Gold markets had a rather noisy day during the trading session on Thursday as the ECB had an interest rate decision and of course press conference following that decision. This volatility of course would not have been a huge surprise, mainly because the EUR/USD pair will be crucial when it comes to where the US dollar goes, which by a knock on effect is a major driver of where gold goes.

As central banks around the world look ready to continue to show signs of quantitative easing and liquefying the markets, it makes a significant amount of sense to expect gold to rally as people are looking for a way to keep their wealth. The gold market is one of the first places people look to get involved in when the US dollar falls, as it does tend to have an inverse correlation.

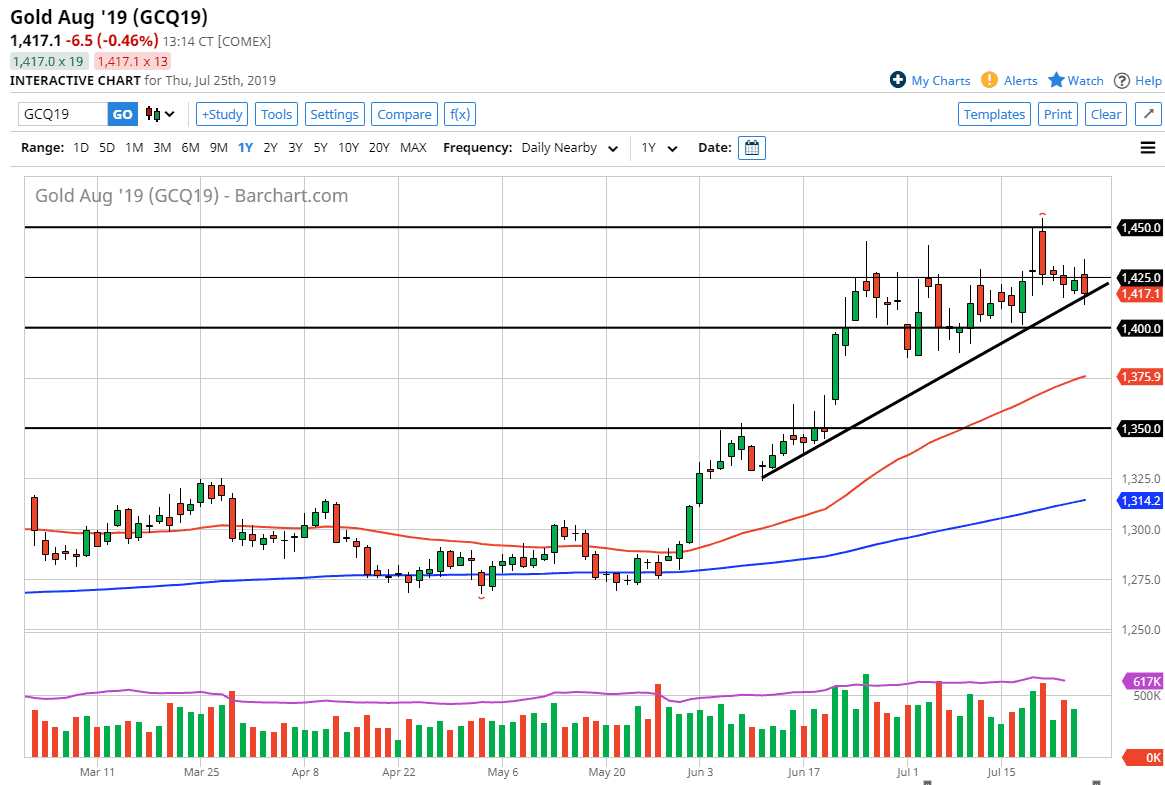

Looking at this chart, there is a major uptrend line just underneath, which should continue to offer a lot of support. Ultimately, this is a market that not only has support here this trendline, but also at the $1400 level underneath that extends down to the $1390 level. All things being equal I think that we should find plenty of support in that area, so I would be a bit surprised to see a break down through it. If we did get that move, then it opens up the door to much lower levels, perhaps even the $1350 level which is the scene of a gap.

All things being equal though, I do think that we break to the upside and I believe that the market will continue to find plenty of reasons to rally, if nothing else just because of the Federal Reserve and its perceived rate cuts coming rather soon. Ultimately, I do believe that precious metals in general grind higher and that gold will go looking towards the $1450 level. If we can break above there, the market will probably go looking towards the $1500 level, which obviously will attract a lot of attention. This is a major level on charts longer term, so obviously if we can get to that point it’s very likely that we will see a lot of noise. Ultimately though, I do believe that we will eventually find enough strength to break above there as well, as we continue to have plenty of reasons to think that central banks stay soft.