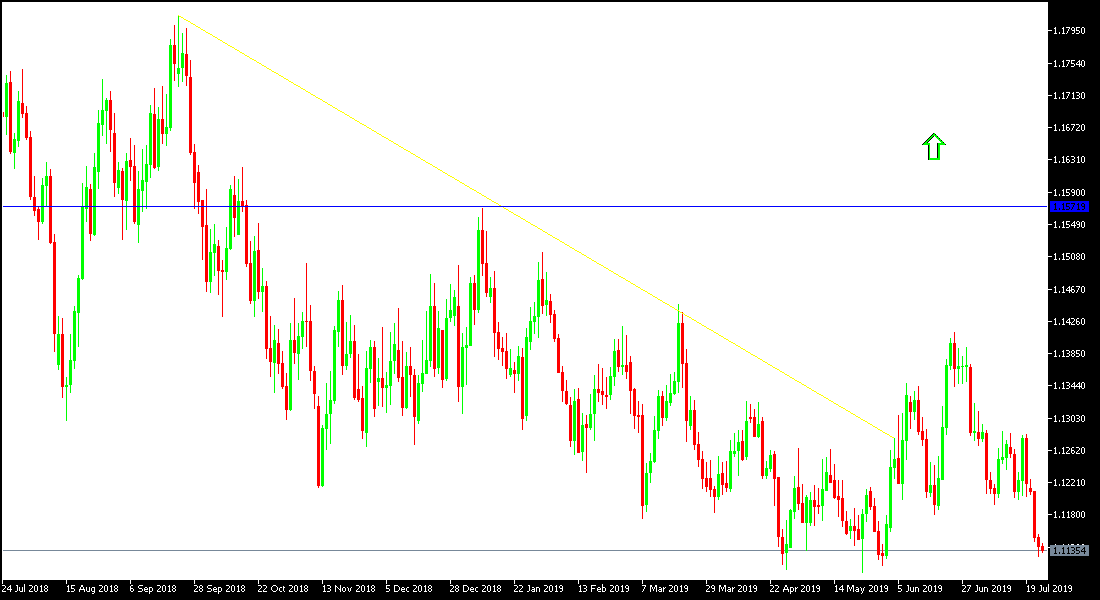

Technically: EUR / USD has been under a stronger bearish pressure and the opportunity for correction may appear if the ECB announcement comes in support of a revival of the region's economy. On the daily chart for the pair, the technical indicators show a test of oversold areas. As we had previously predicted, the stability below 1.12 psychological support will support performance to move towards the support levels at 1.1100, 1.1060 and 1.0980, respectively. In the case of a bullish correction, attempts to rebound may target the resistance levels at 1.1225, 1.1300 and 1.1445, respectively. It is still best to sell the pair from every ascending level.

On the economic data front, the economic agenda today will focus on the announcement of the change in Spanish unemployment numbers and the IFO index for the German business climate, then the announcement by the European Central Bank about their interest rate decision, its monetary policy statement and the remarks from Bank Governor Draghi. From the U.S, there will be announcements of durable goods orders, commodities trade balance and claims of unemployed data.