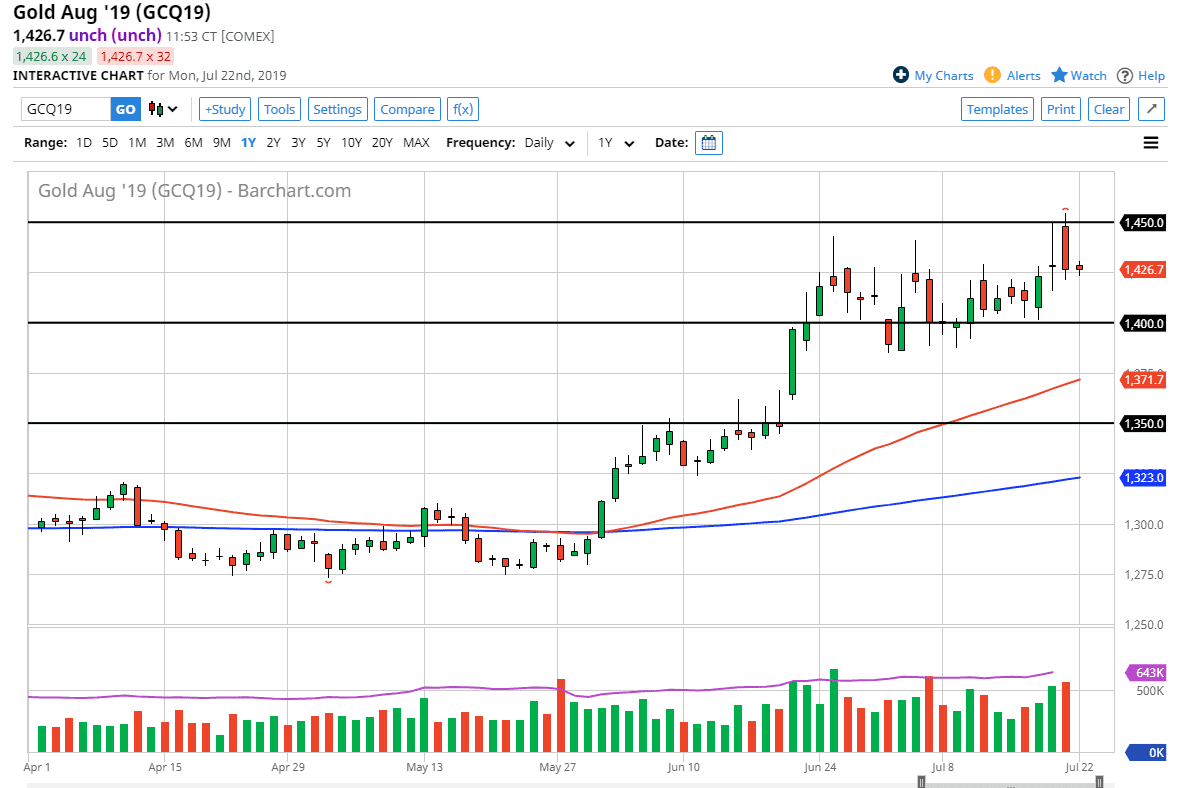

Gold markets did very little during the trading session on Monday, as we have recently broken above significant resistance, only to find more resistance after that. This is a market that continues to be very bullish overall but obviously we are dancing around the $1425 level. This is an area that has caused quite a bit of resistance and now it is offering support. Beyond that, the market looks very likely to continue the upward momentum due to not only technical features of the market, but also fundamental features.

The Federal Reserve and ECB

The Federal Reserve is likely to cut interest rates later this month, and that of course should drive down the value of the US dollar, or at least have people looking to pick up “hard money.” Beyond that though, we also have a Thursday press conference coming out of the ECB, and one would have to think that they are looking to ease monetary policy although maybe not with interest rates. Either way, this increase liquidity should be good for precious metals as people look to take care of their wealth.

With that being said, and other central banks around the world doing much the same, it makes sense that precious metals should continue to show promise. We’ve even recently had a few surprise interest rate cuts, the most latest coming from South Korea, so therefore it looks like we are entering an even lower interest rate regiment around the world, which means that gold should do well against most currencies, not just the US dollar.

Technical analysis

the $1425 level was previous resistance and it is now supported. We did pull back from the $1450 level, which isn’t a huge surprise considering that the market does tend to be attracted to $25 increments. Underneath though, the $1400 level offers support, but that’s more of a “zone”, as I believe that runs down to the $1390 level.

Below there, we have the 50 day EMA which also should offer a significant amount of support, so all of that being the case it’s likely that we will continue to find buyers at several different places. Because of this, I’m looking for some type of supportive candle such as a hammer underneath the take advantage of. If we do break above the $1450 level, then obviously you will be looking at $25 increments, meaning that the $1475 level should be a target, and then most certainly the $1500 level which of course is a large, round, psychologically significant figure and is also an area where we have seen a lot of movement in the past.

With that in mind, I am a buyer of dips and I look for value in the gold market which has been the general analysis for some time. I suspect that there will be volatility in the next couple of weeks as both the Federal Reserve and the ECB are having major announcements, but overall I think it’s very likely that we are going to find buyers sooner than later.