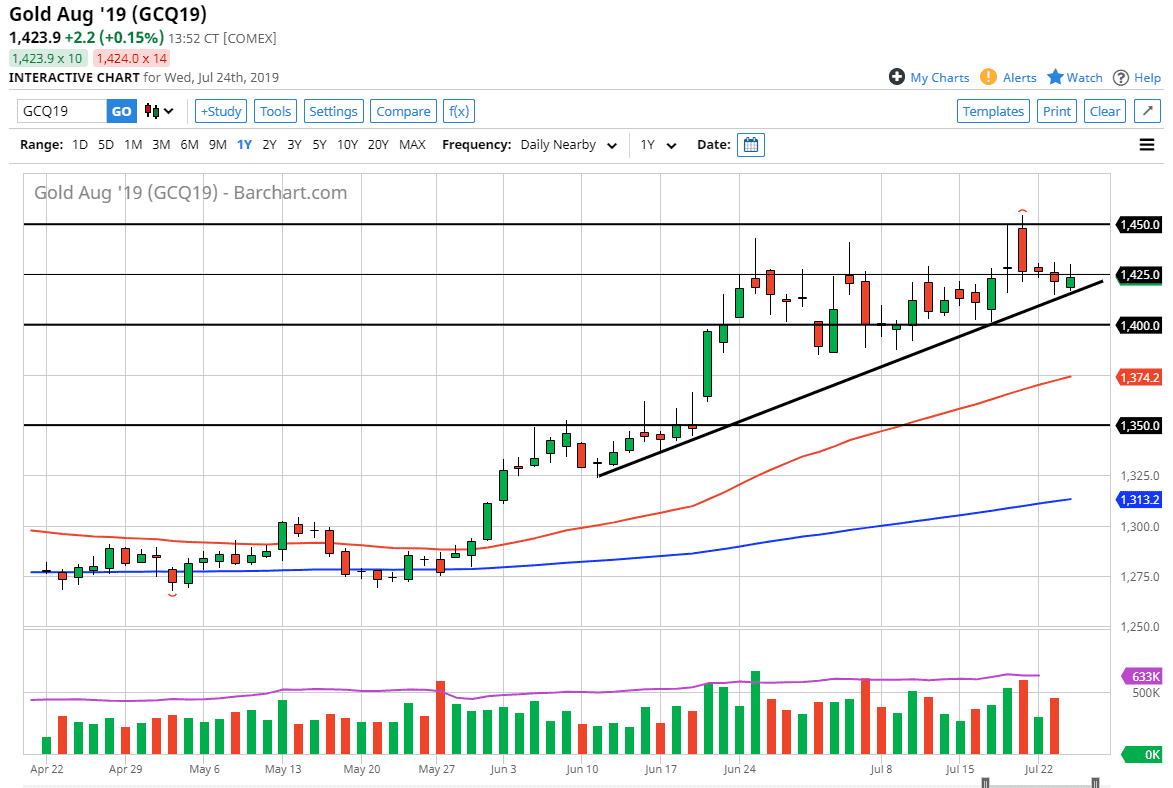

Gold markets have initially tried to rally during the trading session, felt towards the trendline and then bounced again. Ultimately, this is a market that looks like it is ready to go much higher, perhaps reaching towards the $1450 level above. I am aware of the fact that the $1425 level has been significant resistance, so it’s likely that we will continue to see buyers jump in this market, mainly because of the Federal Reserve looking to cut interest rates, right along with other central banks around the world.

Looking at this chart, I believe that the trendline is the first line of defense for traders, but then after that I believe that the $1400 level underneath is also a hard floor in this market. In fact, that area is likely a zone that reaches down towards the $1390 level. This is a scenario where it’s a “buy on the dips” type of trade, and the reality is the Gold markets still have plenty to go as far as the upside is concerned.

Another thing that has me interested is that the 50 day EMA is currently at the $1375 level and racing towards the $1400 level. I think sooner or later we will find plenty of buyers in this market, as it will offer a bit of “value” in the market, as gold is an antidote for these ultra-low levels. The interest rates around the world will continue to be very low if not negative, and you can also take into account the fact that 1/3 of Government Bonds around the world are yielding negative rates, something that the market will pay attention to is the fact that we have so much in the way of negative rates, and therefore it makes no sense to lock up a bunch of currency in one of these bonds as you are guaranteed to lose money. Otherwise, they could buy precious metals that are a way of protecting capital. Looking at the chart, I don’t have any scenario where I’m willing to short gold, at least not at this point. Beyond that, I believe we have multiple support levels underneath including the $1350 level which has a minor gap that could keep this market afloat as well. I do recognize that eventually the $1450 level will be broken, and we could go looking towards the $1500 level.