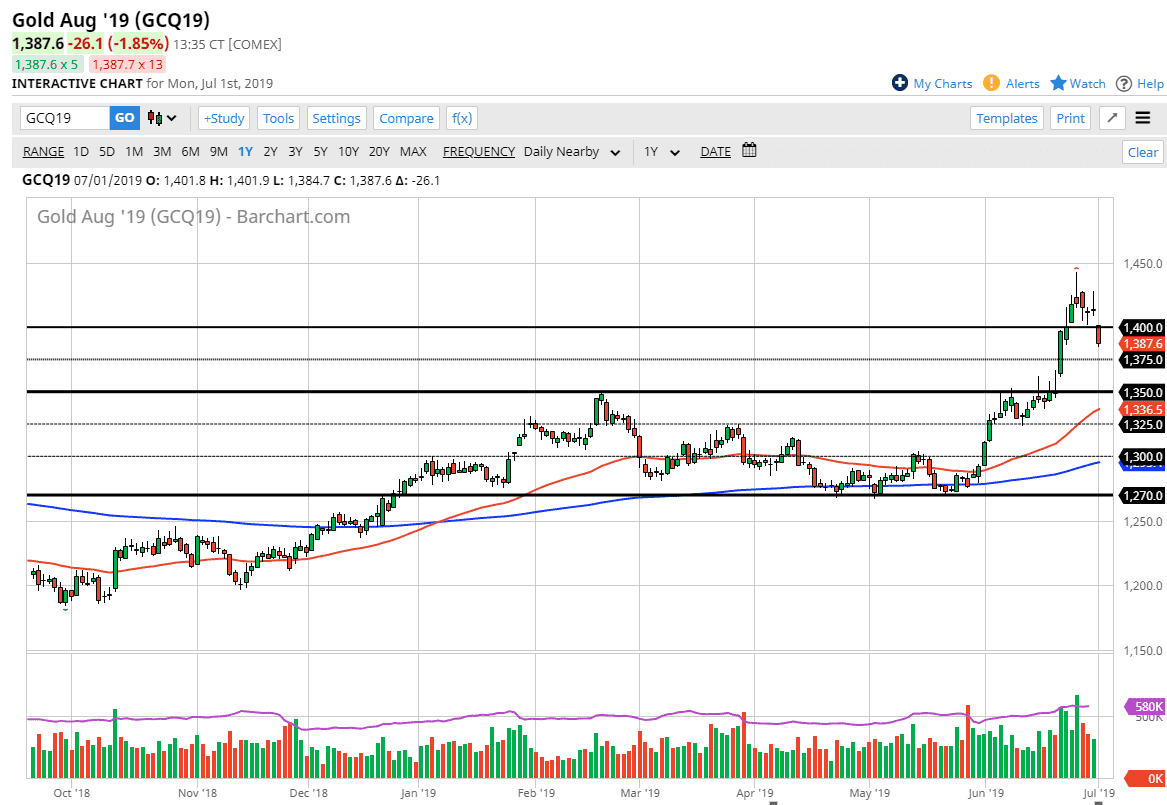

Gold markets gapped lower to kick off the trading session on Monday, slicing through the $1400 level. This is an area that of course would attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and of course the fact that we did end up forming a hammer on Thursday and a shooting star during the previous week. This is an area with a lot of action, and the fact that we broke down through it on a gap is a very meaningful thing.

Now that we are below the $1400 level substantially, it looks as if we could turn things around and continue to go lower. It should be noted that the weekly candle stick was a shooting star last week, and that of course is a very negative sign. Ultimately, this market could go lower, trying to fill the gap down near the $1350 level. That’s an area that was previously resistive, and it now should offer plenty of support. I think at this point it’s likely to find plenty of buyers in that area, especially considering that the 50 day EMA is going to be in that area going forward.

Ultimately though, it looks as if the market will respect that area as it is not only previous resistance, but it is also the 50% Fibonacci retracement level of the massive move higher. Keep in mind that nothing has truly changed when it comes to the underlying fundamentals of this market, as the Federal Reserve looks likely to continue to take a dovish tone, on their way to cutting rates. Because of that, and the fact that the ECB and the Bank of Japan as well as many others will be cutting rates. That should continue to elevate the attractiveness of precious metals, and this pullback should more than likely end up being a nice buying opportunity going forward. The central banks out there pumping the world full of cheap money is going to do more for precious metals than anything else. There is the possibility that we get some type of fear trade going as well, but I think that the next couple of days are probably going to be focused more on a pullback, so at this point I think that simply waiting for a supportive candle stick on the daily chart to start buying again. We did get a bit parabolic so this pullback makes quite a bit of sense. Be patient, you should get a nice buying opportunity.