Gold markets continue to go back and forth, and Tuesday of course was no different. That being said, we did dip during the Asian and European sessions but it appears that the buyers were ready to come back once the Americans took over. By doing so, it’s likely that we will find value hunters willing to come in and take advantage of gold, as the US dollar is likely to have some trouble, and therefore it’s possible that the Federal Reserve will continue to have people running towards gold to protect wealth.

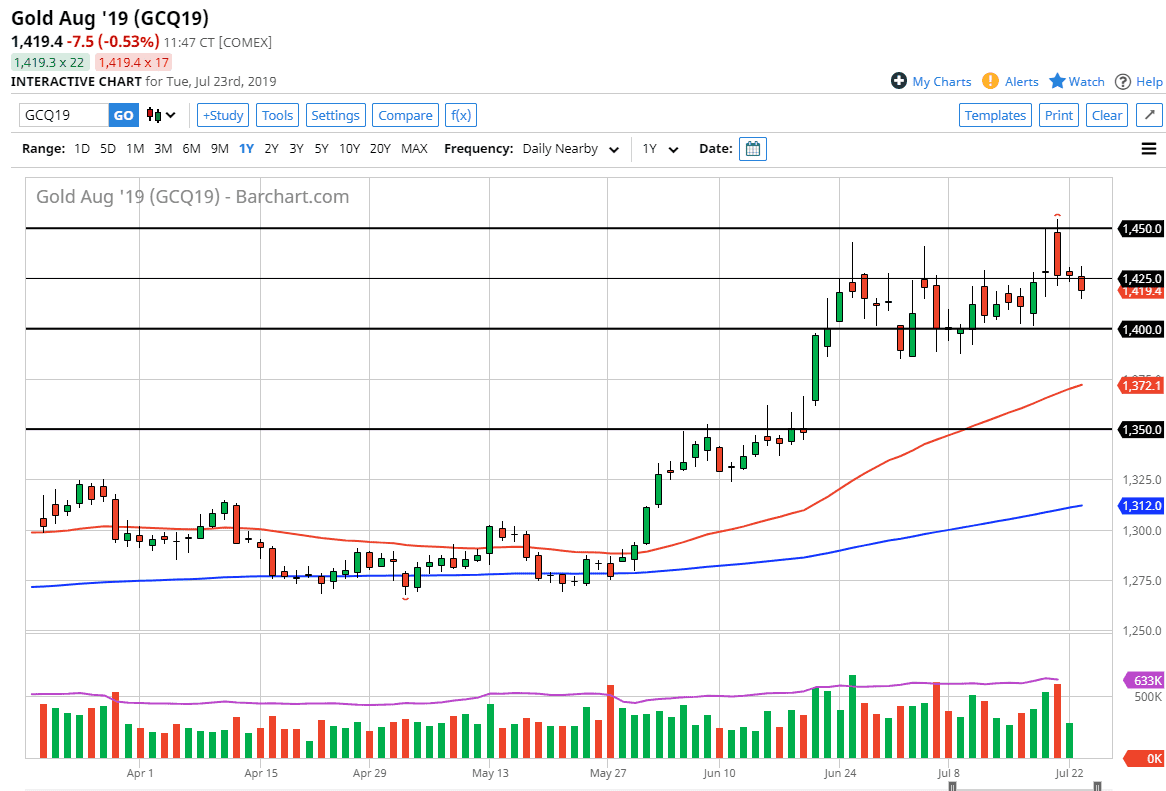

Interest rates coming from the central bank in America of course is very bullish for gold, just as the $1400 level underneath will be massive support. I believe that the absolute “floor” in the market is from $1400 to the $1390 level. This is more of a “zone” in the market and there should be a massive amount of buying pressure in that area. Furthermore, the 50 day EMA underneath is reaching towards that level and should get there relatively soon. That being the case, it’s likely that you should look at this as a potential value proposition.

What I mean by that is that you should be buying dips, as you do in a significant uptrend. Overall, I also see the $1450 level as resistance, and therefore I think that is a significant amount of resistance. However, if we can break above there it’s very likely that we go looking towards the $1500 level. That’s a large, round, psychologically significant figure, and that of course will attract quite a bit of attention. Whether or not we can break above there is a completely different question, but I think it’s very likely we will as central banks around the world look likely to continue to keep monetary policy loose.

With that, “hard money” becomes much more attractive than fiat currency, so therefore it’s likely that we see a lot of back and forth, but ultimately it’s likely that we see more buying than selling. Overall, this is a market that continues to find plenty of reasons to go higher, not only due to central banks, but also the geopolitical situations around the world that could continue to drive gold higher. With this, is very likely that the market continues to look at this market as one that should be bought and not sold, so look for value, don’t waste your time trying to short this rally.