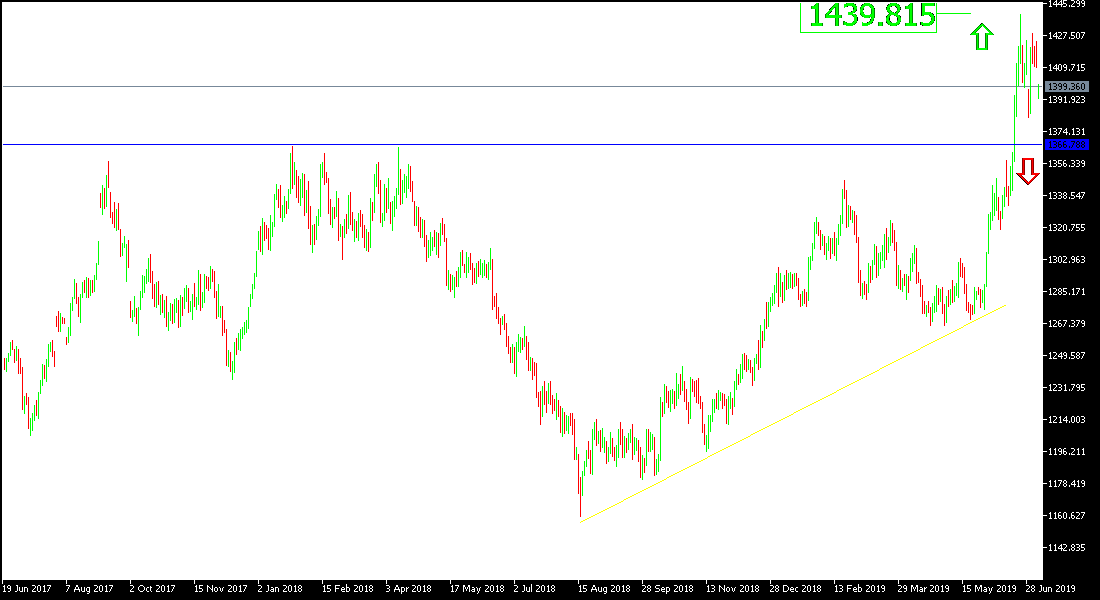

For three consecutive trading sessions, the price of an ounce of gold moved in a bearish correction from the $ 1428 resistance level to reach $ 1410 per ounce. At the beginning of this week, the yellow metal was exposed to a bearish price move towards the $ 1393 support level before reaching around $1400 psychological resistance at the time of writing. Despite the return of the US dollar supported by the strength of the US employment report for June, there are still factors that stimulate gold to return its gains and achieve more, in the form of increasing global geopolitical and trade tensions, even after optimism of renewed negotiations between the United States and China to end the biggest global trade dispute, which threatens economic growth global.

US job numbers, whose results were announced Friday, came in better than expected, so markets ruled out a chance to cut US interest rates this month. On the same day of the announcement, the Fed reiterated that it would act as necessary to maintain economic growth, while noting that most Fed officials had lowered their interest rate expectations. The Fed's statement came in its semi-annual report on monetary policy.

The last correction is very natural and we pointed out that gold has reached strong overbought areas and can be corrected at any time. At the same time, we still prefer to buy gold from a bearish level.

We have confirmed in recent technical analysis that US interest rate cut signals will support the decline of the US dollar and further gold gains.

Technically: Gold prices today confirm the strength of the bullish move around and above the psychological peak at $1400, and therefore the nearest levels of resistance might be 1415, 1428 and 1440 respectively, which were already reached and holding to it, even with the recent correction with profit taking through sales. On the downside, the nearest support levels for gold today are 1390, 1375 and 1360, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will have all its focus on the US dollar performance with the absence of any important announcements.