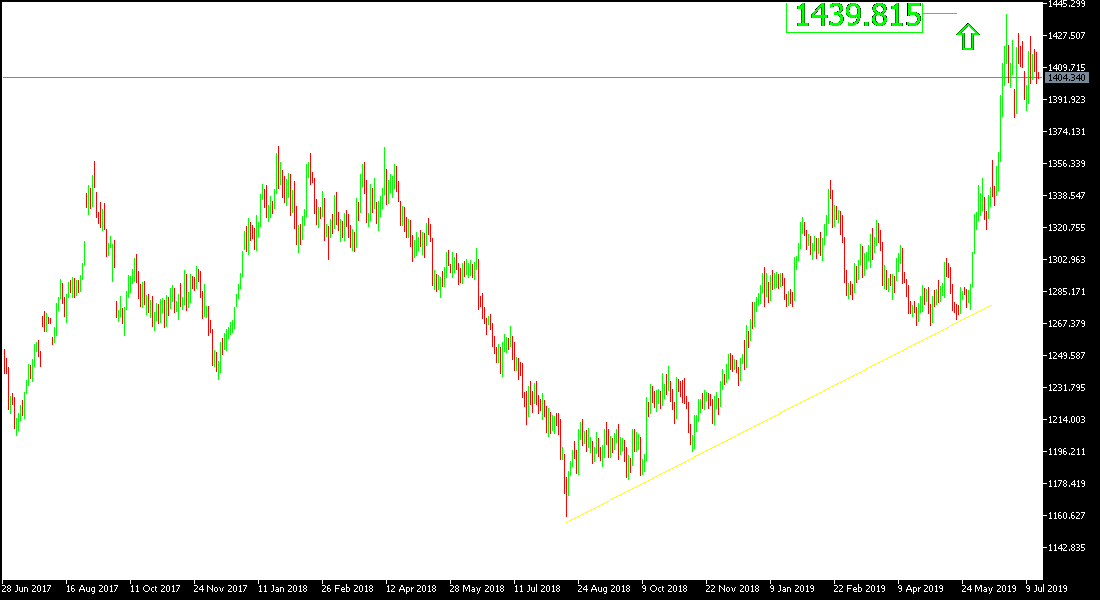

With positive US retail sales figures, contrary to expectations of a larger decline, the gains of the US dollar increased and the price of the gold ounce was pushed due selling pressure reaching $1,400 an ounce after stabilizing around $1420 resistance earlier this week. If the yellow metal moves below the $1400 level, investors will begin to think of better buying areas as global geopolitical tensions continue to support continued gold gains in the future. The nearest buying areas are currently 1388 and 1375 respectively, and targets may exceed 1445 as long as investors are concerned about the future of global economic growth as trade and political wars continue to be led by Trump around the world. Investors are always looking for safe havens in times of uncertainty.

The relationship between gold and the dollar is inverse, and gold will continue to benefit from expectations that the Federal Reserve will cut US interest rates for the first time in 10 years. The latest testimony by Governor Jerome Powell, who confirmed that the US central bank was ready to cut interest rates sooner rather than later, as trade tensions persisted and fears of a slowdown in global economic growth, contributed to those expectations. Those expectations have pleased Wall Street investors, so US stocks achieved record gains and those expectations are in line with Trump's management, which has often attacked the bank's policy to pressure it to start lowering US interest rates.

In recent technical analysis, we have confirmed that US interest rate cut signals will support the decline of the US dollar and hence further gains in gold.

Technically: Gold prices today, and despite the recent decline, are still moving within a bullish channel supported by the $1400 psychological top. Therefore, the nearest resistance levels for gold are currently 1415, 1428 and 1440 respectively, which are supporting the current uptrend. On the downside, the nearest support levels for gold are 1394, 1385 and 1370 respectively. Buying strategy from each bearish level will continue to be the best way to deal with this market.

On the economic data front: gold will interact with the announcement of inflation numbers in the UK, the Eurozone and Canada. And US housing numbers.