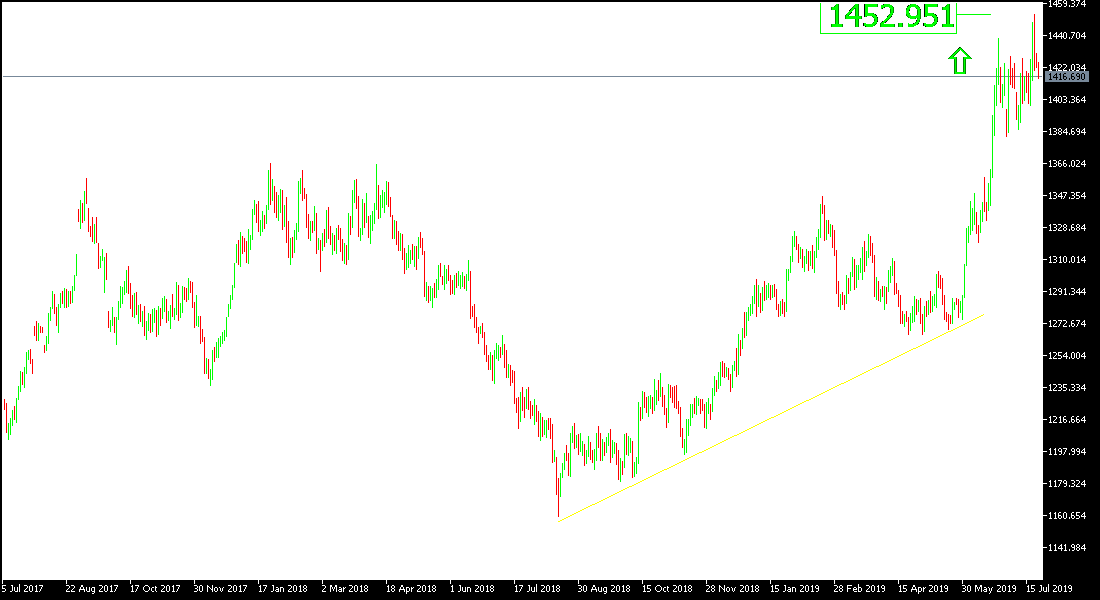

Since the beginning of this week, the price of an ounce of gold has been subjected to sales pushing it towards the level of $1414 support at the time of writing, and last week moved the price of gold to the $ 1453 level, the highest in six years. We note the strong performance of the US dollar against other major currencies, which weakened investors' appetite for buying the yellow metal. The Fed Board is due to meet between July 30 and July 31 and the US central bank is expected to cut interest rates at the meeting. Market expectations are that the bank will cut interest rates by 25 basis points, and this forecast are at 77.5%, and expectations to reduce 50 basis points are at 22.5%. If the central bank cuts interest rates, we will be assured of the extent of concern about a slowdown in US economic growth. Other central banks are also reducing or preparing to cut interest rates.

Gold will remain a safe haven for investors right now until the US Federal Reserve announces its monetary policy next week and we will continue to recommend buying gold until the announcement of this important decision.

The policy shift of the US Central Bank confirms that members of the Bank's policy committee see increasing risks to the country's economic growth and that it is time to intervene to deal with the consequences. This transformation is pleasing to Trump's management, which has long demanded a cut in interest rates and accused the bank of acting against Trump's policy of global trade wars that sees America first. In addition, US stockholders will have new momentum for stronger record gains.

US interest rate cuts will continue to support the decline of the US dollar as an opportunity for further gains for the price of gold.

Technically: Gold prices today are still moving within a bullish channel despite recent selling as long as it holds the move above the $ 1400 psychological resistance. Buying can now return at support levels 1414, 1403 and 1390 respectively. To the continuing bullish momentum, the resistance levels 1434, 1450 and 1468 respectively will be closer to the current yellow metal. We still prefer to buy gold from every bearish level.

On the Economic Data front: Today's economic calendar focuses solely on US data on existing US home sales.