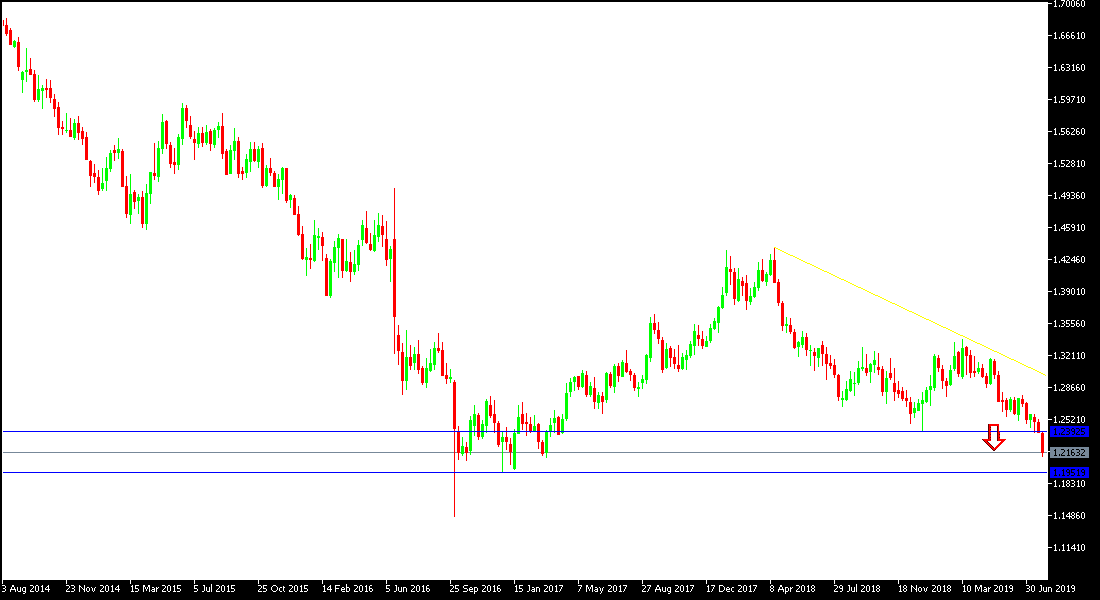

In just two trading sessions, the GBP/USD pair lost a total of 260 points to the 1.2119 support level, its lowest level in 28 months, before settling around 1.2165 at the time of writing. The pair ignores expectations of a US interest rates cut today by the Federal Reserve, and is more affected by the uncertain future of Brexit. As we had previously predicted, the current performance will support the move towards 1.2000 psychological resistance as long as expectations remain strongly indicating that the UK is on its way out of the EU without a deal. The new British government has announced contingency plans to face the consequences of a no-deal Brexit, and it seems that Britain wants a reaction from the EU on that, who also ignores Britain's plans. There is no clarity, and it was normal for the Sterling to be adversely affected and be subject to heavy losses that would strengthen to historical figures if the UK actually left without a deal.

Investors will carefully watch for the announcement by the US central bank to cut US interest rates, which confirm that the bank will cut a quarter of a point of the rate, the content of the bank's policy statement and the comments of Governor Jerome Powell will set the course for the rest of the year. Boris Johnson has said he will make every effort to get Britain out on schedule, on October 31, even if they leave the EU without a deal, and is ready to renegotiate with the EU on the terms of May’s agreement.

Technical Analysis: GBP/USD's price performance, and as we had previously predicted in our technical analysis, we now confirm that it will continue to move within its bearish channel and test all the support levels we have identified, and is currently closer to the 1.2000 psychological support, and then provide new support levels for the pair. On the upside we did not see any signs of near bullish correction. In general, we still prefer to sell the Sterling from every rising level. The pound remains under threat for the future of the Brexit.

On economic data front: The economic calendar today has no important British economic data. Emphasis will be placed on US ADP data for the change in non-farm payrolls, Chicago PMI, Fed monetary policy decisions and the press conference of Governor Jerome Powell.