Gold markets continue to grind and go nowhere ahead of the Humphrey Hawkins testimony scheduled for Wednesday and Thursday in the United States. The Humphrey Hawkins testimony is when the Federal Reserve Chairman Jerome Powell will testify in front of the United States Congress. This gives the Congress an idea on what’s going on with the monetary policy, and it is a highly impactful event.

In a world where we are looking for lower interest rates, Jerome Powell’s words will be parsed very closely. This will move the US dollar, and then by extension almost everything else in the world. Gold of course will be no different as it is highly influenced by the greenback and has seen quite a bit of bullish pressure as of late due to the idea of massive interest rate cuts. If we do in fact get those cuts, it will drive down the value of the greenback, and drive gold higher again.

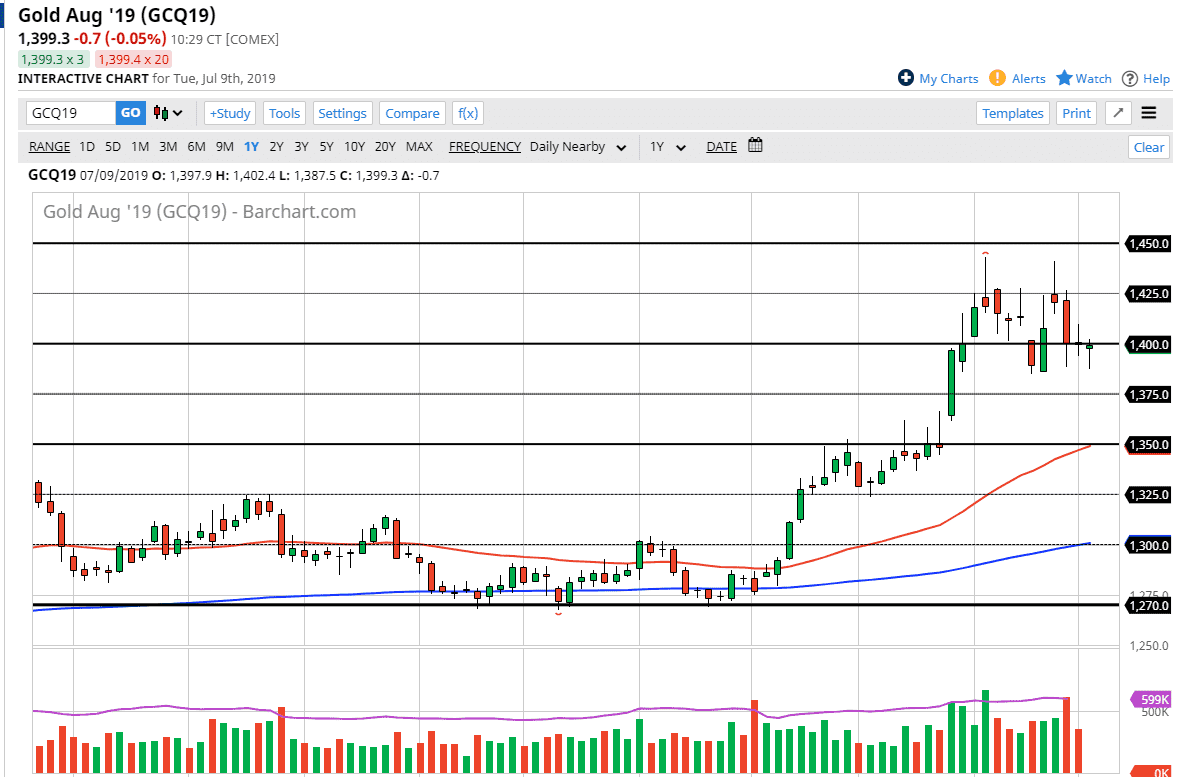

However, there is the possibility that Jerome Powell disappoints somehow. Perhaps he suggests that he may not be quite as dovish as once thought, and that of course could drive the value of gold underneath current levels, reaching down towards the gap that’s just above the $1350 level. I would love to see that offered, and therefore I would be willing to jump into the market at the first signs of support in that area. Beyond that, there’s also the 50 day moving average, the gap, the 50% Fibonacci retracement level, and the previous resistance in the region to ignore that type of set up. I would love to see Gold pull back so I can take advantage of it being cheap, as it has obviously switched to a very bullish tone.

All of that being said, if we do turnaround and sliced through the $1450 level during this testimony, then obviously we will have a bit of a “melt up” on our hands. I don’t think that’s going to happen though, I think at best we are probably going to consolidate between here and the $1425 level. The market needs to do one of two things before going higher: it either needs to pullback towards the $1350 level to fill the gap, or we need to spend quite a bit of time going sideways to convince people to jump in and as we can hold gains. I do think that gold goes higher over the longer-term regardless.