Pairs in Focus This Week

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 21st July 2019

In my previous piece last week, I forecasted that the best trades would be long of the S&P 500 Index, long Gold in USD terms following a daily close above $1425, and short USD/CAD. The S&P 500 Index fell by 1.39%, Gold closed down in USD terms by 0.03%, after closing above $1325 on Thursday. The USD/CAD currency pair closed up by 0.25%. These trades add up to an averaged loss for the week of 0.56%.

Last week’s Forex market saw the strongest rise in the relative value of the New Zealand Dollar, and the strongest fall in the relative value of the British Pound.

Last week’s market was dominated by movement into safe-havens, especially precious metals.

The Forex market was again relatively quiet last week, with almost everything rising just a little against the Euro and the British Pound.

This week has a relatively thin news agenda, but there are some very important items due at the end of the week.

Fundamental Analysis & Market Sentiment

Fundamental analysis now sees the Federal Reserve as more likely to cut rates over the near to medium term as the recent headline strong new jobs number masked a deeper picture of slowing growth. Despite that, the economy is still growing quite strongly, although the the U.S. stock market fell back from the previous week’s all-time high price.

Market sentiment is more risk-off and this is playing out mostly outside the Forex market, with precious metals (especially Silver) advancing against the U.S. Dollar. The British Pound remains weak as a new, more strongly pro-Brexit British government is due to take office this Wednesday.

Technical Analysis

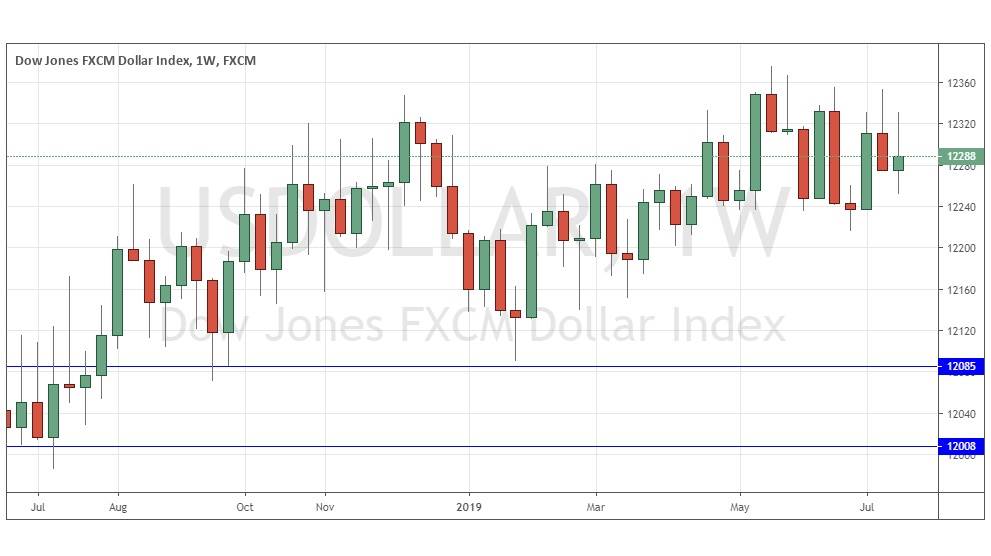

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index rose very slightly, printing a relatively small near-doji candlestick which closed indecisively, which is a sign of unpredictable direction. However, the price is slightly up over both 3 months and over 6 months, indicating a bullish trend. This trend has slowed considerably into a consolidative pattern over recent weeks but remains technically intact. Nevertheless, I have no confidence in the probable direction of the Dollar over the coming week.

XAG/USD

The weekly chart of spot Silver in U.S. Dollar terms below shows that last week printed a large bullish candlestick which made a new 1-year high price before selling off on Friday. This was the largest weekly rise made by Silver in over a year. These are bullish signs; however, it seems likely that $16.50 could be strong resistance now, so it might be wise to wait for the price to begin to rise strongly again and ideally surpass that level before getting long. Silver is certainly in focus right now.

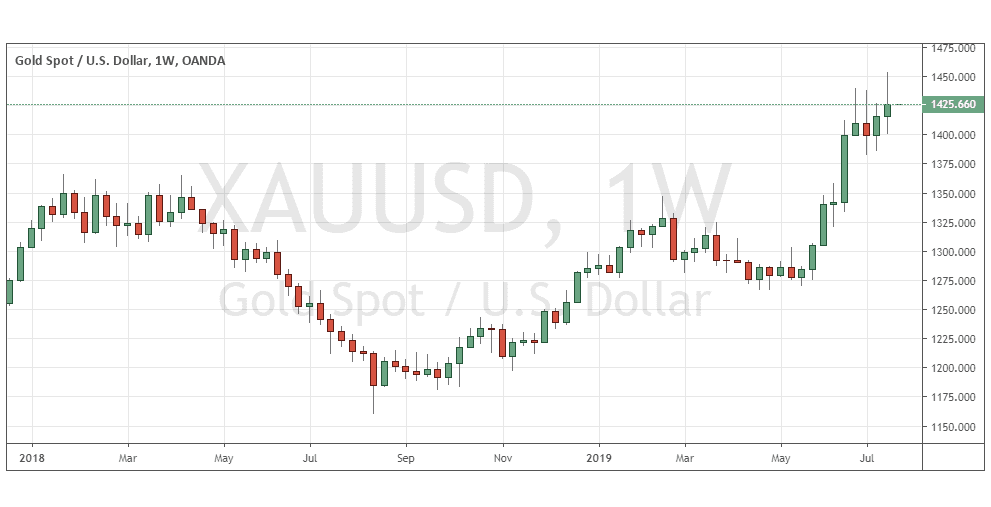

XAU/USD

The weekly chart of spot Gold in U.S. Dollar terms below shows that last week printed a large bullish candlestick which made a new 6-year high price before selling off on Friday. These are bullish signs; however, it seems likely that $1450 could be strong resistance now, so it might be wise to wait for the price to begin to rise strongly again and ideally surpass that level before getting long. Precious metals such as Gold and Silver are certainly in focus right now, although it seems that Silver is leading.

GBP/JPY

The weekly chart below shows that last week printed a relatively small bearish candlestick which closed at the lowest weekly closing price in approximately 2.5 years. This is a bearish sign. The Japanese Yen is broadly strong in the more risk-off environment, and the British Pound is the weakest of all major currencies as the U.K. faces an increased chance of leaving the European Union without a deal at the end of October.