For the first time in a row, gold prices have remained in limited ranges between the $1411 support level and the$ 1433 resistance, forming a consolidation zone that signals a move ahead, and that investors are preparing to start again. The price of the yellow metal is stable around $1420 at the time of writing. Gold has an important date this week with the US Federal Reserve's announcement for a cut in US interest rates for the first time in 10 years to counter the risks that support the slowing US economy. US job numbers by the end of this week will be a catalyst for a strong move for the gold price as well. US interest rate cuts and lower job numbers means losses for the US dollar, and a chance for the yellow metal to take off higher.

Global central banks moving toward easing monetary policy to counter slowing global economic growth and increasing geopolitical risks and global trade tensions, would all be in favor of investors buying gold permanently, because gold is the ideal security for them. The US GDP growth slowed down by 2.1% at the end of last week, with expectations for a stronger 1.8% slower than 3.1% growth in the previous issue. The results supported some gains for the US dollar and therefore the price of gold was under pressure. Economists predicts that Trump's management of its trade wars around the world will remain a valid reason to predict the weak performance of the US economy.

Gold will remain a safe haven for investors until the US central bank announces its monetary policy and we will continue to recommend buying until the actual announcement of this important decision.

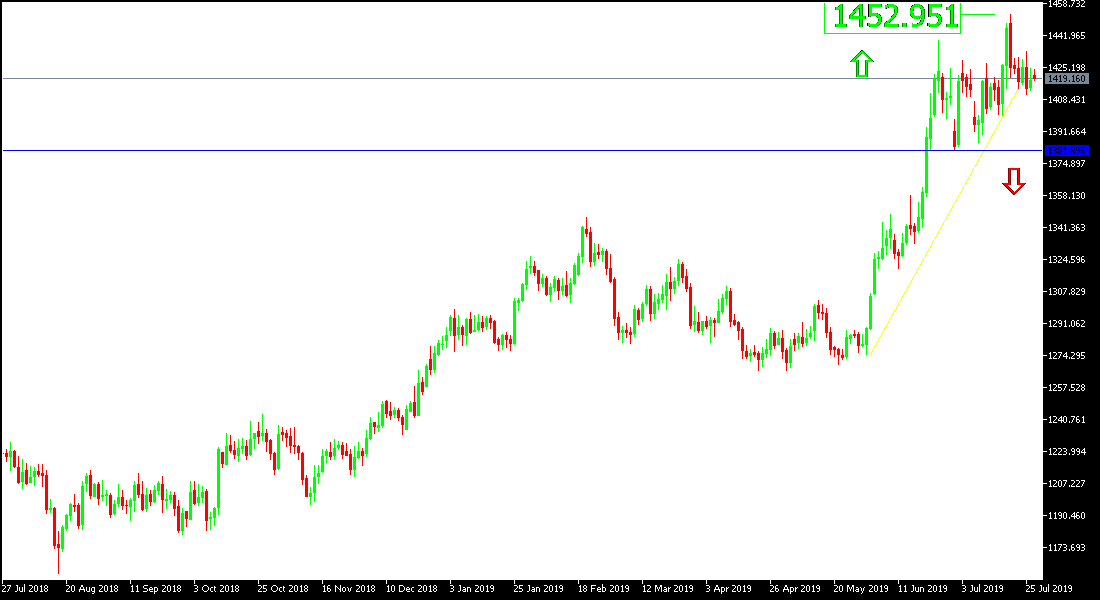

Technically: Gold prices today are poised to rise again with support of stability above the $ 1400 psychological resistance. The nearest levels to buy again would be around 1409, 1400 and 1385, respectively. Global trade war and its consequences, and continuing investor fears, will remain a strong support of gold despite recent US dollar gains. Goals for the continuation of the ascending are resistance levels at 1427, 1440 and 1455, respectively. We still recommend buying gold from every low level.

On the Economic Data front: The economic calendar today has no important and influential data on gold performance.