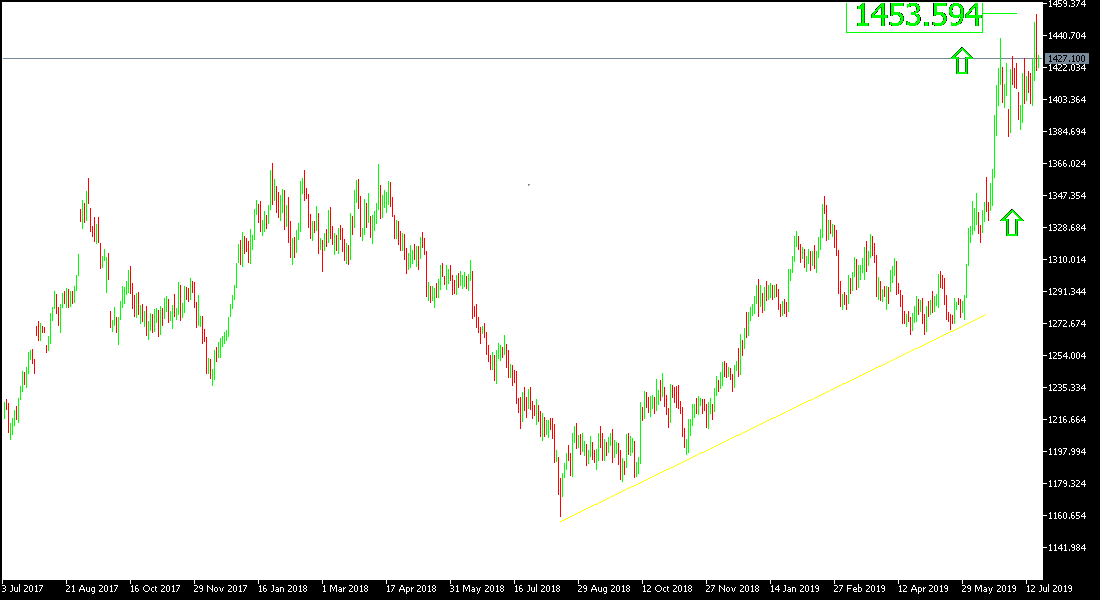

By the end of last week, the price of an ounce of gold reached a resistance level of $ 1453, the highest level in six years, due to increasing pressure on the US dollar, which has an inverse relation with the yellow metal. However, the price quickly fell to $ 1420 an ounce, with markets absorbing what supported gold’s latest gains, and with fast sale to collect profits. The yellow metal is stable around $ 1427 per ounce at the time of writing. Gold remains the preferred safe haven for investors at the moment until the US Federal Reserve announces its monetary policy next week and we will continue to recommend buying until this important decision.

The US central bank is ready to cut interest rates sooner rather than later to meet the slowing world economic growth. This week we will have an important date with the announcement of the US economy's GDP figures amid expectations of a slowdown in the country's economic growth, which may support the expectations of the Bank's policy officials to cut US interest rates when they meet next week to determine the bank's policy. Expectations among economists about the extent and duration of the reduction are variant, with expectations that support the possibility of a quarter-point cut only and monitoring economic developments, and expectations suggesting a half-point rate cut to meet the strongest risks to the US economy, especially as the trade conflict with China continues.

In recent technical analysis, we confirm to our followers that the US interest rate signals will continue to support the decline of the US dollar, which is an opportunity for further gains in the price of gold.

Technically: Gold prices today, despite the recent decline, still retain the move within a stronger bullish channel supported by the $ 1400 psychological peak. The nearest resistance levels for gold will be 1435, 1455 and 1470 respectively. On the downside, if the price of gold falls to support levels of 1415, 1400 and 1390, will be new buying levels from which buying will trigger again for stronger gains. We still stick with the buying position from every bearish levels as the best strategy for gold trading at the moment.

In terms of economic data: The price of gold will interact with the performance of the US dollar and there are no significant economic data today.