The pressure on the US dollar, with the US interest rate cut nearing for the first time in 10 years, drove the ounce of gold price to the $ 1428 resistance level early Thursday, before settling around $ 1420 at the time of writing. The yellow metal tested the $1400 level. We suggested in recent technical analysis that the decline in the price of gold will be an opportunity to buy it again. The Dollar was negatively affected by the release of disappointing US housing numbers, which contradicted with positive US retail sales figures. Global geopolitical tensions continue to support continued gold gains in the future. The global trade war is still in place, and the future of Brexit is becoming increasingly uncertain, and the conflict in the Middle East has not yet resolved. The future of global economic growth is still under threat.

Since the relationship between gold and the dollar is inverse, gold will still benefit greatly from expectations that the Federal Reserve will cut US interest rates for the first time in a decade, despite the longest economic growth chain in US history. The recent testimony of Chairman Jerome Powell, in which he emphasized that the US central bank was ready to cut rates sooner rather than later to counter the slowdown in global economic growth, contributed to the increase. The bank's policy change has strongly contributed to record gains in US equity indices and has in line with the mood of the US administration, which has often attacked the bank's policy to pressure it to start lowering US interest rates.

In recent technical analysis, we have confirmed that US interest rate cut signals will support the decline of the US dollar and hence further gains in gold.

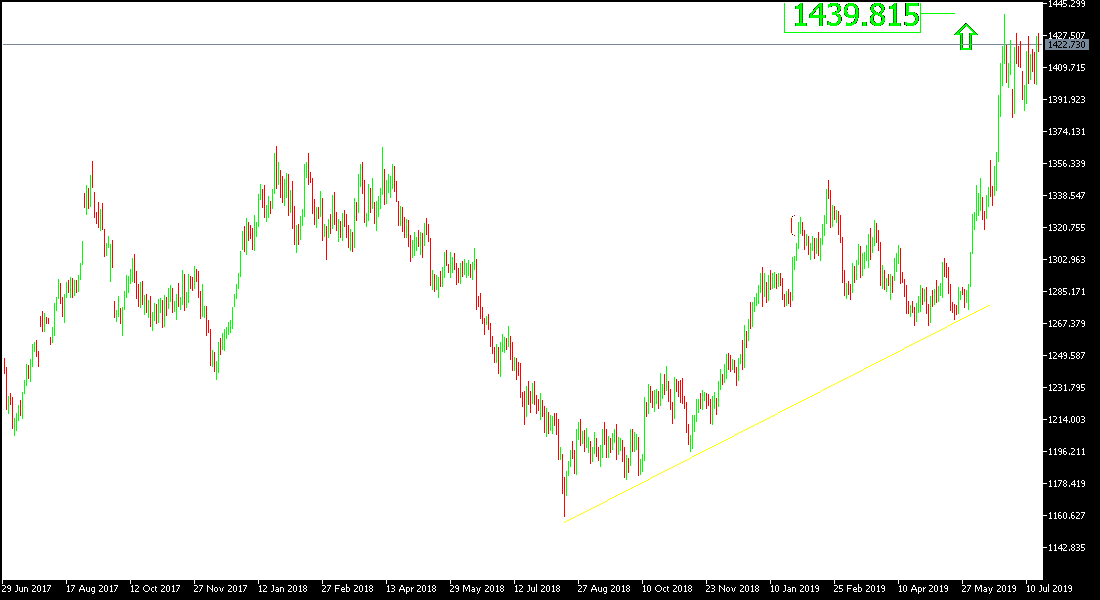

Technically: Gold prices today are back within its bullish channel as long as it holds the highest psychological move above $1400. In the current situation, the nearest levels of resistance are currently 1415, 1428 and 1440 respectively, which supports the current uptrend. On the downside, if the yellow metal moves towards the support levels 1394, 1385 and 1370 respectively, there will be an opportunity to go back and buy it.

In terms of economic data: Gold will react with the impact on the dollar from the announcement of the Philadelphia industrial index and the unemployed weekly claims.