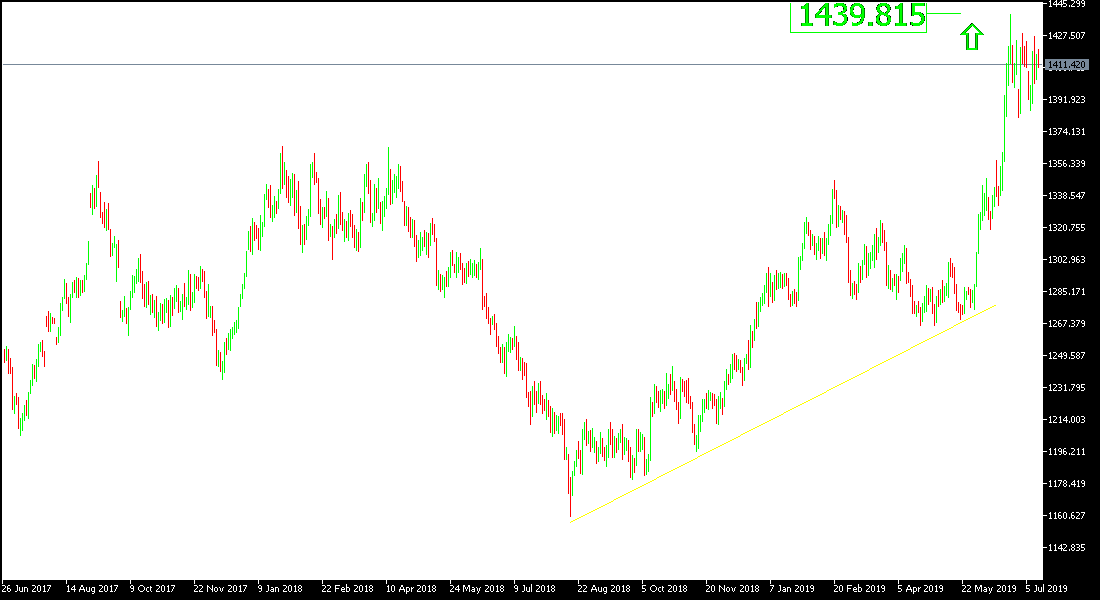

On the gold’s daily chart, it seems clear that the stability of prices for four trading sessions respectively, with gains stopped around the $1427 resistance level, before settling around $1411 at the time of writing. That rally zone foreshadows a strong move ahead for the price of gold, which is closest to continuing to climb, especially as pressure continues on the US dollar amid expectations of a near date of the US interest rate cut for the first time in 10 years. This was further underscored by the testimony of Chairman of the US Central Bank, Jerome Powell, for two consecutive days before the Senate and before the US Congress, in which he emphasized that the US Central Bank is ready to cut interest rates as trade tensions persist and fears of global economic strength are directly affecting the US economic outlook.

According to Powell's testimony, "doubts about trade tensions and concerns about the strength of the global economy still affect the US economic outlook." The latest dovish language of the bank has contributed to record gains in US stocks, as investors believe that the US central bank is ready to cut interest rates, currently between 2.25% and 2.5%, later this month.

Factors supporting continued gold gains remain, led by rising global geopolitical and trade tensions, even after optimism of renewed US-China negotiations to end the world's biggest trade dispute that threatens global economic growth.

In recent technical analysis, we have confirmed that US interest rate cut signals will support the decline of the US dollar and hence further gains in gold.

Technically: Gold prices today are trying to hold on to the 1400 psychological summit that strongly supports the bullish momentum, as the stability above that will support the test of resistance levels at 1415, 1428 and 1440 respectively, which are the levels of consolidation of the current upward trend. On the downside, the nearest support levels for gold today are 1410, 1395 and 1375, respectively. Buying strategy from every bearish level will continue to be the best way to deal with gold prices.

On the economic front, the economic calendar today will only monitor the results of the Chinese economic data.