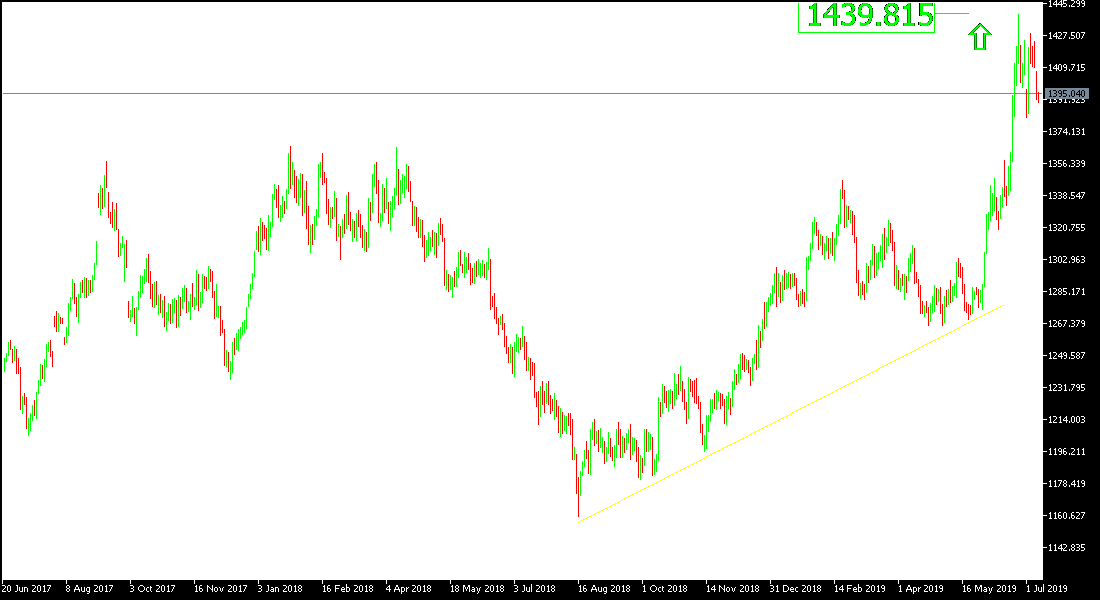

The latest selling of the yellow metal pushed the price of gold towards 1390 dollars an ounce in morning trades on Tuesday, and despite the correction from its highest level in six years, the gold is still inside the bullish channel as shown on the daily chart below, and so far there was no clear break out of the trend. Stability around and above the psychological resistance at $1400 an ounce still supports the strategy of buying from each bearish level. The fundamentals and factors that support the gold track in achieving stronger gains remain, foremost among which is the increasing pace of global geopolitical and trade tensions, even after optimism of renewed US-China negotiations to end the biggest global trade dispute that threatens global economic growth.

US job numbers, whose results were announced Friday, came in better than expected, so markets ruled out a chance to cut US interest rates this month. On the same day of the announcement, the Fed reiterated that it would act as necessary to maintain economic growth, while noting that most Fed officials had lowered their interest rate expectations. The Fed's statement came in its semi-annual report on monetary policy.

The last correction is very natural and we pointed out that gold has reached strong overbought areas and can be corrected at any time. At the same time, we still prefer to buy gold from a bearish level.

We have confirmed in recent technical analysis that US interest rate cut signals will support the decline of the US dollar and further gold gains.

Technically: Gold prices today confirm the strength of the uptrend by moving around and above the psychological peak at $1400, and therefore the nearest levels of resistance might be 1415, 1428 and 1440 respectively, which were already reached, and are still the same targets even with the recent correction with profit taking through sales. On the downside, the nearest support levels for gold today are 1395, 1375 and 1360, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will focus on the US dollar performance after Powell’s comments today.