Gold markets rallied significantly during the trading session on Wednesday after initially trying to fall. At this point, the $1390 level looks to be supportive, but more importantly we have had statements released by the Federal Reserve suggesting that they are all but settled on cutting rates. That should help boost gold, as several central banks around the world look like the Federal Reserve when it comes to keeping an easy monetary policy. In other words, hard money becomes much more interesting for traders.

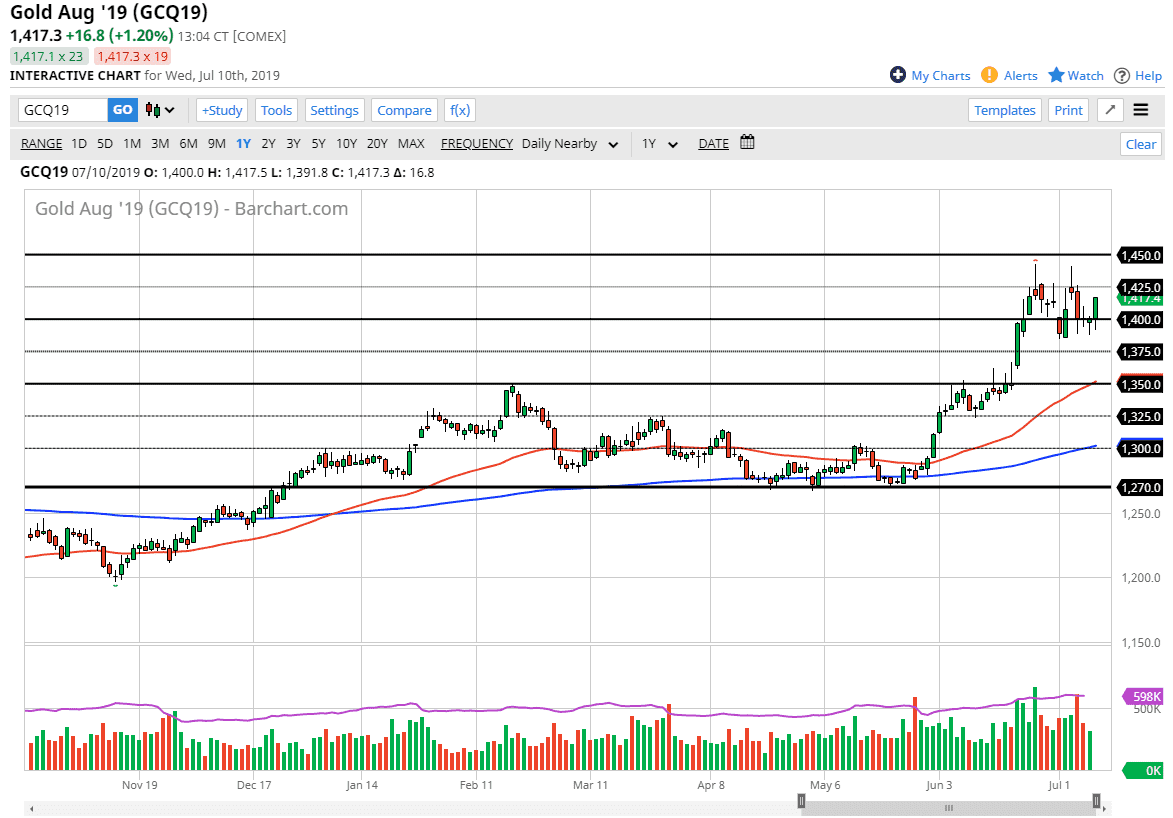

If we turn around and break down below the support that we have had over the last couple of days, we could go looking to fill the gap underneath that I have been paying so much attention to. I truly prefer a pullback to fill that gap, but at this point I don’t know if are going to have it yet. The $1350 level is psychologically important as it was structural resistance previously, plus we also have the 50 day EMA in that general region, which will of course attract a lot of technical traders. What’s even more interesting is that it’s also the 50% Fibonacci retracement level from the bottom.

Looking at this chart, the $1450 level above is obvious resistance, so a break above there would be extraordinarily bullish. I still feel better about this market filling the gap though, so if we get a break down below the recent lows, I think we will go looking for that area. I don’t have any interest in shorting this market, even though we could pull back rather rapidly. Instead, I would rather look for a buying opportunity at the lower level. Overall, I believe the Gold markets continue to offer a nice opportunity but we need to find value whenever possible. Short-term pullbacks offer that value, and more importantly the gap is something that the entire world is paying attention to, so I think it will be one of the more obvious long term set ups that could set up.

If we were to somehow break down below the $1350 level, we could go much lower but I suspect that is a very low probability situation. The larger global macro situation of course suggests that we could have a lot of geopolitical issues, which only adds more credence to the idea of gold rallying. Overall, I look at any pullback in gold as a potential gift.