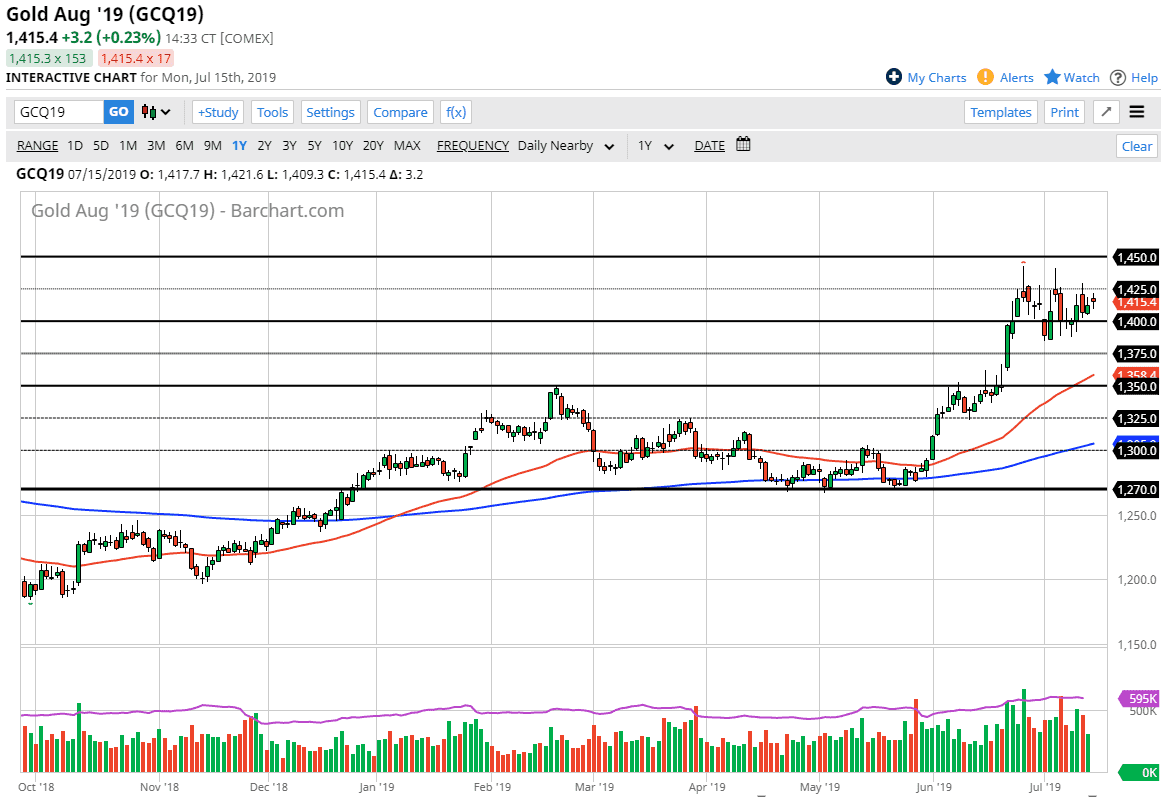

Gold markets gapped a little bit higher during the trading session on Monday, starting out the week rather strong. However, we have sliced back and forth since then, essentially showing nothing but confusion at this point. With that being the case, gold markets simply don’t look like they have anywhere to be and I think at this juncture it’s going to be difficult to get overly bullish or bearish until we get an impulsive candle.

An impulsive candle could be the signal needed, as it doesn’t take a lot of imagination to visualize a triangle from the last couple of weeks. What this tells me is that the market is trying to decide where he goes next, and with the third where you served looking to cut interest rates I do favor the upside. All of that being said, we did get rather high rather quick, and we could be overbought. The question now is whether or not we are getting ready to roll over, or if were just simply trying to build up enough momentum and perhaps even confidence to start rallying again.

If we do break down from here, notice that the market tends to pay attention to $25 increments. That being the case, I start to look at the most interesting levels to trade. Without a doubt, I would love to see this market pullback and offer plenty of value, especially near the gap at the $1350 level. It is of course the scene of the 50 day EMA, and of course is a gap. Beyond that, the 50% Fibonacci retracement level is to be found in that general vicinity, some looking for buying opportunities in that general vicinity.

To the upside, if we were to break above the $1450 level, then the market is ready to go towards the $1500 level. At this point, it’s very likely that dips will be thought of as value but you should be very patient as to placing money into the marketplace. I think at this point you are probably better off waiting for supportive daily candles to make your decisions. As we are essentially in the middle of a huge mess I’m not planning on putting money to work quite yet but I will of course keep you up-to-date here at Daily Forex when situations change in this market, as we are in the midst of a very sloppy trading.