Gold markets were very quiet during the trading session on Thursday as Americans celebrated the Independence Day holiday. With that in mind, you can’t read too much into the way the market moves, but I do recognize that the pullback is probably underway. That makes sense, because we had gotten a bit ahead of ourselves.

That being said, the market pulling back is something that you can take advantage of as we have obviously broken out. The market had tried to reach towards the $1450 level but has pulled back a bit both times we tried to break out. At this point, it looks very likely that we are going to see a lot of volatility coming into the marketplace as the jobs number comes out Friday. That of course will move the US dollar, but we do realize already that the Federal Reserve is likely to cut interest rates going forward. Fundamentally speaking, with interest rates up being cut that should drive the value of the US dollar lower, thereby driving gold higher. What turbo charges this idea is that the ECB is also going to be very dovish as well.

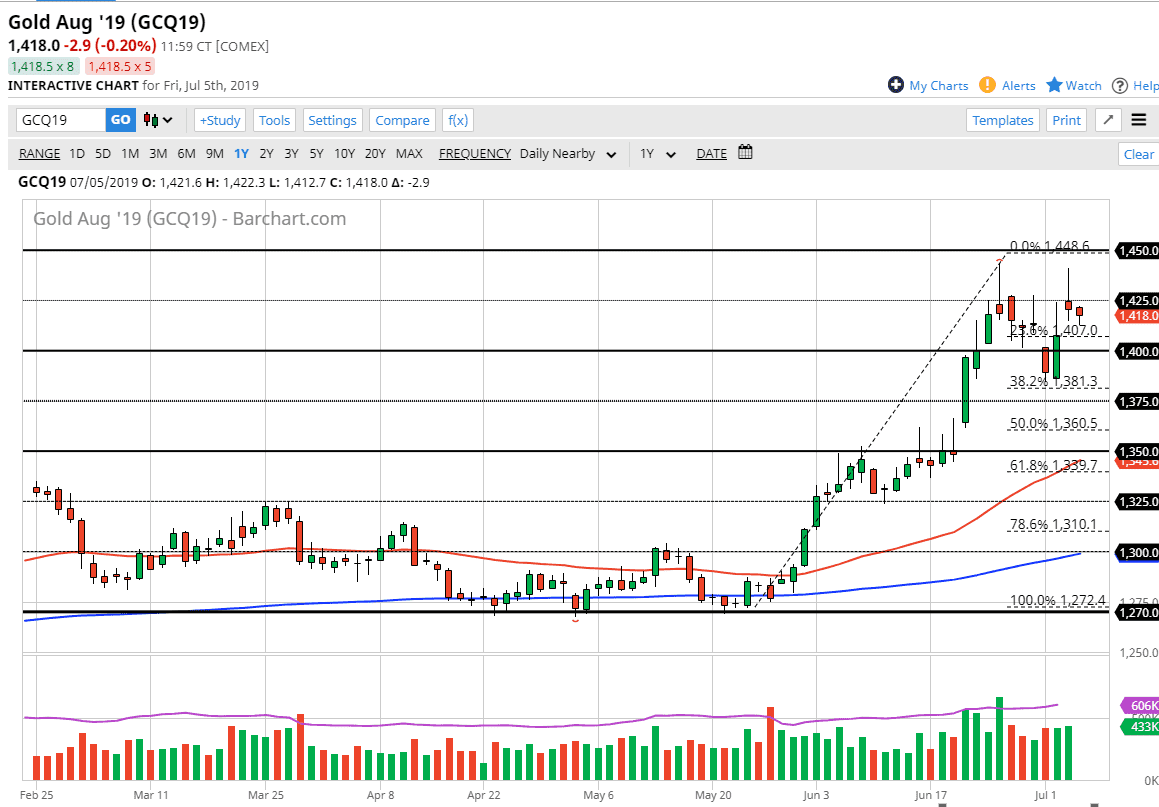

From a technical analysis standpoint, we are forming a little bit of a double top but I think it is short-lived. A pullback from here makes sense, and we could go as low as $1350 over the next several sessions. I would love to see that, so it offers plenty of value. It’s not until we break down below that level that I would be worried about the uptrend. The fact that we have formed a double top doesn’t concern me though, it just shows that we have gotten ahead of ourselves.

If we did turn around and break above the $1450 level, that would be an extraordinarily bullish sign, probably creating more of a “blow off top”, at least from an intermediate term. I believe that the $1500 level should cause quite a bit of resistance as well, but it does make a nice juicy target. All things being equal, I do believe that we have formed an uptrend now for the longer-term, but gold does tend to be very choppy, so keep that in mind and keep your position size relatively small and only add once it works out in your favor. I have no interest in shorting the Gold markets, as the central banks are going to make sure this market goes higher.