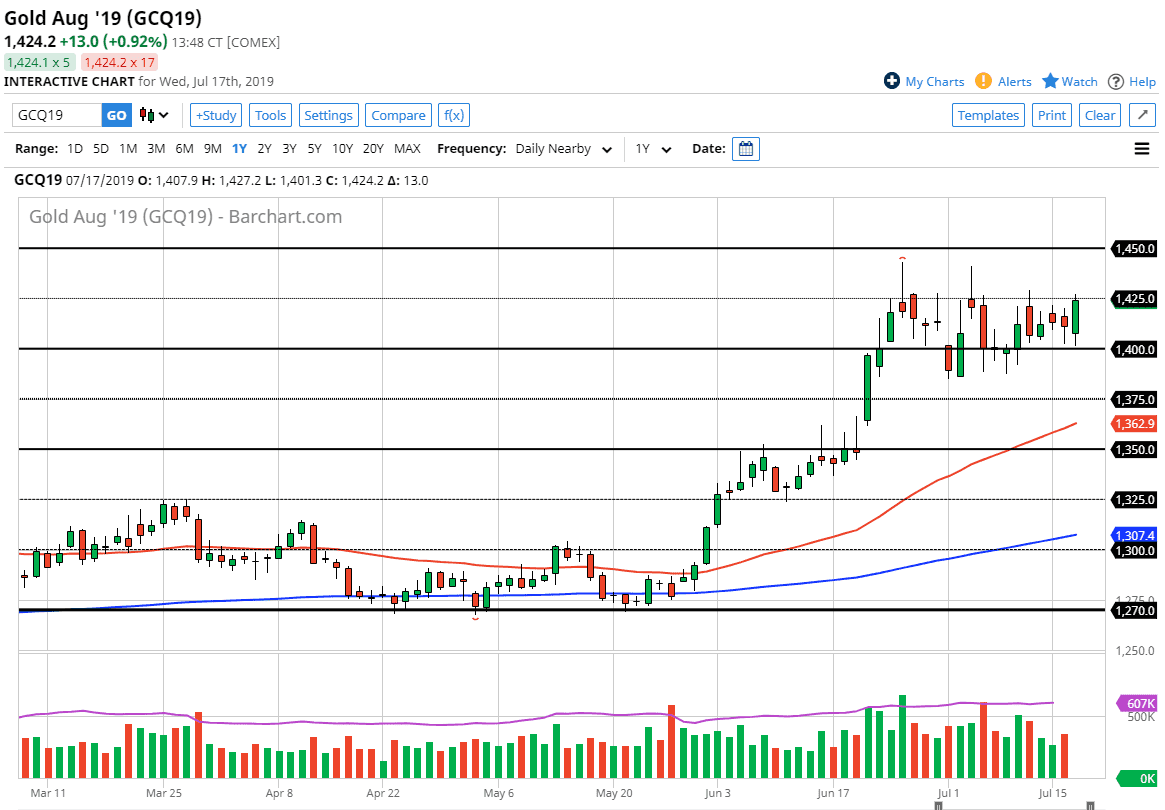

The Gold markets pulled back a bit during the trading session on Wednesday, testing the crucial $1400 level. This is a market that obviously has a lot of factors at work right now, not the least of which is going to be the central bank attitudes of easing, and that of course means that the precious metals market should continue to show signs of strength. Ultimately, a softening fiat currency world means that people start to look to the hard currencies to take advantage of which should be a nice and strong uptrend. One thing for sure, the candle stick for the trading session on Wednesday certainly shows strength and nothing else.

Having said all of that, the $1425 level has been resistance in the past, the fact that we are stopping right there is something that we should be paying attention to. What this tells me is that there is a $25 level of resistance just above that should continue to offer problems. However, I do think that eventually we break out to the upside due to the fundamental aspects involved. If we get some type of short-term pullback, you should think of this as a gift as it allows the market to offer value. The $1400 level should continue to offer plenty of support, extending down to the $1390 level. If we were to break down below there, then it’s essentially going to be a huge “reset” when it comes to the longer-term move.

On a break down, I’m not willing to short gold, I looking to pay attention to the $1350 level underneath which is the 50% Fibonacci retracement region, and of course a large, round, psychologically significant number. After that, we also have a gap that should continue to cause major support as well. We have the 50 day EMA, and now at this point it’s likely that there will be plenty of reasons out there, at least from a technical analysis standpoint, for the market to rally significantly. It’s not until we break down below the $1350 level on a daily close that I would become concerned about the overall uptrend. I believe the Gold has entered a longer-term uptrend that should last for quite some time, as we are entering a new easy monetary policy regime from several central banks, the most important of course be in the Federal Reserve.