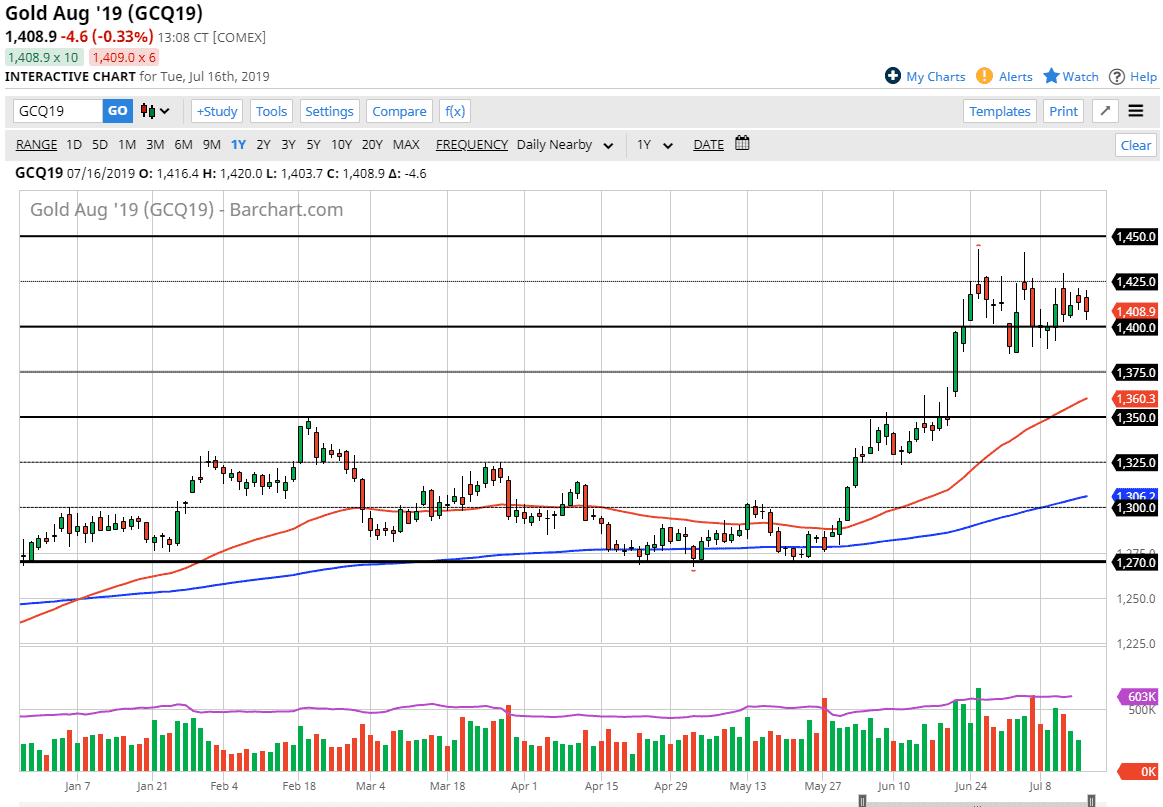

Gold markets initially tried to rally during the trading session on Tuesday but gave back the gains to reach towards the $1400 level. There is significant support from $1400 down to the $1390 level, so I think it’s probably only a matter time before the buyers jump back in. If we get a bit of a bounce from there, it could be a nice opportunity to go long.

However, to the downside we have a gap near the $1350 level that will almost certainly attract a lot of attention as well, and I would love to be able to buy the market down there. If that were to happen, I would become aggressively long of the gold market as we have several central banks around the world getting ready to cut interest rates. By doing so, that would more than likely attract a lot of attention, so therefore I think that could be a self-fulfilling type of prophecies situation.

We also have the 50 day EMA down there, so that will also cause issues. Ultimately, this is a market that should show a lot of interest in that area. However, there is also the possibility that we simply go higher from here. If we were to break above the $1450 level, then it would be a massive breakout and should send this market much higher. I think a pullback makes a lot of sense because we can’t just simply take off to the upside. This is a situation where you should be looking at pullbacks as value, and you should be looking to pick up gold as it becomes cheap. The fundamental certainly help gold, and we have been in and uptrend for some time so it’s very likely that there will be plenty of people looking to jump in when they get an opportunity.

The longer-term target is probably going to be closer to the $1500 level, possibly even further than that. Ultimately, you can expect volatility but you should be willing to take advantage of it as we continue to see plenty of reasons why the central banks are looking to cut rates, therefore pushing the value of fiat currencies down, and gold up higher against most of them, not just the US dollar. Beyond that, if there are geopolitical concerns, and let’s face it we are about a blink away for one, that could also help the gold markets.