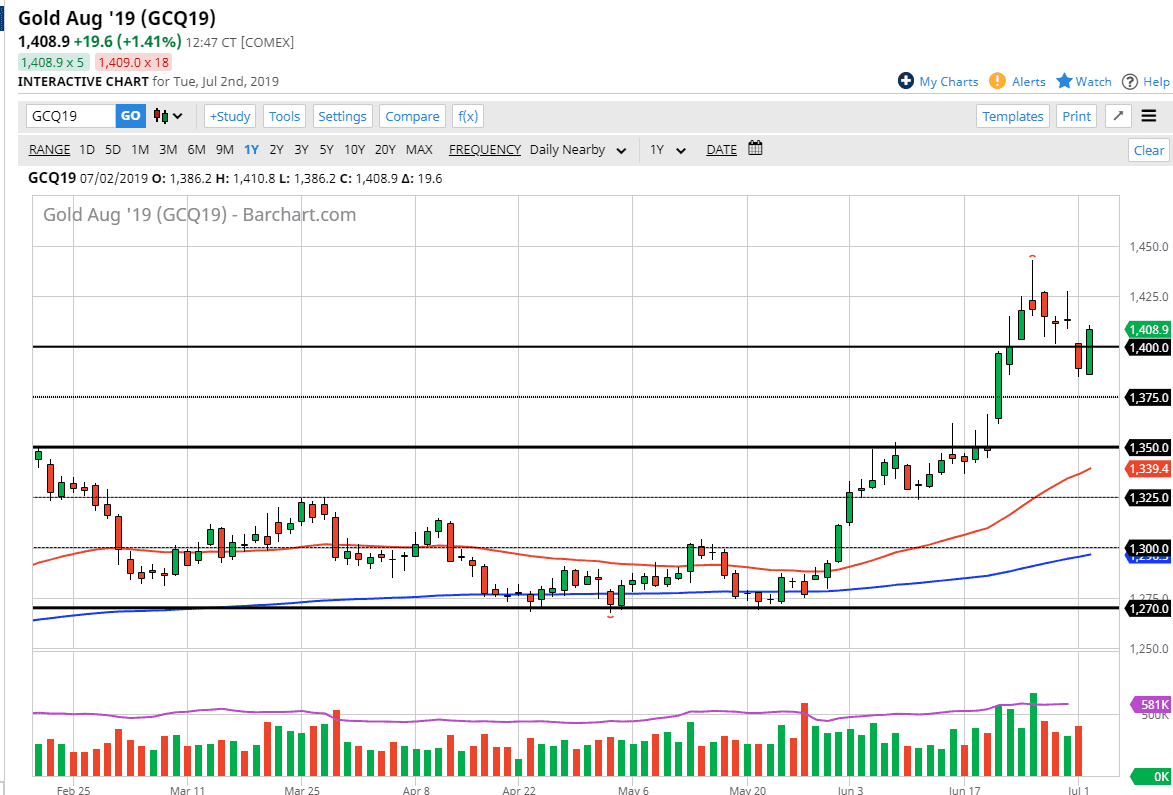

Gold markets rallied significantly during the Tuesday session, slicing through the $1400 level which of course is a psychologically significant figure. Beyond that we have a massive gap that has just now been tested, so that’s a good sign as well. This bullish engulfing candlestick is very strong and the question now is whether or not we can break above the gap? If we can, that would be an extraordinarily bullish sign but let us not forget that there is a major gap underneath that has yet to be filled.

It is difficult to suggest which way we should be trading in the short term, mainly because the next 48 hours will feature a major holiday in the United States, and then of course the day before at which will be thin also. Ultimately, this is a market that will be waiting for the jobs figure on Friday, so therefore it’s likely that the market will be extraordinarily volatile during the day which not only has the jobs figures coming out but probably a bit less in the way of volume.

Ultimately, looking at this chart I recognize that the $25 levels underneath all offer buying opportunities, but what I would really like to see is this market reach down to the $1350 level underneath. That is also the 50% Fibonacci retracement level from the most recent move longer term, and you can even start to suggest that the structural support is probably built-in due to the structural resistance. The 50 day EMA is just underneath there as well, so this point I would be very interested in the $1350 level for a long position.

However, you can also make out a bullish flag currently. If we break above the $1415 level, we will have not only filled the gap but shot through it which of course is an extraordinarily bullish sign. At that point I would expect the market to go to the highs again. Longer-term I do believe that we make fresh new highs, but it is going to be very noisy on the way up, because there are so many moving pieces when it comes to geopolitics and trade negotiations, just to name a few potential landmines out there. If the US dollar starts to fall that could also send Gold markets much higher as well. More than likely this market is probably going to be very noisy and lacking significant direction until we get the jobs number.