With the beginning of this week’s trading, gold prices are trying to rebound to the top and compensate for its recent losses, reached during Monday's session to the $1428 resistance level, where it is currently setting almost at the beginning of Tuesday’s trading. The troy ounce price fell to $1411 last week, as the US dollar gained more. The yellow metal is preparing to the return of investors' fears and then run to gold as a safe haven. Expectations have grown that Britain is on its way out of the EU without an agreement and tomorrow the Federal Reserve will announce interest rates amid strong expectations of a cut, which will stop the recent gains of the dollar. In terms of global trade tensions, there has been no strong sign from both sides of the US or Chinese negotiations that the opportunity is ripe for a close agreement, which could irritate Trump and thus push him implement his threat of imposing tariffs on all imports from China. Tensions in the Middle East have not calmed down so far. Those factors, along with what will emerge with them, will be stronger catalysts for the gold price to return to stronger gains. Gold is one of the most important safe havens for investors in times of uncertainty.

Global central banks are moving toward easing monetary policy to counter slowing global economic growth, and increasing geopolitical risks and global trade tensions would be in favor of investors buying gold permanently because it is an ideal security for them.

Gold will remain a safe haven for investors until the US central bank announces its monetary policy and we will continue to recommend buying until the actual announcement of this important decision.

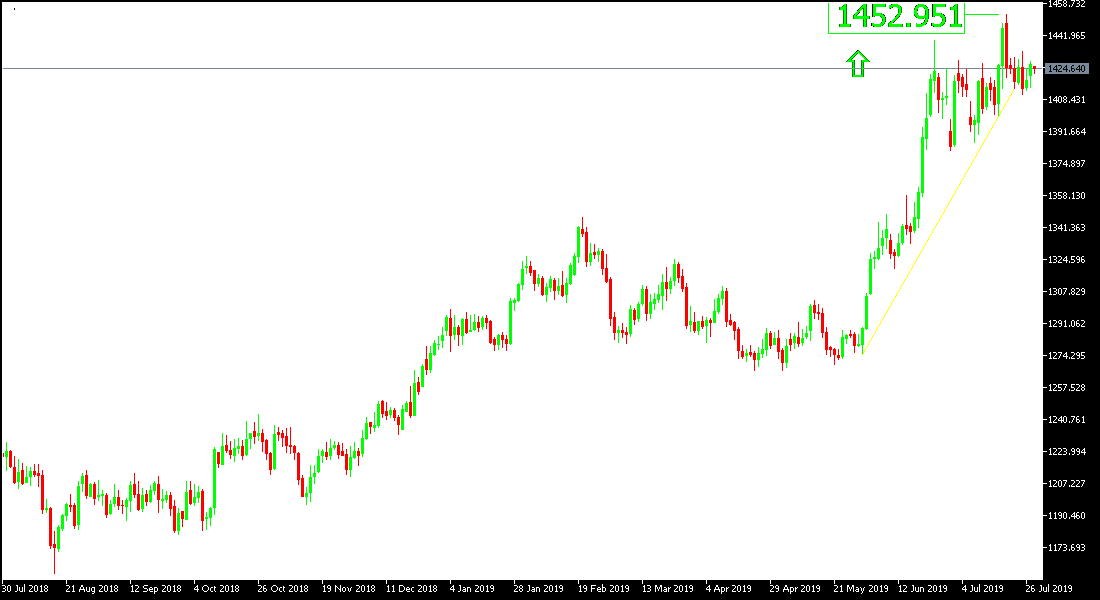

Technically: Gold prices are now in a state of readiness to complete the move within its bullish channel, which is still supported by the $ 1400 psychological top. The nearest resistance levels are currently at 1435, 1447 and 1460 respectively. To the downside, the nearest support level are 1409, 1400 and 1385 respectively. We still recommend buying gold from every low level.

On the economic data front, the economic calendar today will focus on the announcement of the monetary policy of the Central Bank of Japan, German consumption data, and U.S consumer spending and consumer confidence data.